Not a Quiet Place

Over Memorial Day weekend, A Quiet Place Part II set a pandemic-era record with a box office of over $58 million.1 This figure may seem small, but considering that Memorial Day 2020’s box office clocked in at a measly $840k, $58 million is a substantial improvement.2 It’s another data point in the larger trend toward a society - and an economy- that is beginning to normalize. We’re doing things! With *gasp* other people!

This is welcome news to AMC, the United States’ largest movie theater operator, and the company’s shareholders: the stock popped over 20% in a day. But, that isn’t even the whole story. AMC’s stock price began to rise before Memorial Day, and has more than quadrupled in the last month! It peaked at over $60 dollars last week.

What is happening? Is this a case of investors anticipating re-opening stocks like movie theaters doing well as restrictions were lifted? Surely, the weekend box office figure and subsequent stock price move confirm this hunch. Right?

As shocking as it is to say, businesses tend to do better when lots of people buy their stuff. AMC is no exception. But the global movie industry didn’t just revert back to normal: 2019’s Memorial Day office was over $200 million!3 One tepid weekend does not translate into a 5x more valuable company.

Something’s up with this story.

Let’s zoom out before the pandemic and look at something called Market Capitalization (“market cap”). Market cap reflects the number of shares the company has available to the public multiplied by the stock price. It’s one measure of a company’s value, expressed in dollar terms.

Before the pandemic, AMC was worth less than $1 billion. For some context, other companies with a market cap of around $1 billion include Land’s End (at $1.1 billion, sender of fine catalogs) and Cars.com (at $966 million, payor of nearly $4 million for terrible Super Bowl ads).

Market cap is a formula - Stock Price X Outstanding Shares. So if the price and the number of outstanding shares go up, then the market cap must increase.

Here’s where AMC’s market cap has gone over the last year:

AMC is now worth 22x more than it was to start 2020. This is after Covid, after losing $4.5 billion last year, and after studios started launching new movies simultaneously on their streaming platforms. After all that, investors are rushing to buy AMC at these insane levels, and what is even crazier is that some don’t think we should stop here.

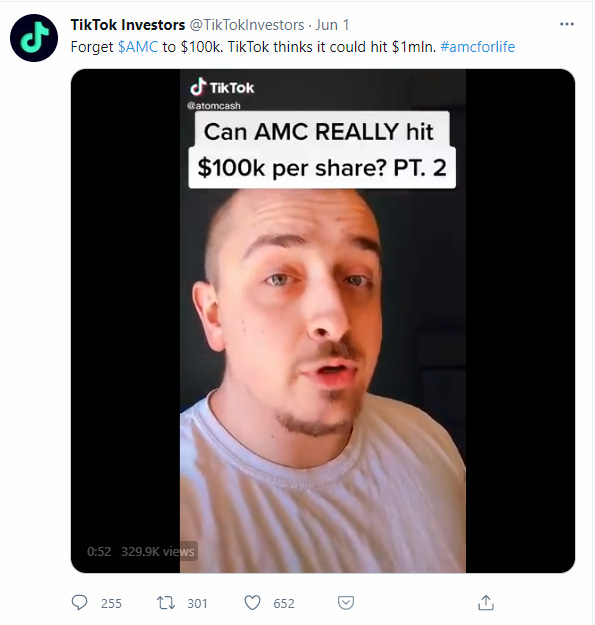

We give you, this guy:

If you aren’t able to watch the video, the guy on TikTok is saying that it is statistically possible for AMC - the previously moribund and still very-much-struggling movie theater chain - to reach a per-share price of $100,000. For the record, the only publicly traded stock with a share price over $100,000 per share is Warren Buffet’s Berkshire Hathaway.

We won’t mince words here: that person is a fucking idiot.

What’s shocking (though perhaps it shouldn’t be) is that over 300k people viewed that video. No doubt, someone took action because of what he said, thinking they’re catching a stock early. That is terrible and dangerous, and it's why we write this blog every week.

Let’s say AMC’s stock price goes to $100k like he says is possible using his “statistics.” Using our Market Cap math:

Share Price multiplied by Shares Outstanding equals Market Cap

$100k x 450 Million = $45 Trillion

That will not even fit on the chart above, so let’s put it this way.

That is more than 20x Apple’s market cap! (The largest company in the world)

That is roughly the value of the ENTIRE US STOCK MARKET!

