📈The 7 Stages of Correlation

It’s been a tough year to make a buck - at least in the stock or bond market. Both asset classes have faltered on a confluence of macro factors like inflation, the war in Ukraine, and supply chain disruptions. How is an investor supposed to process all this? Alex takes us through a familiar framework.

For the first time in a while, stocks and bonds have lost money together. Since many Americans utilize investments within these two asset classes for their retirement assets, this development has prompted reactions along the emotional spectrum.

Shock

“JFC I’m down how much?!”

Unless you’ve been paying close attention to market developments, the most recent retirement account statements likely were a shock.

Stocks and bonds diving off a cliff together isn’t what’s supposed to happen, leading you to:

Denial

“That can’t be right!”

If you have been following what’s been going on, it’s one thing to see or read about it because there’s an element of separation. It’s quite another to see how it impacted you.

Anger

“This is someone’s fault!”

That stocks are prone to steep drops isn’t really news and shouldn’t be surprising. All in the game.

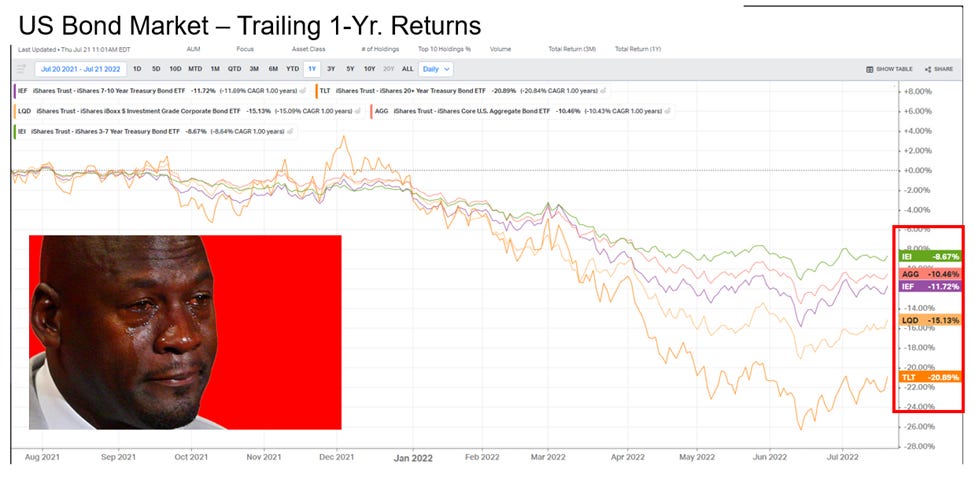

Bonds falling at the same time as stocks is likely where the confusion lies since no one really pays attention to bonds. If you remember nothing from this post, remember this: when interest rates rise, bond prices fall; if bond prices fall, then returns go down.1

With inflation raging at forty-year highs, the Federal Reserve has aggressively hiked interest rates. Which means you get performance that looks like this over the last year:

Given the aggressive rate increase schedule the Fed has followed, this chart was a mathematical certainty.

That interest rates were allowed to sit at zero for the decade after 2008 is where your ire should be directed. Which, given the number of parties with influence over interest rate policy, means you might as well vent your frustration at the sky.

Bargaining

“There must be something I can do?”

This stage is where people will hunt for solutions, looking for ways to prevent this from happening again and make things right. This is when opportunists come out of the woodwork with all sorts of “protective” products that purport to keep you in the market without exposing you to the ups and downs.

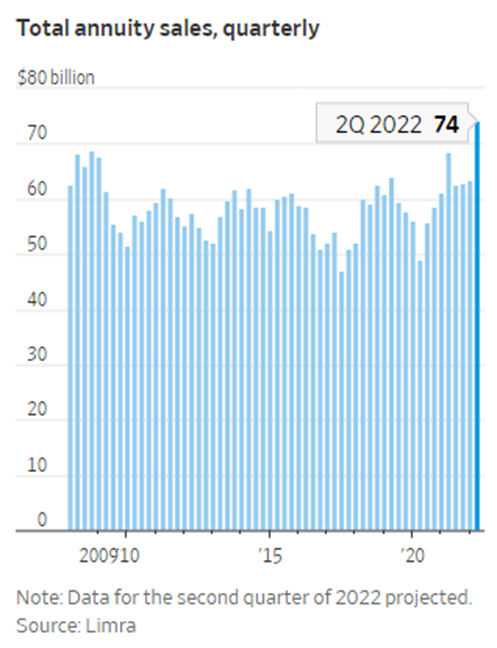

To wit: the fixed annuity industry is having a good quarter:

The truth is that unless you’re willing to invest outside the stock or bond market or take a different kind of risk, you’re stuck with the ups and downs systemic to these two markets.

