Home Security

DeFi-nitely time to lawyer up, Brian

Last week, the CEO of Coinbase - the largest cryptocurrency exchange - decided to pick a fight with the SEC (Securities Exchange Commission). Now, the impli --

What am I saying? You definitely missed it; you aren’t finance nerds like us. But it is worth paying attention to for a few reasons.

Reason #1: The SEC is the big swinging dick in the finance world. Their job is to enforce the regulations passed by Congress. They’re the Sheriffs of Wall Street. While they are far from perfect, and it pains us to defend a government entity, they are the one government agency with real power to shut down businesses, levy fines, and even send executives to prison.

Unless you are Elon Musk:

So, when the SEC gets involved, it’s reason to sit up and pay attention.

Reason #2: It involves cryptocurrencies, the hottest and least understood topic in the financial world. Lack of regulation has been a central part of cryptocurrency’s brand, making it the Wild West of finance.

Now, the main place where people transact crypto has come under scrutiny from the Big Bad SEC. It’s the Showdown at the Dorky Corral.

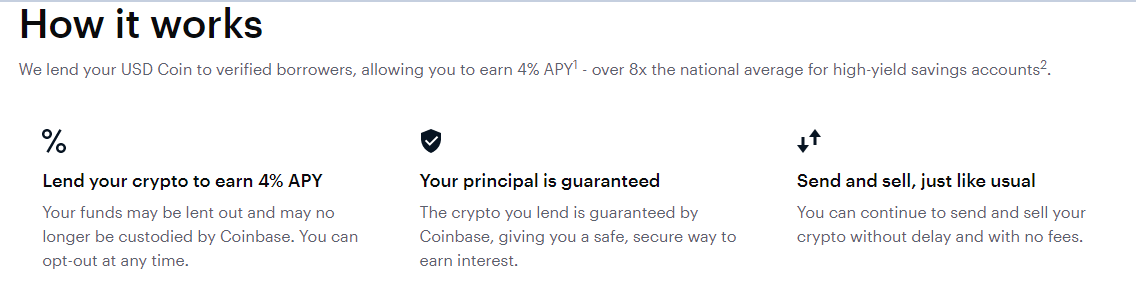

Reason #3: The issue at hand: Coinbase is offering a product called Lend. They’re advertising Lend as a “savings account” that earns 4% interest in exchange for lending out your crypto. If that sentence made your brain hurt, that’s okay.

If you are new to crypto, this may seem like a shockingly high-interest rate. Meanwhile, the crypto crowd is laughing because 10+% interest rates are readily available elsewhere.

So, what do we have here?

4% interest - outstanding

Principal is guaranteed - love it

Ah, but before we get too excited, let's check the footnotes on this page.

Huh:

“Your funds may be lent out and may no longer be custodied by Coinbase.”

Weird, but okay. But, your principal (what your account is worth) is guaranteed by Coinbase.

Oh, wait. What’s that footnote say?

“Lend is not a high-yield USD savings account, and Coinbase is not a bank. Your loaned crypto is not protected by FDIC or SIPC insurance.”

FDIC and SIPC are quasi-independent Federal agencies that guarantee bank deposits and investments from loss if the banking institution goes bankrupt. So, if Wells Fargo goes under, FDIC/SIPC will reimburse you for whatever is in your savings account, up to $250,000. Coinbase is not.

This means your deposit in Coinbase Lend is not guaranteed and if they go out of business, or lose money while “lending” your crypto you can lose EVERYTHING.

Coinbase is advertising Lend as a “high yield savings account” and the SEC is saying: “nah, bro.”

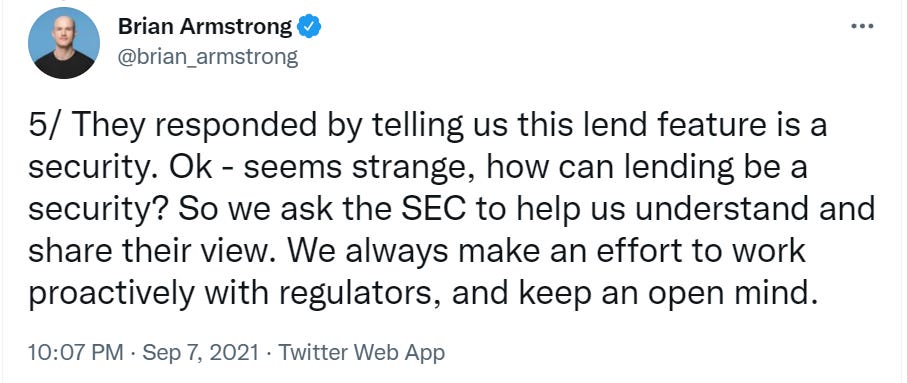

Reason #4: Brian Armstrong, the CEO of Coinbase isn’t doing himself any favors in the court of public opinion, (aka Twitter). When the news broke that the SEC was investigating the Lend product, Armstrong, like any self-respecting irrational Millennial, quickly took to Twitter for a thread 🧵🧵🧵 that culminated in some tweets that left us wondering: is this guy stupid or is he lying?

Exhibit A: (Full thread here)

If you are confused, don’t worry, it’s not your job to know, (it’s Brian’s). Luckily our friend @cullenroche reminded us of the Howey Test, the four questions the Supreme Court used to decide if something is or isn’t a security, and, therefore, under the jurisdiction of the SEC.

It is an investment of money - YES.

You can’t wish a savings account open. You need to put something into an account.

There is an expectation of profit - YES.

I recall someone saying something about 4%? 8x the national average, if memory serves?

The investment of money is in a common enterprise - ALSO YES.

Coinbase has provided me the account that I wish to open

Any profit comes from the efforts of a promoter or third-party - ALSO ALSO YES.

“Your funds may be lent out and may no longer be custodied by Coinbase.” So, obviously lent to someone else. Wonder how they get that 4% interest rate when interest rates are zero? Probably doesn’t matter.

Sure looks like the SEC has every right to be involved as Lend meets the test to be considered a security. Sorry Brian.

Reason #5: There IS risk of financial loss here, despite what other financial advisors may tell you. Below is a convo about a competitor Gemini offering 7.4% to lend and some brain-dead advisor making the faulty “savings account vs crypto lending” argument we just debunked.

I post this not only because I like dunking on idiots who appear on CNBC but to hammer home the point: Savings accounts are not only safe but GUARANTEED by the federal government via the FDIC. Crypto lending - while lucrative - is NOT, and should be regulated.

What’s the Upside?

We are generally big believers in the crypto space, not only do we hold Bitcoin, Ethereum, Solana, and other coins. But we believe there are a lot of good things that will come out of crypto via DeFi (Decentralized Finance).

That being said, we think Federal Regulators are right to protect consumers from products that are advertised as, and often are, too good to be true. And we especially want them to protect you from grifters like Coinbase.

If you have questions about Crypto please reach out or comment below and we can help guide you through the Wild West.

For Your Weekend

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

“Norm Macdonald Was an Agent of Comedy Chaos” by Rob Harvilla (The Ringer)

The comedian, who died Tuesday after a long and private battle with cancer, was a singular talent who always committed to the joke.

Watch:

What We Do in the Shadows (FX)

FX’s What We Do in the Shadows is based on the feature film by Jemaine Clement and Taika Waititi. The mockumentary follows the four vampires and their human familiar Guillermo as they navigate modern life in Long Island. It is one of the most creative shows on TV. It’s a must-watch.