📈 When I Dip You Dip We Dip

“Only when the tide goes out do you discover who's been swimming naked.”

Some rich dude.1

The proverbial tide has certainly receded in 2022. After “easy” money periods of the last few years made it a cinch to trade stocks and make money, life has gotten a lot harder for your humble day trader.

Did someone forward this to you? Thank you! We only grow through referrals so do us a favor and subscribe! Thanks!

Rewind to just a year ago and trading stocks looked like the easiest game in the world. After the initial drop as COVID-19 lockdowns spread across the globe, stocks rallied hard, finishing 2020 up 18.4% and 2021 up 28.7%, respectively, good for a stellar +52.3% over these two years.

Pretty easy to hit the target when 68 out of 503 stocks in the S&P 500 had a positive return over 2020 and 2021; of those, 41% of stocks doubled the S&P 500 Index’s total return over this period, averaging a 111% return.2

All those numbers mean that you basically could have blindly thrown a dart at stocks and made money over the last two years. Why that’s the case is for another post; the super-short version is that when it doesn’t cost anything to borrow money and the government is showering consumers with more money, risk assets like stocks tend to benefit.

No better embodiment of how “easy” the last two years were than Dave Portnoy of Barstool Sports. The whole clip is worth watching with the sound on.

2022 is a different beast entirely. The market has bumped along like a sedan with bad shocks on an unpaved road, jostling investors and jangling nerves.

What’s the lesson here? a) Trading individual stocks can be profitable, but isn’t for the faint of heart and b) buying stocks is the easiest and least important part.

What do I mean?

It’s easy to buy stocks: open your app, enter the ticker, click buy. Done. What happens when the stock inevitably goes down? People lie to themselves all the time with the idea that “I’m a long-term investor, I can hold through the pain because I believe in the company.”

That’s a fine mantra. Let’s put it on a coffee mug because that’s about what it’s worth.

The reality is that even the “best” companies experience periods of nerve-shredding losses; some never recover and just move sideways; others go out of business. One long-term academic study found that “just 86 stocks have accounted for $16 trillion in wealth creation, half of the stock market total, over the past 90 years.”

Yowch. That dartboard just got a lot smaller.

You might be ready to trade stocks if you can answer these three questions:

When do you buy? When do you sell? When do you buy again?

Buy discipline can be anything and is the least important of the three. Figuring out when you sell is critical because that protects you from holding all the way to the bottom. And knowing when to buy again keeps you from sitting in cash the entire time and missing out on a rally.

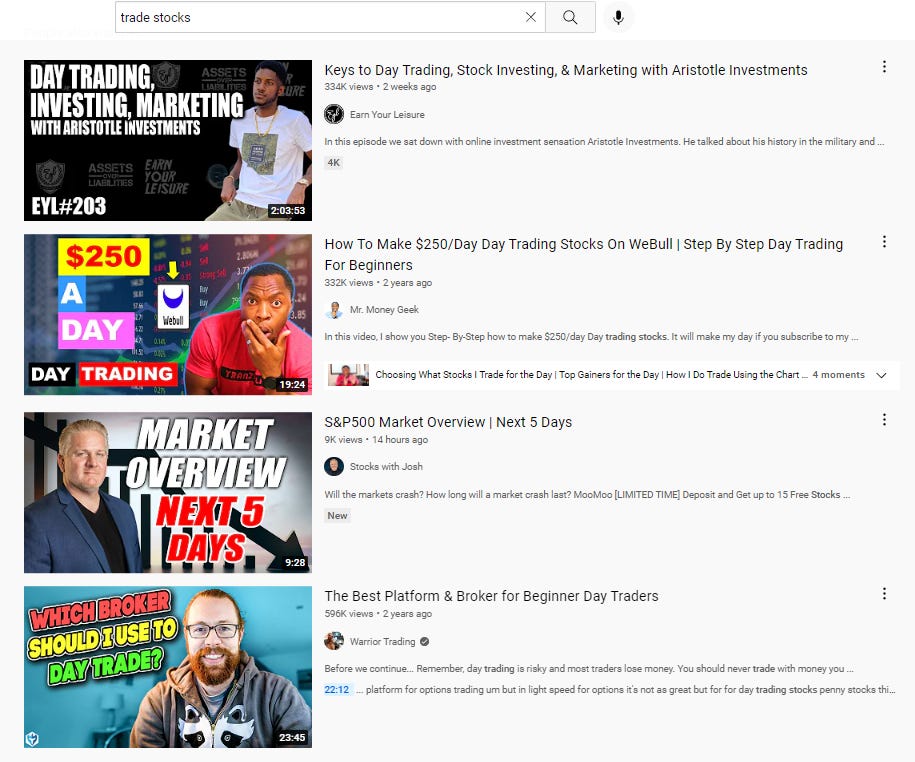

A Google search for “how to trade stocks yourself” yields 21.9 million results. So, lots of opinions out there. All of them are selling versions of their answer to those three questions, and, unless you’re really gonna go for it, all of them should be ignored.

The takeaway is that you need a system to survive trading stocks and actually make some money.

I have good news, though. You can buy a system that will invest in stocks for you where someone has already figured out the answers to those three questions. It’s called a fund!

Sarcasm aside, funds like the ones in your 401(k) or on your brokerage account will apply their system to make those buy/sell/hold decisions on your behalf. They all move at different speeds and have a wide spread of results, but many of them should get you where you want to go - making money - over the long term, and, most importantly, with a lot less stress.3

What’s the Upside?

For 95% of our readers, you can’t trade individual stocks in your 401(k). By default, funds (usually mutual funds) are your only option. We covered this topic in an earlier post where the recommendation is that if you’re not sure what to buy, the target date fund that’s your expected retirement year is often the best place to start.

For those who also have an individual retirement account with a wider investment universe available to them, our suggestion would be to check out "Lazy Portfolios” on Bogleheads.org if you’re trying to figure out what to do.

Otherwise, for the tiny percentage of you degenerates left who still think you can trade stocks better than a professional fund manager, read this. Summary: it’s possible, but not probable.

For Your Weekend

Read:

Against Algebra by Temple Grandin (The Atlantic)

“As a professor of animal science, I have ample opportunity to observe how young people emerge from our education system into further study and the work world. As a visual thinker who has autism, I often think about how education fails to meet the needs of our very diverse minds. We are shunting students into a one-size-fits-all curriculum instead of nurturing the budding builders, engineers, and inventors that our country needs.”

Listen:

🚨Politics alert! Proceed with caution🚨

The Bulwark Podcast: Ruy Teixeira: Some Tough Love for Democrats

“Normal voters hate crime and want a secure border, but Democrats don’t project toughness because they’re scared of their base. And the party’s quasi-religious belief in wind and solar also makes them less competitive,” argues liberal commentator and political scientist Ruy Teixeira.

Chuckle:

I know it’s Buffet I just thought it was funny to attribute to some rich dude. Get a life, nerds.

If the numbers look a little big it’s because I’m citing cumulative returns rather than annualized returns, you nerds.

One very simple way to screen for a “good” fund is to look for the highest assets under management with a ten-year return number. Lots of money means other people like this fund and a long track record means they’ve survived a few market environments. PLEASE NOTE that lots of money and a long track record IS NOT synonymous with “safe.” Investing involves risk, including loss of principal and past performance IS NOT a guarantee of future results.