Note: we’ve been following the Afghanistan situation closely. It’s heartbreaking, infuriating, and tragic. We felt it was inappropriate for us to provide commentary on the situation beyond that. We’ve linked to commentary we felt provided appropriate analysis in the ‘For Your Weekend’ section below.

We get asked variations of “I have money, now what?” more frequently by our friends than anything else. Now that you’re actually making a living, you want to make sure you get the most out of your money by avoiding bad financial decisions. Logically, someone calling themselves a ‘financial advisor’ should be someone you engage with, on the assumption this person will provide the sage, worldly guidance you expect from someone with that title.

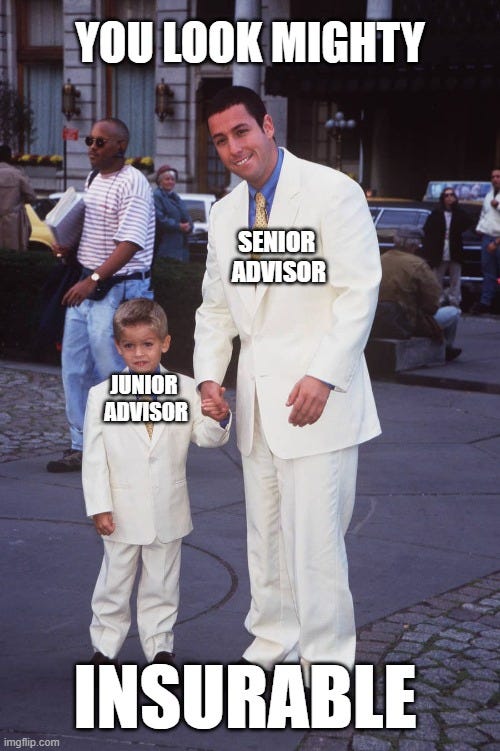

Does this picture scream ‘trust me?’

If this doesn’t set off every alarm bell in your body then we’re not sure we can help you. Run - don’t walk - run from this level of nonsense.

Most likely, someone you know now calls themselves a “financial advisor” at a firm like Northwestern Mutual, Prudential, or MassMutual. You’ve likely been called by one of them.

The problem with these firms is they almost exclusively sell life insurance, with an emphasis on whole life insurance. Since these firms don’t pay your friend a salary, they have to resort to slinging as much life insurance as possible to whoever will buy it, suitability be damned. Which kind of makes it a pyramid scheme of referrals to sell insurance to people who may or may not need it:

Now, we don’t blame your friend. We blame the lack of options for young people attempting to find real financial help. Which begs the question: what is wrong with whole life insurance?

Well, nothing, if you have a gaggle of children, a large mortgage, any other number of other debts that would burden your loved ones if you die, and you’re maxing out your retirement accounts (which, as a reminder, exceeds $25,000 per year). In this case, it may be a viable option, albeit still infinitely more expensive than other options like term life insurance.

Whole life insurance essentially means paying for a set rate per month until you die. The death benefit (payout amount) goes to your spouse/surviving heirs. This is why it is insane it gets sold to us by Northwestern Mutual when we are in our early 20’s and we own jack.

Now, your drinking buddy in their new Joseph A. Banks suit will sing the praises of whole life insurance. Here’s what they leave out.

A Roth IRA has the exact same benefit without the cost

This is an insanely inefficient way to save for retirement

Meaning:

Whole life insurance costs five to fifteen times more than a term life policy. The “financial advisor” pushing this on you makes between 40-100% of the first-year commission as soon as you pay your first monthly payment. So, if the policy costs $1,000 per year, your friend just earned between $400 to $1,000 in commission.1

Here’s the rub: life insurance isn’t like a stock or a mutual fund that you can buy and sell at will. It’s a legal contract. Signing on that dotted line means the company agrees to provide you all the benefits outlined in the contract if you pay your premiums. The insurance company has the legal right to terminate the agreement between you if you stop making payments. You cannot get back any of the money you gave them.2

Honestly, if your friend is that hard-up for money, just tell them to find $500 to hire a resume writer and get in touch with a recruiter to find a new job. It’s a better long-term deal for both of you.

What’s the upside?

Insurance has its place. Own a home with a partner and pay a mortgage? Own a business? Have children or expecting to have children? Buy life insurance, specifically term life insurance. We reject the idea of overpaying early in life for products that don’t fit your needs.

And tell your buddy that Brooks Brothers is out of style.

For Your Weekend:

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

Real Afghanistan Withdrawal Has Never Been Tried by Robert Tracinski (The Bulwark)

Some serious and thoughtful people hold [the position that withdrawing was the right decision, but President Biden botched its implementation], but it strikes me as fitting a little too comfortably with certain powerful partisan impulses.

If you’re on the left, it allows you to establish that of course you’re a good peacenik and you want America to end its interventions overseas—while disowning the actual consequences of doing so.

If you’re on the right, it allows you to indulge the fantasy that Trump would have executed this withdrawal so much better—it would have been the best, the strongest retreat, everybody says so—even though Biden was following the basic roadmap Trump drew.

But we should take a few minutes, while this disaster is fresh and before it goes down the memory hole, to consider whether the actual, real-world results show that withdrawal was a bad idea in the first place.

Every Option in Afghanistan Was Bad by Nicholas Grossman (Arc Digital)

There are two ways to interpret [the fall of Afghanistan]:

The Afghan government couldn’t stand on its own, and the security forces couldn’t hold the country, despite 20 years of international support. They’d never be able to — so something like this collapse would’ve happened whenever the U.S. pulled out.

American and allied efforts clearly made a difference, keeping the Taliban at bay and a better government in power (which, despite many problems, let girls go to school, didn’t host al Qaeda terrorists, etc.)

Both interpretations are right.

The Uncomfortable Truth of Biden’s Rapid Afghanistan Withdrawal by Jane Ferguson (The New Yorker)

The Biden Administration’s rapid withdrawal of U.S. troops from Afghanistan has spurred a debate over the moral responsibility that America bears to its partners in a failed foreign intervention… The rapid withdrawal of U.S. forces has exacerbated long-running dynamics in Afghanistan… Critics say that Biden’s surprise announcement in April that he would withdraw nearly all American troops in five months did not allow enough time for U.S. officials to safely evacuate Afghan allies. There are currently just over twenty thousand applicants, half of whom have not completed the initial stage of the process. In Kabul, Biden’s withdrawal increasingly appears poorly planned, rushed, and chaotic.

This is personal for Jack on the Weekly Upside team: he sold this shit out of college and this post is his atonement!

Unless it’s stipulated in the contract. There is a specific policy called ‘return of premium’ but they’re very costly and sold much less often than straightforward term and whole life. https://www.investopedia.com/articles/pf/08/return-of-premium.asp