📈 Full Self Destruction

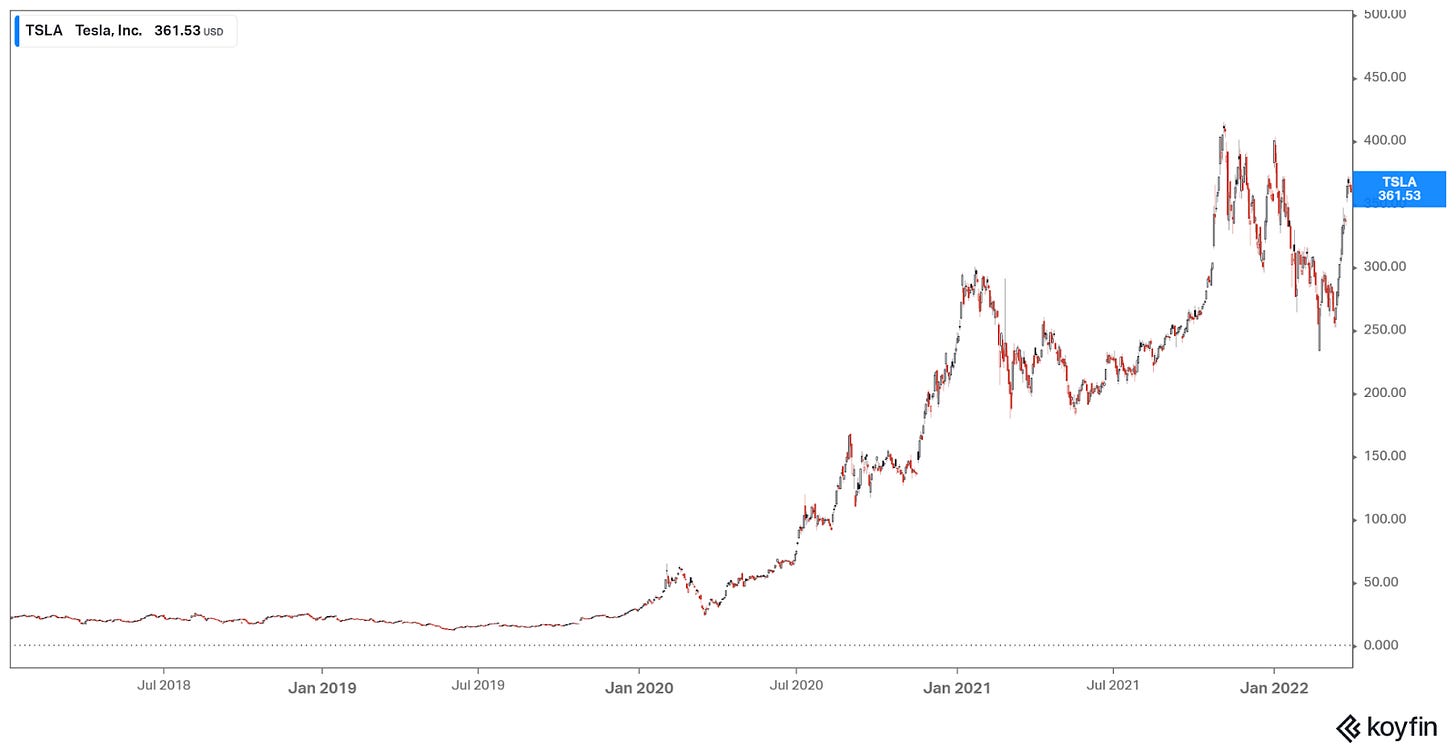

Ian’s up this week with some thoughts on Elon Musk and the ongoing Tesla saga. If you haven’t seen the news, Tesla’s stock has fallen over -70% as of this writing from its highs, as of this writing, sending many a fanboy, bagholder, and Elon stan into meltdown mode. Let’s explain why Tesla’s fall isn’t that nuts.

When you’re done, do us a favor and hit the share button with the last person you sent an email to. Worst thing they can do is ignore it, right? And if they don’t, maybe we continue the growth we’ve enjoyed over the last year thanks to you!

As many of you may know, I am not a fan of Elon Musk. And I’m not some bandwagon Elon hater, I was a hater before it was popular.

This is an unfortunate reality because I am a big car guy and the original Tesla cars, specifically the Model S, were groundbreaking cars. And even more so I am a big space guy so him building giant rockets that can land themselves is also really fucking cool. Unfortunately all that cool factor quickly goes out the window because they are attached to a grown man who thinks 420 and 69 jokes are the epitome of humor.

This is cringy enough before you consider he has 10 children with multiple women, including twins with an executive at one of his companies. Or the alleged offer of buying a horse for a flight attendant in return for sexual favors.

