For the last ten years or so, the tech sector has been an absolute monster. The MANGA stocks (formerly FAANG) – Meta (formerly Facebook), Apple, Netflix, Google, and Amazon – have become unstoppable money-printing machines. They have installed themselves into our daily lives to such a degree it’s hard to envision how they could ever fail.

The way we talk about these companies now - invincible money-printing machines that absorb everything they touch - reminded us of the way we used to think of some companies in the past. The one that came to mind was IBM.

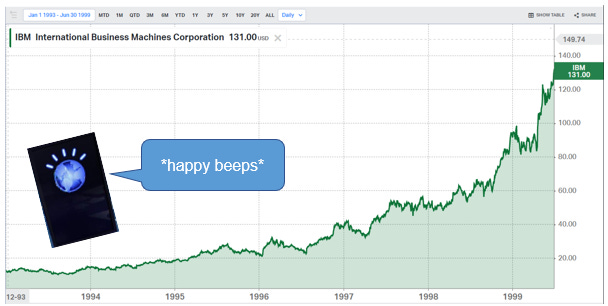

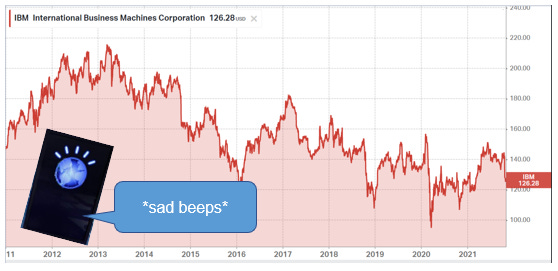

You know IBM. Nowadays, IBM might be best known for their ad spots featuring their 2001: A Space Odyssey-looking talking monolith thing that is their – spokesperson? Spokesmachine? Spokesentity? Let’s go with spokesmachine – called Watson.

This thing:

Before the spokesmachine did all the talking, IBM produced microchips that powered the personal computer explosion. If you owned a computer anytime between 1970 and 2014, odds are it was powered by an IBM chip.

Once computers started showing up in people’s homes, the stock price took off. Fast-forward to 2011 and IBM is now the fourth-largest company in the S&P 500.1

The investment world loved them some IBM, too. It checked all the boxes: It was a well-known company,2 it generated good returns, and it threw off a dividend. That’s a win-win-win, man.

IBM was such a no-brainer that it earned its own maxim in the financial advice space: “you don’t get fired for buying IBM.”

Until you got fired for owning IBM. A series of decisions (and maybe some bad luck) turned the stock price mostly negative for the last ten years.

Here’s the thing to remember about stocks: they represent an ownership stake in a real company staffed and led by real people. For all the technical wizardry at work in capital markets right now, decisions made by the management team determine the strategic direction of a firm. Good decisions are rewarded with a higher stock price, and bad decisions are punished with a lower stock price.

IBM’s leadership team made some good decisions. Then, they didn’t. The stock price reflected those choices in both instances. What’s clear now is that while IBM caught the computers-into-homes wave, and they missed the second, larger computers-into-hands wave, to their detriment.

Apple did not miss that second wave. After some early stumbles, Steve Jobs (and Jony Ive) gifted us with the iPod and then the iPhone. And the rest is history (go watch the biopic - Fassbender version, not the Ashton Kutcher version - for the details).

Not to make you feel old, but the first-generation iPhone was released in 2007 – fourteen years ago! Since then, Apple seems to have just as many hits as misses. However, the ubiquity of the iPhone covers up most of the blemishes.

Like this monstrosity, described by Macworld as: “weird hybrid blend of handbag and failed art project.”

