I have money, now what?

We get this question a lot. It takes different forms – what should I do with my first paycheck after college? Should I pay down debt or save for my first home? What do I do with my company’s retirement plan? What the hell is a stock option? Over the last year, stimulus checks have made this question even more relevant.

A desire to understand what to do with your money is at the root of these questions. However you define “having money,” we are here to help you make decisions that, hopefully, improve your life.

We’ve spent a little over a decade in the financial services industry in several roles. If there’s one consistent thing, it’s that there isn’t a consistent definition of a “financial advisor.” Most are honest and looking to help. Some, unfortunately, are charlatans, grifters, or con artists looking for a buck. All these types of people are present in the industry for the same reason: understanding finance enough to make the right decision is hard, and we have to make financial decisions almost daily in the modern environment.

The “average person” is often portrayed as helplessly ignorant of finance, especially younger generations like Millennials or Gen Z. In our view, we don’t believe that’s the case. We’d argue that the younger generation is better-equipped than any generation before to navigate the complex financial system successfully. We’re missing is cohesion, a method to tie the tools we have together and points us in the right direction.

Our mission is to provide the thought leadership to guide that process and help point you in the right direction. We hope to save you time, money, and stress. Ideally, our content helps put you in a position to make the right financial decision at the right time.

Why is this important?

Traditional financial advisors underserve the younger generation

Most advisors make money by charging a percentage on investable assets, commonly 1%. Meaning, if you have $1 million of liquid assets (as in, not including your house, car, etc.), they make $10,000 per year on that account. Stack even twenty $1 million accounts together, and it’s not a bad living. This incentive structure means that the traditional financial advisor has little incentive to help someone with few investable assets.

Some advisors charge a flat fee. Unfortunately, these fees can be prohibitively expensive. Like their asset-based peers, these advisors cater to households in the back third of their careers when investable assets are high and retirement is near. There is built-in pressure to do something. For those early in our careers, we know we need to do something, but the cost to use many of these advisors doesn’t make sense.

It’s a challenge for one set of advisors to justify working with us, and another set may be out of our price range. This leaves us sorting through the least-defined and often least-experienced version of a financial advisor: commission only.

Firms like Northwestern Mutual, Prudential, and Metlife are insurance salespeople masquerading as financial advisors. Let’s be clear about their incentive structure: 50% commission or more is quite common for many insurance products, especially term and whole life insurance. That commission pays in the first year, and then the firm will pay the rep a steadily declining amount as long as you pay your premiums.

There’s a time and place for insurance. But it ain’t right out of college. Generally, insurance is appropriate when you have something of value you can’t afford to replace out of cash flow. To qualify for a home or to drive a car, you’re obligated to carry insurance. The conversation becomes more nuanced than a car or home when you start talking about the value of human life. Again, insurance is useful but has a time and a place. Here’s what it’s not good for: as a savings or investment account.

And yet, there’s your college friend, gleefully slinging insurance (you should never have let them copy your answers in that econ class).

That’s one type of “advisor” the younger generation commonly comes across. The other type is the robo-advisor. These are automated platforms designed by big financial institutions. Typically, they are available in both an app and a website format. All of them seem to come in that “Silicon Valley” color palette of muted pastels and rounded-off, non-threatening humanoids to guide us through sub-menus. Blech.

Robo-advisors are a clear step up from insurance-only advisors. That there’s an app on your phone means notifications provide a nudge to take some action, usually to invest more or review spending. Nothing wrong with that! That alone can serve as a good way to build behaviors that help make you money. Also positive is that many of them use low-cost ETFs to invest in anything you save.

By design, robo-advisors seek to capture the younger generation as they accumulate wealth. The charitable view is that the firms want to encourage positive behavior to provide additional services to those who distinguish themselves. The cynical view is that robo-advisors are another fee extraction scheme. The reality is a bit of both: low-dollar amount accounts aren’t worth pursuing, but the traditional banks can’t ignore a generation that’s bigger than the baby boomers. It does have the feeling of ‘here kid, play with this toy until you’re older and worth my time.

To recap, there are three types of advisors out there to offer some guidance. They each come with trade-offs:

To pay down debt or to invest in a retirement account?

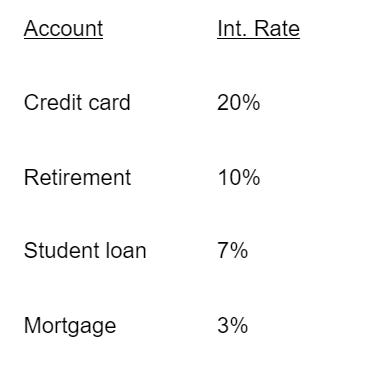

You unlock tremendous leverage when you take advantage of compound interest. The question of paying off debt or investing in a retirement account is the same action, from two sides of compound interest. Conceptualize debt as ‘negative compounding’ and investing as ‘positive compounding.’ The faster you can flip from negative to positive compounding, the better.

How to get there? Rigorous prioritization, according to the interest rate. Suppose you have five account types that could accept any excess cash you have, net of necessary and discretionary expenses: credit card, student loan, mortgage, brokerage, retirement. Each of these carries different interest rates, listed below, from highest to lowest:

We are firmly in the camp of paying off credit cards before anything else. Every other account carries specific tax advantages that credit cards do not enjoy. Begin the attack on credit cards after you get a handle on a budget (to create the cash you need to accelerate pay-off), and you’ve set aside a bit of cash for emergencies (think one or two months’ worth of monthly expenses). Then, it’s go time.

