📈Bondage

No one ever asks for a "hot bond tip"

Note: we apologize for the delay in this week’s newsletter. Our team experienced some scheduling pressures that necessitated pushing the newsletter to today. Blame it on “supply-chain issues.”

Stocks get all the attention. They’re the Daphne to bonds Velma. Like Velma, bonds are a little nerdy and, often, end up being the member of the gang who has all the answers. What’s the deal with bonds? Let’s dive in.

A bond is essentially a loan to a company or government in exchange for interest payments, called a coupon. This dates back to the days of physical paper bond certificates with a set number of coupons attached that you would turn in to receive payment. Like those coupons you get in the mail:

So, instead of turning to a bank for money, Apple will sell bonds to investors and pay them a fixed amount per year (coupon payment) until a specified time (maturity date). This deal is often mutually beneficial: companies like Apple need money to grow and they are willing to pay investors much higher rates than banks will on a savings account. Currently, the average investment-grade bond yields ~1.5% vs less than 0.1% in a savings account.

Bonds carry more risk than a savings account, but are much less risky than just investing in the stock market or, say, DeFi crypto lending.

Why are bonds risky? We’ve outlined the risks of stocks and crypto lending in earlier blogs, but bonds guarantee you a payment at set dates so that seems pretty safe right?

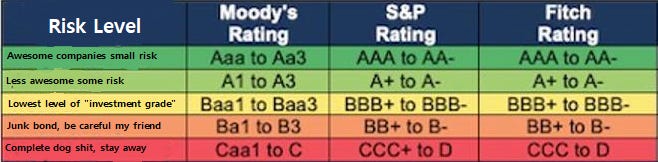

What happens if the company decides not to pay investors or falls off the face of the earth like The Labrador Company from the image above? Luckily, there are multiple rating agencies shown in the chart below to evaluate that risk on your behalf. I added our own plain English risk levels on the left.

The yellow level and above is where most people invest in the bond market. Billions of dollars are invested in something called the Aggregate Bond Index fund (ETF ticker: AGG). Like an S&P 500 Index fund, AGG allows you to invest in bonds from hundreds of companies in one fund. That degree of diversification can help mitigate the risk that things go belly-up like The Labrador Company.

You may have seen some headlines recently about the US debt ceiling and the scrum that’s causing on Capitol Hill. Congress is arguing over whether to allow the US to raise the debt ceiling to permit the spending plan proposed by the Biden Administration.

The natural, All-American follow-up question is: can I make money here? Yes, you can! That’s because you can buy US government debt!

Just like Apple, the US Government issues bonds to raise money to fund its operations; in this case, that’s the government and not iPhone factories. Turns out the US government has been selling bonds - called Treasury bonds - for a long time.

Treasury bonds carry less risk than company bonds because, unlike Apple, Treasury bonds are backed by the full faith and credit of the US Government. Meaning, bonds issued by the US Government are considered risk-free because Congress has the power to tax the ever-living shit out of its citizens whenever it damn well pleases. As we live in the wealthiest country on earth, there is no risk that the US government will not pay its debts.

There’s something called maturity risk in the bond market, which is the risk that the issuer of the bond won’t repay you in full at maturity. To use the US Government example, we can very sure the US will exist and pay its debts in 30 days; we may be less confident of that in five years, and even less confident in thirty.

In general, the longer the length of the loan (called duration), the greater the risk, and therefore, the higher the interest rate to justify the risk. So, we end up with what is called an upward sloping yield curve, where more time equals more money. That’s why a 30 day T-bill pays >0.1% and a 30 year government bond pays >2%.

What’s the Upside?

Bonds are an opportunity for you to play banker to public companies or the US government. Bonds are generally considered less risky than stocks and give pay you more interest than a savings account.

For Your Weekend

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

“Can Nuclear Fusion Put the Brakes on Climate Change?” by Rivka Galchen (The New Yorker)

We all know nuclear fission - that’s the reaction that gets you atomic bombs and flattened atolls - but what about fusion? Fusion is the Iron Man-style dream of limitless clean energy. However, fusion seems to operate according to the law of the “conservation of difficulty”: when one problem is solved, a new one of equal difficulty emerges to take its place.

“The Great Disappearing Worker” by Brent Orell (The Dispatch)

The labor market remains unusually turbulent with surfing competition-sized waves of unfilled jobs inundating low-lying areas of available workers and gale-force levels of job quits just to keep it interesting. Like meteorologists watching as tropical depressions become hurricanes, jobs data junkies are tracking the nation’s employment market with equal parts awe, curiosity, and unease.

Chuckle:

This gem has been making the rounds on the Interwebs. May you be blessed to ever be this confident:

Here’s the Wikipedia page in case anyone needs a refresher on Enron and how this prediction ended up.

![Enron: blast from the past [update] | Financial Times Enron: blast from the past [update] | Financial Times](https://substackcdn.com/image/fetch/$s_!azAE!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fcb0b0222-d581-4903-adc5-4d7345ae6bf9_700x906.jpeg)