📈You Up?

Regular readers know we’ve talked our fair share of shit about the “financial advisors” aka insurance salesmen masquerading as advisors. They aren’t the same as a genuine professional, who is often worth their fees many times over. We were reminded of this fact in this piece in the Wall Street Journal where Millennials tell stuffy old advisors to take their golf clubs and shove them back… in their bag.1

On the one hand, the Millennial profiled here has a point - plowing your savings into crypto has gifted significant wealth to some, we’re always in favor of young people taking control of their financial future, and, betting on crypto to play some role in the future of finance is a prudent bet, in our view.

The level of risk some self-assured Millennial investors2 are taking on to invest in things like crypto, NFTs, or just high-flying growth ETFs like ARK Innovation ETF (ARKK) are… concerning.

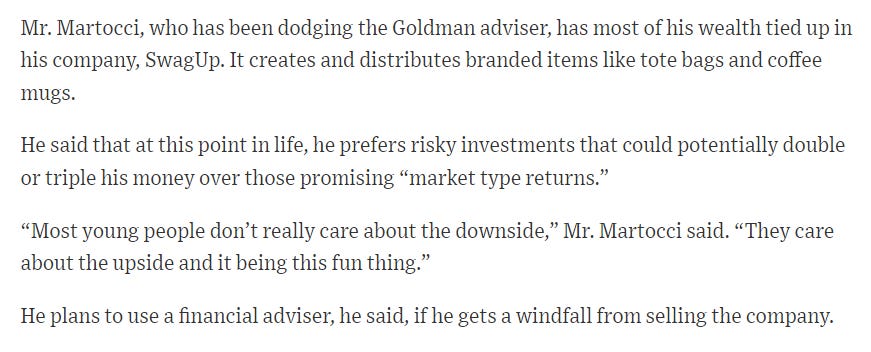

WSJ:

Now, we are in favor of crypto (and gambling), however, we’re not so sure about putting 90% of your net worth into something as volatile as crypto - that’s potentially (likely) dangerous. “Market type returns” of 27% for the S&P 500 may sound boring compared to the risky investments providing 2x or 3x mentioned above but it provides some diversification that this Goldman adviser likely would have told Mr. Martocci about on the golf course.

WSJ published this article on November 8th, 2021, just a few months ago. And a lot can happen in a few months, particularly in the “we don’t care about downside” world.

ARKK has been one of the most popular “upside should be fun” investments recently. That fund set the world ablaze by dramatically outperforming the S&P 500 by crowding into buzzy names like Tesla and Roku; companies that, in their manager’s view, represented game-changing innovation.

Now you may say, “well, sure guys, but look how much this ETF is up since 2020. Besides, we’re long-term investors! Who cares about a little volatility?” Generally, we would agree. Except that’s not how most people invested in this ETF. Most people chased the performance and invested near its peak price. In other words, most people bought high. Now that the ETF has collapsed, many people lost a lot of money, particularly on a cumulative basis:

h/t @Keubiko

The orange line shows how much money investors have piled into ARKK, reaching almost $20B before performance took a hit. Meanwhile, the blue line shows the investors’ cumulative return, which is *checks notes* a loss of $1.9 billion!

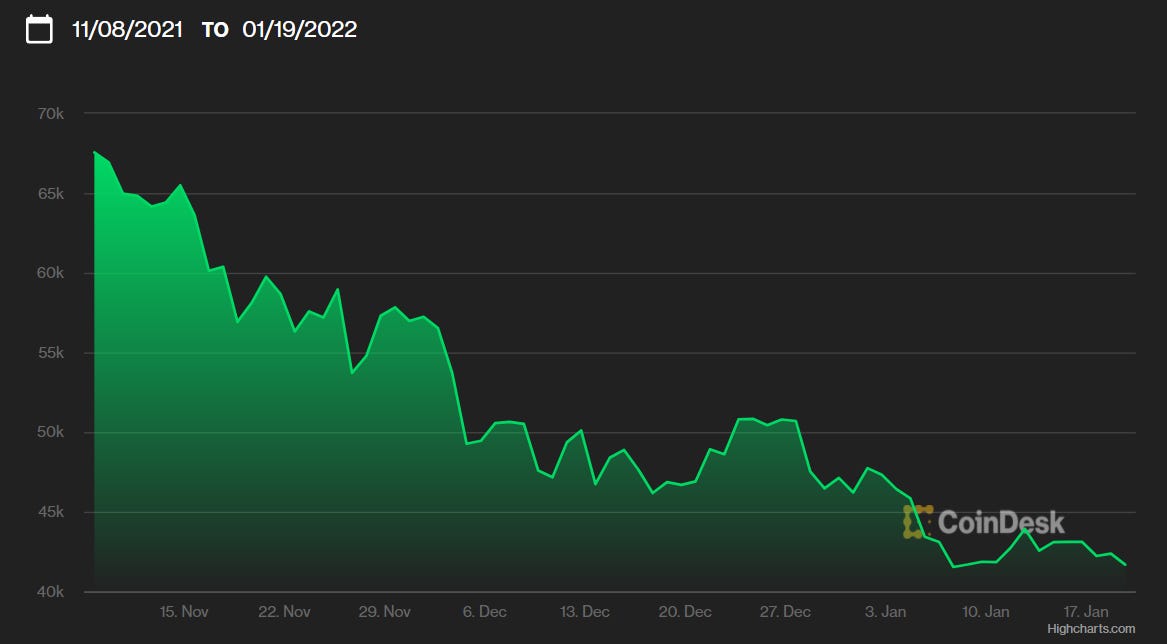

Crypto has followed a similar path.3 Here’s how Bitcoin has done since that WSJ article ran:

Look at Coindesk, trying to put a positive spin on dismal performance with the green-tinted chart. They should work for SoftBank’s Vision Fund. The WSJ article absolutely nailed the most recent all-time high for Bitcoin. Since this article was published, Bitcoin’s value relative to the US Dollar has tumbled from $67,000 to about $41,000 today, a 40% decline in value. Our technical analysis revealed something very interesting:

Ole Abe has always been characterized as nothing but honest. Especially about using crypto bro tears as fodder for just this sort of #content. Shocked it didn’t make it into some address or speech somewhere.4

For those scoring at home, two of the most popular “fun things” are down 40% in the span of three months, while boring “market type return” vehicles like the S&P 500 are down less than 10% from all-time highs.