Depression

“There’s nothing I can do.”

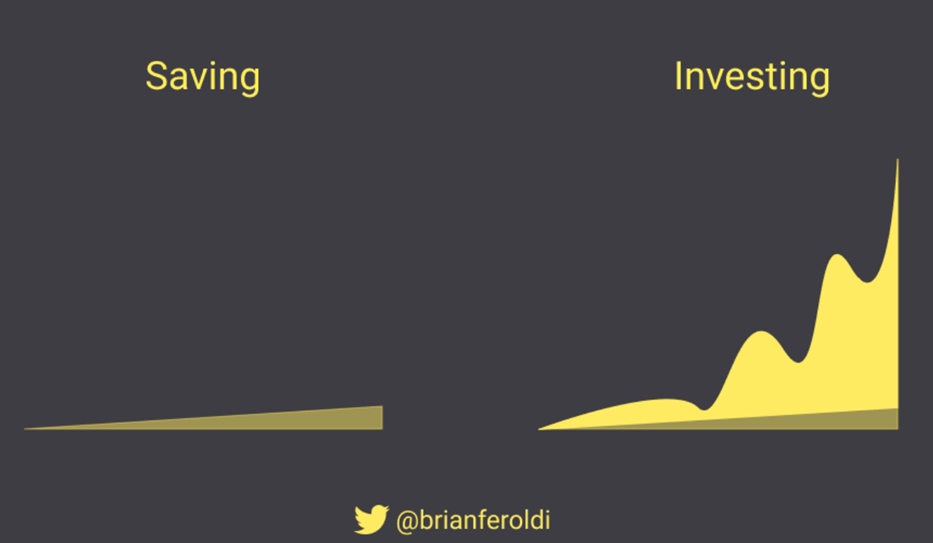

Not true! Recognize that investing in any market – stock, bond, or otherwise – involves rewards that come with bearing risk. It’s just not going to be a linear path to those rewards:

Right now, any losses you have in your accounts are what’s called “unrealized.” It’s a tax and accounting term that means the losses are true, but they aren’t “final” because you haven’t sold your investments. “Realized” losses are just that: losses (or gains) that are “final” because you sold your investments.

In practical terms, the surest way to guarantee the losses you see in your accounts is to sell now. And that is depressing since the easiest and simplest way to mitigate market fluctuations is dollar cost averaging.

Acceptance

“I can’t change the past…”

Are you retiring tomorrow or in the next five years? For almost everyone reading this post, the answer is “NO.” In fact, the answer is that your retirement date is 20 years in the future. This means that you have time to make up for any losses you see right now.

Hope

“…And that’s okay.”

Bear markets last about a year on average; bull markets last over five years on average, historically. If you have 20 years or more to go before retirement, you’ve got at least five more bull markets in your future.

And that’s an encouraging thought.

What’s the Upside?

Inflation at forty-year highs isn’t great; inflation rinsed through the politics-media-internet spin cycle makes it feel even worse. Stocks and bonds losing money together doesn’t feel good. A recession seems to be inevitable, if not already here.

However, as Ian and I were discussing earlier this week, it’s like we’re talking ourselves into a recession: many of the underlying fundamentals remain positive (people have jobs, wages are up, and consumer demand is still strong). Not every recession resembles 2008. Most of them are actually short, sharp declines in risk asset prices (like stocks and bonds) that then rebound as investors scoop up quality assets at discount prices.

Want to tilt the market back up? Buy! Buy! Buy!

For Your Weekend

Watch:

The Bear (Hulu)

A fine-dining chef must take over his brother’s greasy Chicago beef sandwich shop. Tension ensues. A comedy in the very traditional sense, it’s rarely laugh-out-loud funny, only that it may end on something of an upnote.

Worth a watch and definitely for mature audiences only.

Chuckle:

It's also important to note that, unlike stocks, bonds have a fixed maturity date and they will eventually regain their value as long as they don’t default. So, returns should be expected to recover over the long run. In other words, if you have a bond with a 10-year maturity, you will get your money back in 10 years, plus some interest along the way. Prices drop in reaction in changes in underlying interest rates to reflect the bonds’ value on the open market at the time.