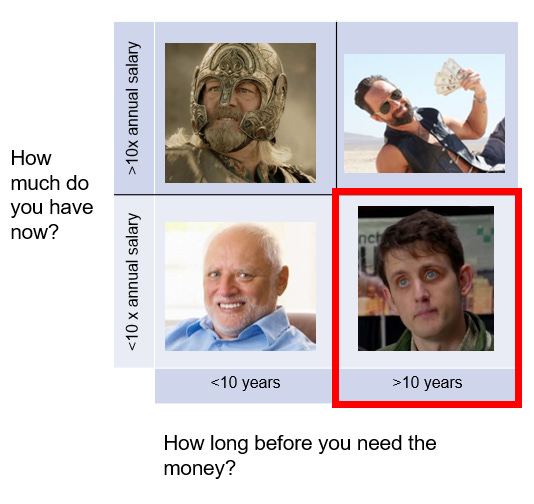

Two weeks ago, we talked about four types of portfolios segmented based on assets and time horizon. Today, we’re going to take a closer look at the max growth portfolio.

As a reminder, the objective here is to find the asset allocation expected to produce growth. Now, chances are good that most of the assets are in a 401(k) or something similar. The way most 401(k)s are set up, your investment choices are limited to stocks and bonds. That’s okay - let’s walk through how aggressive you should be using these two asset classes.

Stocks

Stocks represent fractional ownership of a publicly-traded company. If the company’s share price goes up, your investment goes up along with it (and vice versa). Most retirement portfolios rely on the stock market to drive investment returns over the long run. This isn’t a bad bet because betting against the stock market, in the long run, is like betting against capitalism1, and capitalism is mostly undefeated over the last 700 years or so.2

In our view, most, if not all, of your retirement portfolio should be in stocks. And that goes for however much money you have in your 401(k). How much in stocks depends on – and we’re not kidding here – how often you check your 401(k) balance. If you’re watching every tick every single day, you may be better off with less in the market because the day-to-day swings may drive you bonkers. But, if you’re checking every few months or so, then a higher allocation may be right for you.

If you ask us, we’re on the high end of this range, like 70% or more.

We’re comfortable having our retirement assets overweight stocks for two reasons.

One, we see tailwinds forming in the current environment that we believe will continue to push the market upward over the next twenty years.3

And two, there’s a pretty strong historical basis for the stock market producing positive returns over a twenty-year period.

The chart above shows stock market returns (net of inflation) since 1951 using rolling twenty-year periods. That means the January 1971 data point represents the annualized return from Jan 1951 - Jan 1971, and so on.

In other words, stocks have never lost money over any twenty-year period since 1951, and they’ve outperformed the rolling 20-year average return of 6.1% nearly half the time (42%). And that’s through inflation, deflation, wars, plague, and political strife.

In other, other words - you can’t go wrong with stocks for the long haul.

Bonds

Bonds represent fractional ownership of an entity’s debt, be that a government or corporation.4 In exchange for giving them money by virtue of buying the bond, the entity will repay you gradually over a stated period, with interest. Understanding bond returns is a little more complicated than stocks; in brief, bond returns depend on the underlying interest rate. If interest rates go down, that means returns go up; if interest rates go up, that means returns go down.5

Annndddd interest rates have gone in one direction since the 1980s:

Yes, that is down.

So, that means bonds have pretty much printed money for the last forty years or so.6 Now, with inflation concerns mounting, Fed chair Jerome Powell has indicated his desire to inch rates back up.

Given all of that, how much should you have in bonds?

Given the headwinds facing bonds – namely, the prospect of higher interest rates – it seems prudent to limit our exposure to this asset class.7 In our view, we’re on the very low end of this range at 10% or less.

What’s the Upside?

It’s okay if this all feels like a lot. It is a lot. There are people who dedicate their entire careers to figuring this out. In a way, it’s a blessing that we have the flexibility to make our own investment choices and determine our own outcomes. We control our destiny.

On the other hand, holy sh*t is there a lot to think about.

Fortunately, there’s something called a target-date fund8 that pretty much does all of this for you. The idea behind a target date fund is to dynamically adjust your asset allocation based on a future date – retirement, for most people.

Plus, almost every 401(k) offers a few target-date funds to choose from. Using a target date fund is simple: pick the fund based on the date you expect to retire. As you age, the asset allocation will adjust. So, if you expect to retire in ten years, the fund will automatically rebalance to something less aggressive.

Let’s say you expect to retire twenty years from now in 2041. Let’s look at Target Retirement 2040.

That’s about 80% stocks, 20% bonds. Right in line with what we’d suggest. Notice that the closer you are to retirement (right side), the more bonds you own. Again, target-date funds do all of this automatically.

As much fun as it is to think through what to buy and when to buy it, for many, the right decision for many is simply to push everything into a target-date fund and leave it alone.

As usual, the Kunu Dictum remains unchallenged. When it comes to investing:

For Your Weekend

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

Half a Billion in Bitcoin, Lost in the Dump by DT Max (The New Yorker)

After mistakenly throwing away a hard drive containing his Bitcoin stash in 2013, a Welsh systems engineer has been fighting to excavate the local landfill. And for good reason - finding the little hard drive would make James Howells about as rich as the Queen of England.

Watch:

14 Peaks: Nothing is Impossible (Netflix)

In mountaineering, there are 14 peaks recognized as ‘8,000ers’ - meaning they are 8,000 meters (26,247 feet) above sea level. The first person to summit all 14 peaks was Italian Reinhold Messner, who completed the feat after 10 years.

Now, watch as Nepali Nimsdai Purja seeks to accomplish the same feat in seven months. And maybe hungover.

Fun fact: “capitalism” derives from the Latin caput meaning “head” as in cattle or livestock. It took on the meaning of “wealth or property” during the Renaissance. The word “capitalism” – used to describe an organized market-based system as we’d recognize it today – comes from the mid-1800s.

Or 2,000? Were the Romans capitalists? Perhaps not explicitly but I think it’s a fair bet that Julius Caesar would have loved this market, given his proclivity for levering the f*ck up.

Three big trends we don’t see going anywhere: the continued shift away from bonds in favor of stocks (or less duration-sensitive instruments in general) due to gradually rising interest rates, Federal Reserve support, and, perhaps the biggest driver of them all representing the confluence of these factors, the mass retirement of Boomers who, given their current life expectancy, need to take more market risk to afford retirement. There’s a counter-narrative based on these same factors, but this newsletter is called the Weekly Upside, so that’d be a bit off-brand, right?

Or people? Student loan debt is now securitized, meaning that you can buy and sell it. Not sure if we’d recommend that or what that says about where we’re at, culturally, but it’s there. Given that student loan forgiveness has been a political talking point for a few cycles now, this may be a risky endeavor for a few extra bps of yield. Also, there’s a Soylent Green joke in here somewhere, I’m sure of it.

This characterization is an over-simplification, though correct enough for our purposes.

There’s a case to be made that bonds have been a far better place to be invested than stocks over this time, particularly on a volatility-adjusted basis.

It sure seems like bonds have shifted from unbeatable uncorrelated money-printing machines to portfolio volatility reduction tools with limited upside. No doubt, there are exceptions to this characterization, but one wonders how that would be accomplished without financial engineering.

As heinous as Wells Fargo is at virtually everything, you can thank Donald Luskin and Larry Tint of Wells Fargo Advisors for coming up with the target date fund in the 1990s.