What’s the Upside?

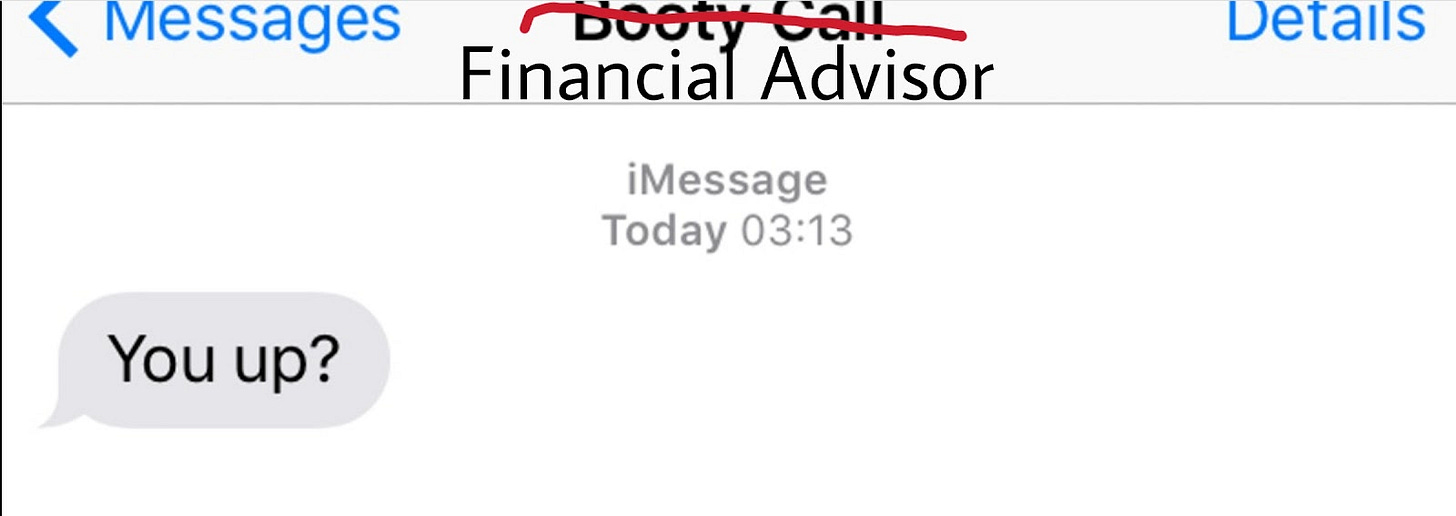

Paying an advisor fees may sound dumb when you are crushing “market type returns” on the way up in a bull market. However, bull markets don’t last forever. So, having a good financial advisor will pay for themselves many times over when shit hits the fan. They can guide you on a prudent way to diversify your investments (and, yes, things like ARKK and BTC can be a part of this), while also educating you on how to protect gains, reduce taxes, and stay calm during a market drawdown. In some cases, simply having someone you can trust to talk to when emotions are running high in a bad market can be worth any investment manager's fee.

It’s not too late. Text your advisor.

For Your Weekend

Our round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

Microsoft’s Purchase of Activision Blizzard Encapsulates an Industry in a Single Deal by Ben Lindbergh (The Ringer)

The deal, announced Tuesday and expected to close in 2023, touches on every hot-button gaming-industry issue, from consolidation to workplace reform to Netflix-style libraries to speculation around the “metaverse”

The Case Against the Trauma Plot by Parul Sehgal (The New Yorker)

In a world infatuated with victimhood, has trauma emerged as a passport to status—our red badge of courage? The question itself might offend: perhaps it’s grotesque to argue about the symbolic value attributed to suffering when so little restitution or remedy is available. So many laborious debates, all set aside when it’s time to be entertained. We settle in for more episodes of Marvel superheroes brooding brawnily over daddy issues, more sagas of enigmatic, obscurely injured literary heroines.

Watch:

Beanie Mania (HBO Max)

If you think crypto bros trading .jpegs of poorly drawn apes is crazy you need to watch this documentary about one of the first internet-fueled manias. Instead of 20 somethings on Discord, this doc follows several suburban housewives (shout out west Chicago Suburbs) as they become hooked on the thrill and money of collecting Beanie Babies.

Chuckle:

Look at that; a PG-rated euphemism in the Weekly Upside.

Have Millennials ever been described as self-assured? Is this an Internet first? I mean, how else would you describe this cohort of investors? Delusional seems a bit strong, no?

By now, everyone has heard the story of Bitcoin and its meteoric rise. For the sake of argument, we will use it to represent crypto and 90% of the investments from our friend in the WSJ article.

Oh, look: a crypto bro has entered the chat to tell us how if Abe had just used the blockchain he could have avoided that bullet.