Inflation? AGAIN?!

Ian’s up this week to blow the lid on a coordinated government conspiracy! No, not the UFOs! Inflation!

Help us grow by sharing this post.

We first wrote about inflation waaaaay back in the summer of 2021.

Since then, we have heard pretty much every phrase in the book about why inflation shouldn’t be a concern or that it would go away soon. To be fair, even we were a tad bullish on how quickly inflation would fizzle.

The phrase “transitory” defined 2021. Then, we were told inflation had “peaked” in 2022.

On Tuesday, CPI (the main measure of inflation) read 6.4% year over year, more than economists had expected and still more than 3x the target rate of 2%. So while we may have peaked if we want to consider transitory anything less than the time it takes to get a college degree, inflation had better fall fast.

But instead of admitting inflation was not transitory and the peak was called too early several times. Economists are lining up to move the goalposts (call back to the Super Bowl, we are that good) on what inflation measure we should use. In fact, Nobel Prize-winning economist Paul Krugman has been working on this angle since we wrote our first piece on inflation back in 2021.

Many economists have in the past used a measure called “core” inflation, which is CPI without the food and energy components included because they strip out these volatile items to show a more stable measure of inflation.

As you can see “core” inflation remained higher during the pandemic initially before regular CPI shot past it when food and energy prices skyrocketed. In some ways, this makes sense because as you can see, inflation was probably still higher than expected during the pandemic but lower than it showed at its worst during the peak of supply chain constraints in 2022.

However, this measure has also proven difficult to bring down to the 2% target level. This leads us to the ludicrous “super-core” inflation measure, which also strips out the housing component of CPI to further lower inflation in most cases.

At this point, you may be thinking: “isn’t that basically everything I need to buy on a regular basis?”

And the answer is a resounding YES. Not only do these 3 categories account for over half of the CPI weight basket but they are also the most essential items we have to buy. Housing, food, and energy. Without these, no other expenditures really matter, but the Wall Street Journal does have an idea for you bordering on parody.

Or, rephrased: have you considered starving yourself if you’re poor?

Notice how they said “cooled” next to an inflation number that is still over 6% nearly 2 years later, and a number that came in higher than expected. All while telling you to skip breakfast to save money.

They are not alone in this, the White House has continued to trumpet victory every time inflation is lower than the prior month which, again, does not mean prices are DOWN but rather the rate at which they are increasing is slowing down. Below you can see how inflation year over year is declining, but the purple line (overall price level), continues to rise to all-time highs.

What’s the Upside?

The battle over inflation has been raging on for over two years now, with every word in the book being used to try and minimize the impact it is having on consumers. As words have continued to fail, new metrics and numbers have been created with even crazier-sounding names to further this cause. Meanwhile, consumers continue to pay higher and higher prices for daily necessities.

While there is little you can directly do to combat inflation, investing in your future allows you to keep up with these rising costs.

Super Bowl Betting Recap

What wasn’t inflated were the odds that the Chiefs would win last Sunday. Mahomes & Co. saved an otherwise disastrous betting card. Since I was hosting a party, I completely missed Hurts' first rush for 11 yards and saw his TD run of 1 yard which led me to think I started the day with 3 winners.

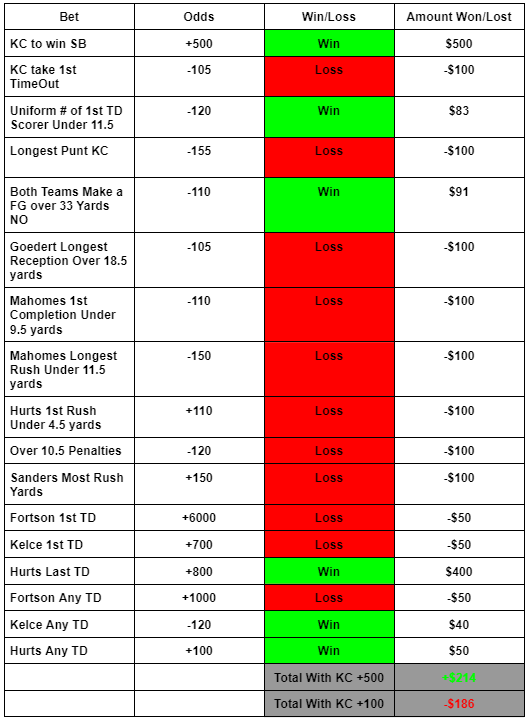

Ian’s betting card:

Butker’s doink won me the NO FG bet (while triggering PTSD) which was sorely needed and my friends can vouch for me losing my shit when Geodert had not 1 but 2 straight catches of 17 yards just barely going under his longest reception of 18.5 yards. Hurts scoring the last TD saved my day and with the Chiefs +500 I was a small net winner. Below is if you bet $100 on each prop, and $50 on the TD scorers.

However if you didn’t have that and simply bet the Chiefs pregame at +100 and followed me, you lost some money.