Suppose you have three credit cards: credit card one charges 15% interest; credit card two charges 17% interest; and credit card three charges 22% interest. Which one do you start paying?

Some well-known pundits espouse the ‘snowball’ method: you begin paying off the smallest amount before moving to the next credit card with the next smallest balance. The thinking here is that paying off the small debts first can improve your cash flow (one less account to pay off) and provide a psychological boost (you did it!). The downside is that math still exists. You may leave larger loans at higher interest rates untouched for longer, which ends up costing you more money in the long run.

We believe that debt should be paid down in the interest rate, starting with the account that carries the highest rate. The reason is simple: you will pay less money into the pocket of the lender over time. Which means more money stays in your pocket. Which, we’re being told, is good and preferred.

In the example above, you would start with the 22% card, then the 17% card, and finally, pay off the 15% card.

Handling debt in a financially optimal way is a critical skill that you will practice throughout your life. Like most developed countries, the United States has fully embraced a ‘financialized’ society. Meaning, financial services make up a greater percentage of our national production, leading to an increased number of financial decisions we need to make regularly.

Don’t believe us?

Need a blender? Williams-Sonoma will gladly cut the price if you open a new credit card account today. Fixed your car? Firestone has very competitive rates for a new credit card. Do anything at all? Apple or Google will gladly loan you the money for that one purchase, open a new account. Want that degree? Your preferred institution – hell, even the Federal government! – will gladly lend you the money.

It’s not wrong to get a discount but consider the trade-offs. For example, ‘depth of credit’ is one of the major factors in your credit score. It’s an average. If you keep opening new accounts, the average age gets smaller, which hurts your credit score.

In aggregate, younger generations are reasonably responsible for credit card debt. The big anchor to our financial success is student loan debt. A big part of what makes student loan debt a challenge is the size of the loan. It’s great to pay off big chunks of debt at a time, but what if you have $100,000 of debt? Unless you receive a big injection of cash, most of us need to pay student loans off steadily over many years.

Basic math tells us to pay more than the minimum to reduce interest charges and pay down the debt faster. Immediate follow-up question: how do you create an extra payment without creating pressure elsewhere?

For many, the number one victim is the retirement account.

401(k) or bust

The creation of the 401(k) dovetailed with the Reagan Administration’s aggressive dismantling of unions to land a near-perfect strike at the heart of the pension system in America. The pensions that remain are struggling, many in a mess of their creation (different topic for a different day). If you do have a pension, odds are you’ll have to accept a lower payout or a delay in the payment start date. Unless you’re a government employee, odds are you don’t have a pension, which means you’re on your own for retirement. So now what?

What you invest in is much less important than when you begin investing. The old chestnut ‘time in the market is more important than timing the market’ applies here. It’s another way of talking about ‘compound interest’ and ‘time value of money.’

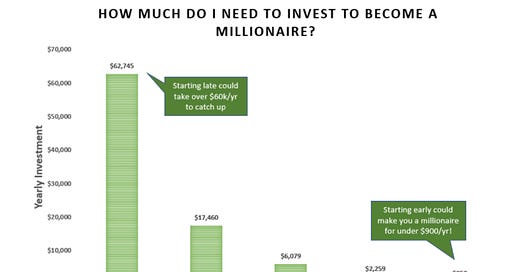

Compound interest is another way of saying ‘your money makes money.’ Suppose you wanted to become a millionaire by 60. How much money do you need to put away each year to achieve that?

What you invest in matters less so long as you catch the general trend of the market going up. That’s why we recommend funds over individual stocks in most cases. Instead of purchasing shares of specific companies (like Coke, Disney, or Gamestop), you buy into mutual funds or exchange-traded funds. These funds use your money to buy shares in hundreds (sometimes thousands) of companies. In this way, you get to participate in the general trend up in the stock market without suffering the big price swings that can come with holding individual stocks (see Gamestop).

In general, get in, get in early, and own something cheap and broad (that sounds dirty, but we stand by it).

Once you’ve built up some funds in a retirement account, we can start to get creative. The average person has never had so many investment options available. By one measure, there are over 2,000 different ETFs available. That doesn’t count mutual funds and other investment options! All those options mean you can tailor your retirement account to you.

On the other hand, there are over 2,000 ETFs! How do you narrow them down? How do you know what’s worth investing in and what’s better to avoid? More importantly, how do you choose the right investments for tomorrow, not today?

That’s where we can help. There is an argument to be made for making prudent allocations towards more opportunistic investing options. Sorting the good from the bad can be a fun hobby. Still, it can be hard to stay on top of more opportunistic investments (particularly more esoteric strategies like options or futures).

The bottom line is this: you’re not investing for next week, you’re investing for thirty years from now. The decisions you make today carry implications for the you of tomorrow. Let’s make sure you’re making the best ones.

Conclusion

In many ways, the younger generation is the ‘too-much-information generation. We have access to so much data, it can fade into just static without ways to tune out the noise. We have more tools than any generation of Americans ever. And, we have time on our side. Now, we need to put the pieces together to form one cohesive picture. Now is the time for us to take control of our financial future.

[1] https://riabiz.com/a/2017/4/28/as-acorns-grapples-with-monetizing-11-million-micro-accounts-the-laid-back-la-robo-advisor-brings-wealthfronts-former-chief-exec-onto-its-board