📈Summer Doldrums

This time of the year it’s tough to get excited about investing, or the economy or even gambling (baseball just doesn’t have the same excitement, and the Open Championship isn’t for a couple of weeks).

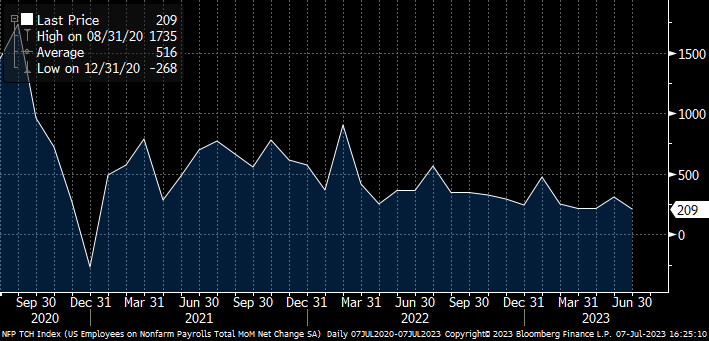

In addition to the fact we are in the middle of the dog days of summer, we are also in a period of good but unremarkable financial data and stock performance. On Friday the monthly job report came out and the economy added a solid but generally uninteresting amount of jobs, 209k.

Over the past 3 years this is somewhere in the middle and again not that exciting so let’s take a look at inflation, our annoying companion. Below is a chart of CPI (next week we get June’s data) over the same time frame as the jobs report.

As you can see inflation is steadily falling back near the Fed’s target of 2% so while it remains higher than it should be, and is important, it is also no longer very exciting. And as you know we have covered it ad nauseam.

All this has led to a stock market that has recovered from lows seen earlier in this period due to the solid job data and lowering inflation. But again remains below its peak and again in a generally boring area.

You may be asking?

And if you ask again I will turn this car around.

I am telling you all this for a couple reasons. First it is okay to be bored with the markets. We are not day trading here, we are investing for the long term. I can actually tell you first hand most Hedge Fund managers take the summer off for a reason.

Secondly, boring does not = bad. In fact there was a stretch in time where the best investment in the world was actually the most boring investment. Bonds.

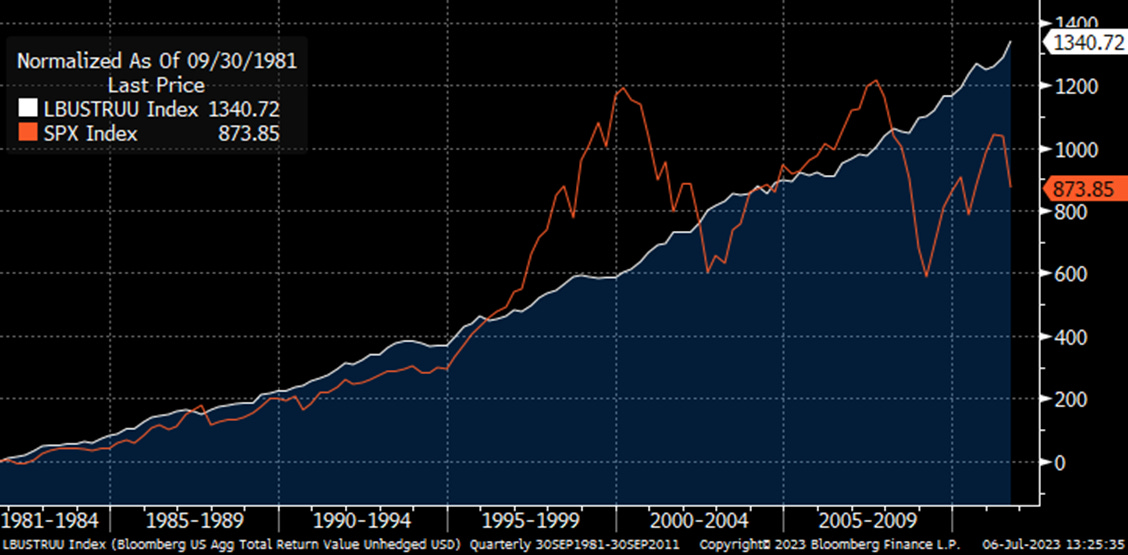

They not only outperformed stocks for a 30 year stretch but they did so by going up in one of the most perfect line charts you will ever see. Below shows the Bloomberg Agg Index in white (the universal generic bond index) soaring perfectly up and to the left for 30 years from 1981 to 2011. Outperforming the S&P 500 shown in orange, which as you can see took a much rockier path.

Now we cherry picked these dates because rates hit their peak in 1981 in the double digits as inflation roared. But this is an example of how boring can in fact be beautiful.

We discussed above how inflation is cooling, which would generally mean rate hikes are coming to a close. And while there is some proof to that already (the Fed paused in June) longer duration treasuries have seen rates hit decade long highs. The 2-year treasury is hovering around 5% while the 10-year is near 4%, both key psychological levels.

In October last year we called for people to take a look at bonds when the 2-year was trading around 4.3%, and at various times over the last 9 months that has looked like the perfect time to buy and today it looks like we were a bit premature. But let’s look at what we said at the time.

Updating the chart from that article last year we see yields are even more enticing than back then.

What’s the Upside?

Even in dull markets there is always something to see. And while our usual hot button topics were boring, treasury 2-year yields broke out to their highest level since 2007. Which gave us the opportunity to look at that as a potential to use to save for short to mid-term investment goals.

For Your Weekend

Watch

Hijack ($ Apple TV)

Hijack makes sure the tension stays high while not taking leaps in logic. Combine the tight writing with the compelling lead performance from Idris Elba and you have a show that gets us leaning forward in our chairs, and that says a lot.