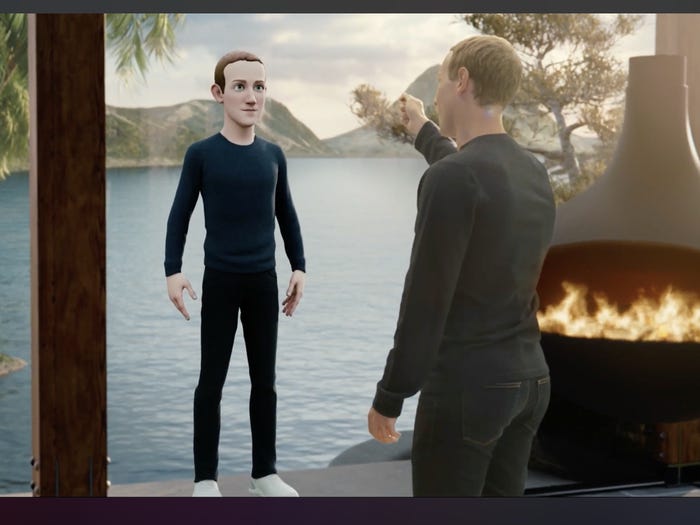

Apple’s stock is doing just fine - thank you. But, what do you think would happen if Apple suddenly made a series of tone-deaf decisions and weird pivots that led to the rebranding of the entire company in a hail-mary attempt to distract the public and lawmakers from the fact their platform shreds the social fabric of democracy and hurts young people using its products?

No self-respecting tech firm would ever take such desperate steps, right?

What’s the Upside?

Other than crypto, the tech sector has been one of the hottest places to hunt for gargantuan returns. The MANGA stocks, Microsoft, Nvidia, Shopify, etc., are all eating the world and, ten years on, it still feels like the only place in town to make any money.

At some point, things change and it’s almost impossible to identify the catalyst ahead of time (unless you’re Michael Burry). Diversifying your portfolio - making smaller bets on more outcomes - can help make sure you don’t ride a stock too far before selling at the bottom.

Take a page from Apple’s book: a few great ideas can help offset a few bad ideas. Just don’t bet it all on one idea.

For Your Weekend

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read

‘You Are Mommy Tracked to the Billionth Degree’ by Emily Peck (Politico Magazine)

When F, a 37-year-old media strategist, started working at a tech company based in Austin in June 2019, she negotiated a hybrid schedule. She would work from home Tuesdays and Thursdays so that she could spend more time throughout the day with her 15-month-old son.

This was pre-Covid 19, and F was the only person on the marketing team at her 30-person company who chose to work from home a few days a week. With a child that young, her priorities were different than those of many of her colleagues, who preferred not just to work together all day but also to socialize together afterwards. “I’m not going to be in an office from 8:30 to 5, and then [go to] happy hours and drinking party boats,” said F, who asked for anonymity to speak openly about her former employer.

In hindsight there were red flags. Her colleagues told her they thought it was “fascinating” she had children, she recalled. “The thing haunting [me] was, they kept saying, ‘We really want an adult in the room,’” she said. That “adult” was supposed to be her.

After a few months, it was clear something was off. She’d come into the office on a Friday and find out about a new direction for the business that everyone else already knew about. When she asked why she hadn’t been told, they’d say, “‘If you were here, you would know,’” F said.

Safety First, Success Later: The Mac Jones Experiment Is Going According to Plan by Kevin Clark (The Ringer)

Richard Thaler, a Nobel Prize–winning economist whose work on NFL draft value has become wildly influential in NFL front offices, told me something a few years ago I’ve thought about ever since. He thought the generational quarterback prospect—the one teams yearn for, tank for, and rearrange their lives for—does not, strictly speaking, exist.

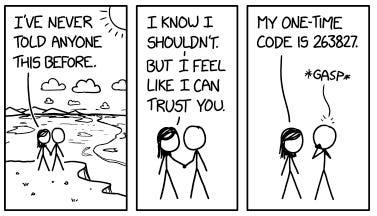

Chuckle:

IBM was part of CAMIX, the MANGA or FAANG of the day. CAMIX was Chevron (CVX), Apple (AAPL), Microsoft (MSFT), IBM (IBM), and ExxonMobil (XOM). I point this out because CAMIX kinda sounds like a “comics,” which fits with our MANGA theme, only as if it were pronounced by your great-aunt from Mt. Greenwood.

Which meant advisors had to spend little time explaining who IBM was since clients recognized it immediately.