All of this occurred long before he lit $44 billion on fire to own Twitter and shit post full time. But from a finance bro perspective none of this is actually why I started hating Elon. My bigger issue has always been the mockery he has made of financial markets. Which in some ways kicked off the ridiculous meme stock craze of last year.

While I could fill multiple articles with all the shenanigans that he has pulled, the biggest one was in 2018 when he tweeted this…

Credit where it is due, he is so committed to the 420 bit that he included it in a fake buyout deal that landed him in trouble with the SEC. In this instance he suggested in a tweet that he had secured funding to take Tesla private at a price significantly higher than it was trading at the time.

This is highly illegal as it represents material non-public information and which caused a trading frenzy around the stock. Despite his insistence that he was joking, or the funding was close, or whatever else he came up with. The SEC fined Musk and Tesla $40 million, stripped him of his board seat and required his future tweets to be screened ahead of sending, which we know is not happening.

Because Musk was given a lavish options package from the Tesla board of directors in March of 2018 that granted him what turned into 100s of billions of dollars at the peak of Tesla, he had a lot of incentive to focus on elevating the stock price.

So it was no surprise that he tweeted “funding secured” in 2018 or started a string of ambitious but missed goals in order to boost Tesla stock price and his net worth.

1. April 2019 - Full Self Driving Robotaxis will exist by 202, making Tesla cars appreciate in value by driving “Uber” for you while you slept

It is now 2023 and this is not close to available

2. November 2019 - Cybertruck will be available by early 2022 and be invincible

Deliveries are now expected in late 2023 and well…

3. April 2022 - Tesla Bot will be a humanoid robot available in 2023

There has still not been a working prototype and the first event had a human dancing in a robot costume

Elon Musk unveils plan for 'Tesla Bot' with man dancing in a bodysuit

And guess what all of this worked (until earlier this year)!

Not only was the stock near all time highs, up huge multiples since Elon’s stock options were granted but it also made Tesla worth more than every other car maker in the world combined at its peak.

TLDR: Elon successfully pumped Tesla stock to become one of the largest companies (and the richest man) in the world through various promises that remain to be delivered.

While some including Musk have argued that this did not cause investors harm because it simply made the stock go up (he notoriously hates short sellers which is a red flag). But much like we saw with AMC and other meme stocks, gaslighting retail investors into buying a stock, or fighting the shorts can have real consequences for investors who fall for this gambit.

It’s all fun and games when the Fed is pumping money into the economy with 0% rates and everyone is YOLOing their stimmies into whatever stock they could find on Robinhood. When all that goes away however, investors are left only with a narrative and company fundamentals.

In Tesla’s case the fundamentals actually aren’t bad; they recently reported car deliveries for Q4 and while they fell a little short of expectations, they continued to grow to all time highs, and overall growth rates for the company were over 40%.

Unfortunately, with Elon buying Twitter he became even more in the public spotlight than ever. This largely has been negative to his brand for a variety of reasons and in turn has hurt Tesla’s public perception. Combine this with Elon selling billions of dollars in shares to purchase Twitter has really popped the hype bubble causing the stock to plummet. Down over 50% vs the broader tech market decline of less than 10%.

This has caused some analysts and super fans to double down and say now is the time to buy more stock. Uninformed investors are even calling Tesla a value stock since the value has declined so much despite the record sales.

Unfortunately there are several issues with this, first being that as a car company it is massively overvalued even after this most recent drop in price. The Price to Earnings ratio is still 3-4x more expensive than several other large car manufacturers.

And while it is true that Tesla is growing its sales at a much faster rate than its competitors, they are failing to keep up with their stated growth targets. 50% was the stated growth goal for 2022 so while they grew at an impressive ~40% rate that does not live up to the expectations, further piercing the hype around the stock.

What’s the Upside?

Short term prices on growth stocks like Tesla make the stock more of a “story” and less of an investment in fundamentals. In this case you need the company to keep creating hype and delivering to justify sky high valuations.

If the public loses faith in the story or the leader that story can quickly fall apart, and the stock will revalue quickly in the market.

Despite this there is a history of “story” stocks delivering amazing returns, including Tesla. So as long as you are well diversified feel free to buy some stocks that you believe in. Just for my sake please choose a story written by someone other than this guy.

For Your Weekend

Read:

The Future Will Go Wrong by Varad Mehta (ARC Digital)

OK Computer couldn’t be further away in spirit [from 1997] if it was in a different galaxy. It sounds like a dystopian, technological nightmare. But in 1997 hardly anyone was afraid of technology. The late ’90s was an optimistic time, the beginning of the internet age and a zillion AOL discs in our mailboxes. Technology was our friend. Few feared the possibilities of the internet then; most embraced them, waiting for more to turn up.