📈What's your benchmark?

I’ll let you in on a secret: ignorance is bliss.

Particularly when it comes to your investment/retirement accounts. Human beings are just not programmed to think what asset allocation mix will generate the highest Sharpe ratios1 ten to thirty years in the future. We’re built to either run away from pain or pursue pleasure.

Curiously, the stock market offers both. Our brains get a hit of that sweet, sweet, dopamine when our investments go up; if they go up more than the market did, that makes us the smartest human alive (per our brains).

Conversely, if our investments go down with the market, the alarm bells go off. Subconsciously, the brain freaks out. It takes discipline to not have second thoughts. Or, perhaps more accurately, to shrug off that nagging twinge of doubt and not do anything.

Anyone who has read this blog knows our favorite GIF is Paul Rudd as Kunu the laidback surf coach from “Forgetting Sarah Marshall.” Why? Because, more often than not, the best and most correct response to anything that happens in the market, good or bad, is to do nothing.

The best thing you can do is get an asset mix together that you feel reasonably comfortable about, and then look at how things are going… once a year?

Oh, okay, Alex. I’ll just jump into the asset allocation spaceship and shoot on over to asset allocation land where everything is easy to understand and no one is trying to gouge me with fees or overly complex and/or unnecessary investments. Thanks, buddy, great advice. I’ll get right on that.

That’s a fair criticism.2 Most of us don’t have a pension/defined benefit plan where picking our investment mix is out of our hands, so it falls to us to choose our investments.

We wrote another blog that walks through the options you might have for your 401(k).

📈 Grow Baby, Grow

Two weeks ago, we talked about four types of portfolios segmented based on assets and time horizon. Today, we’re going to take a closer look at the max growth portfolio. As a reminder, the objective here is to find the asset allocation expected to produce growth. Now, chances are good that most of the assets are in a 401(k) or something similar. The way…

We stand by that advice.

That piece didn’t address the human urge to benchmark ourselves. We need the validation that what we’re doing is working. How does a monk know whether all that meditation pays off? They’re still calm and centered.

So, let’s scratch the itch and suggest a reasonable benchmark to judge your investment’s performance.

Spoiler alert: it isn’t the stock market.

The stock market is flashy and gets all the headlines. The real benchmark we would suggest paying attention to is inflation. Stocks go up and down; inflation eats away at the purchasing power of your future dollars. So, all you have to do is beat inflation.

Our article above suggests that you’re okay just going with the target date fund, particularly if you: a) don’t have time to do your own research, b) don’t have any strong views on your investments, and c) have a life you wish to live.

As a reminder, a target date fund is a mutual fund that adjusts what it owns as you approach retirement. The workflow is simple: pick the approximate year you expect to stop working and then funnel all your 401k earnings into that one fund. The manager of the fund will take it from there.

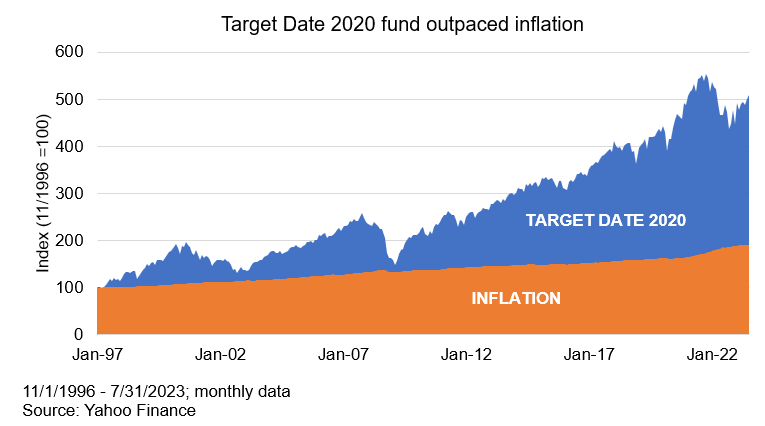

For some, it might be unnerving to think that one fund will do enough to get you through to retirement. Fortunately, we can use publicly available resources to test if a 2020 target date fund3 did enough to get you over inflation.

SWEET. Crushed it.

Basically, this chart means that, despite inflation ripping over the past few years, the one target date fund did enough to keep you ahead.

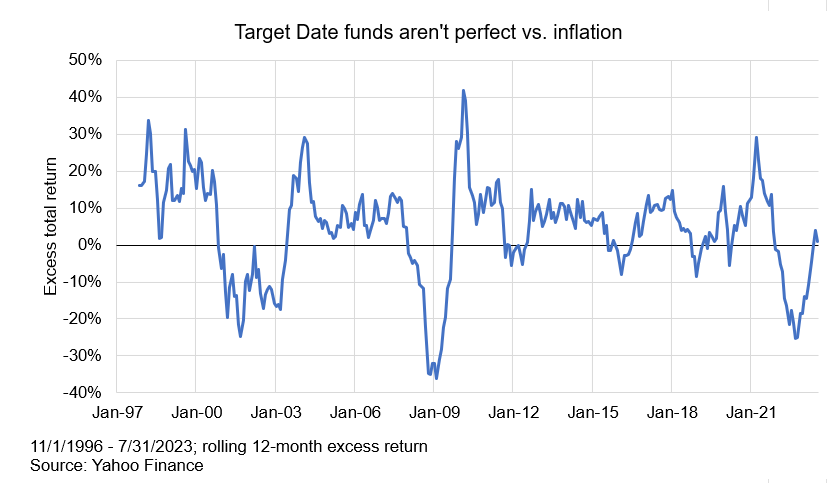

Last thing worth noting: these funds aren’t perfect.

This specific fund underperformed inflation about 30% of the time. And those periods of underperformance came during some gnarly periods for the market (financial crisis, COVID, etc.). There are a lot of other factors at play here that influenced the results as well; but overall, this target date fund did its job, beat inflation, and got its investors across the finish line.4

What’s the upside?

Target date funds aren’t sexy. You cannot boast to your friends or family about how your target date fund is doing. You also are unlikely to get royally screwed over by a target date fund (how’s that crypto thing going, guys?).

The biggest thing: if you feel like you want a benchmark of how you’re doing, look at inflation over anything else. That matters more than anything.

A Sharpe Ratio is a measure of risk-adjusted returns. Numerator is total return, less the risk-free rate; denominator is the asset’s annualized standard deviation. Sharpe should always be considered in context. A Sharpe of .50 might be good unless everything else has a Sharpe of 1.00, in which case, it’s terrible.

Thanks, me. I’m being very balanced with myself. You sure are, Alex. Good job, other Alex.

Meaning, you would have bought this fund 20+ years ago to retire in 2020.

One key point: this presumes said investor NEVER SELLS the fund.