📈 Bond Fire

Ian discusses the merits of *gasp* bonds? Blasphemy! Read on for why.

Did someone forward you this post? Thank them for us by subscribing!

As many of you know, investing continues to be a no good very bad time. We have covered this here and here if you want to punish yourself. Or you can simply log into any of your investing accounts.

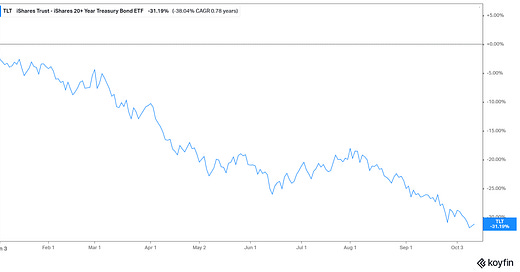

And while we have mostly focused on stocks, rising interest rates means that bonds have also had a terrible year making it nearly impossible to hide from this market. Below is a chart of a government bond funds performance which looks more like a meme stock than a riskless investment vehicle.

This is probably the time to give you guys some good news. And that good news is most of you are not retiring anytime soon so this represents a great opportunity to buy stocks at a discount. Stock returns are largely positive following significant periods of loss and the longer horizon you look at they are always positive, historically.

Past performance is no guarantee of future results, or whatever bullshit line companies use to cover their ass when marketing. But luckily for me I am not selling you anything.

Yes the brilliance you’ve become accustomed to is still free so please tell a friend.

Now we have repeatedly told you to keep buying stocks and not worry about short term fluctuations. So this is nothing new.

So I am going to do something that I didn’t think I would ever do. I am going to try and sell you bonds as a viable investment vehicle in the year of our lord 2022.

Now some of our more astute readers may remember that I actually did this with I-bonds a while back.

Those were a unique opportunity thanks to our nemesis inflation. If you have not taken advantage of this please make sure you do that here before the end of October to lock in a 9.62% interest rate for the next six months. This is expected to decrease to 6-7% range after that - still good, but no longer amazing.

There are however other opportunities in the bond market given where interest rates have risen over the last several months.

As we saw in the chart above about government bond performance, you will see that, unlike I-bonds, buying bonds in general can be risky just like the stock market. To understand how this works let’s discuss bonds.

We will stick to government bonds, since they are risk free in terms of repayment. Bitcoin bros can back off, if the government actually fails to pay its debts the only thing that will save you are guns and ammo. What’s bitcoin trading at again, these days?

Essentially, if you buy a $100 bond from the government with a yield of 4% (this is close to accurate) you will receive $104 at the end of the year. This is pretty great right? You are guaranteed a rate of return and it is much more than your savings account most likely so if you don’t need the money for a year it’s a no brainer.

BUT there is the risk that rates keep going higher, and let's say they move to 5%. Well that sucks for you, because you locked in 4% rates. So now the bond you bought for $100 is only worth $99.05!

Not ideal, but also you know this will be worth $104 at the end of the year so who cares!

On the other hand, if rates go down from 4% to 3% your bond is immediately worth $100.97 so you are up money right away.

In both these cases, the fact remains you will be locking in a 4% gain because it will be worth $104 in a year no matter what, as long as you hold it to maturity. You can bet on the short term moves if you like but more importantly you can lock in gains across different maturity levels.

So let's say you are saving for a wedding a year from now, or want to buy a house in 3 years; you can buy bonds with those maturity dates locking in that interest rate for that amount of time. While they may fluctuate in the short term, you can be sure you will get a solid return at the end of the day. Just look at these current rates vs last year.

What’s the Upside?

We should always be buying stocks for our retirement, that advice is easy.

But we also have shorter term goals and obligations that we need to invest given the current high rates of inflation. For the first time in my adult life, government bonds, the most boring investment of all, offer those opportunities.

If you have any questions on how or where to buy these bonds, please post your questions in the comment section and we will respond and/or write a follow up piece.

For Your Weekend

New Movies and Shows To Watch This Weekend: ‘Halloween Ends’ on Peacock + More (Decider)

It’s still October, which means that more scary movies are dropping on streaming, including the brand-new Halloween Ends. But of course, there are plenty of non-serial-killer-related new releases on Netflix, Hulu, Amazon Prime Video, and more, including a Shakespearean tale, and a highly-anticipated adaptation of a best-selling book. If you’re curious about what’s new on streaming, just sit back and let us here at Decider help you figure out what to watch this weekend and where to find it.