This does not even account for the fact that every time the price of the stock goes up, AMC will continue to issue more shares to take advantage of a price they know is far too high, like they did last week.4

Which makes the Redditors insistence that this is some sort of war against Wall Street a bit puzzling. Like the Occupy Wall Street movement before them, all of this feels very performative: lots of people make lots of noise who ultimately accomplish very little.

Why? The short answer is that the hedge funds betting against AMC have advantages a normal person doesn’t have.

Consider what happened with one of these hedge funds, Mudrick Capital. According to Bloomberg:

“Mudrick Capital sold all its stock in AMC Entertainment Holdings Inc. as of Tuesday, the same day the movie theater chain disclosed that the investment firm had bought $230.5 million of fresh shares to bolster its finances, according to a person with knowledge of the matter.

Mudrick no longer holds any AMC shares and sold at a profit, the person said, asking not to be identified discussing a private matter. The firm disposed of its stake after concluding that AMC’s stock is overvalued, propped up by a recent wave of day-trader enthusiasm, the person said.”

In other words, the hedge funds did what hedge funds can do: flip from betting against a stock to betting for it to make a profit. That move alone is evidence that the hedge funds have seen what’s happening with the Meme Stocks and are adapting their strategies. Which, can best be summarized thusly: Heads I win, tails you lose.

You’ve got to wonder how many of these run-ups the Reddit community has in it. Unlike the hedge funds, which can deploy billions of dollars at will, Redditors and TikTokers don’t have unlimited funds to work with, nor do they have unlimited attention spans.

If you invested in AMC a long time ago and have benefited from the Meme Stock craze, then we applaud you. But if you are thinking about jumping on the trend now, you may as well hit a casino; there, at least the rules are clear and the drinks are free.

Programming note:

We’d like to thank everyone who signed up for the newsletter last week. We’re grateful for your support!

If you’re a Gmail user, please tell Google to move future messages from us to your ‘Primary’ folder. You can do this by dragging the message into Primary, and agreeing to the pop-up message asking if you’d like to do this for all future messages.

We appreciate it!

For Your Weekend:

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

For political junkies out there, The Dispatch is a great newsletter led by former National Review contributor David French. This essay outlines a brief history of Federalism and how it’s historically been a laboratory for States to try stuff. Now, it’s being weaponized:

State power is great when it balances and limits the authority of the national government. But when it becomes a vehicle for harassing people in other states, it defeats the constitutional vision for limited, divided power.

FDA Approves First New Alzheimer’s Drug in Nearly Two Decades

This week, the FDA approved Biogen’s aducanumab, the first new Alzheimer’s drug in nearly two years. Biogen plans to market it under the name Aduhelm. It doesn’t cure Alzheimer’s, but it can slow the disease’s progression. It won’t come cheap though: the drug is estimated to cost $56,000.

This week marks three years since chef, documentarian, and novelist Anthony Bourdain took his own life. He led a colorful, balls-to-the-wall life in his 61 years, and we, as an audience, were fortunate enough to go along for the ride. In celebration, read the New Yorker article that got him started. It is worth your time:

Gastronomy is the science of pain. Professional cooks belong to a secret society whose ancient rituals derive from the principles of stoicism in the face of humiliation, injury, fatigue, and the threat of illness. The members of a tight, well-greased kitchen staff are a lot like a submarine crew. Confined for most of their waking hours in hot, airless spaces, and ruled by despotic leaders, they often acquire the characteristics of the poor saps who were press-ganged into the royal navies of Napoleonic times—superstition, a contempt for outsiders, and a loyalty to no flag but their own.

Listen:

RadioLab: The Dirty Drug and the Ice Cream Tub

RadioLab consistently produces outstanding podcasts. In this episode, find out just how many mouse brains it takes to assess the impact of a revolutionary drug.

Doctor-reporter Avir Mitra follows the epic and fantastical journey of a molecule dug out of a distant patch of dirt that would go on to make billions of dollars, prolong millions of lives, and teach us something fundamental we didn’t know about ourselves.

Watch:

Mare of Easttown (HBO): once you get past the first episode that establishes all the characters, the story picks up momentum quickly over its seven hour-long episodes. Come for the murder mystery, stay for Kate Winslett’s Pennsylvania accent. Then, watch the SNL parody.

https://www.vulture.com/2021/06/a-quiet-place-part-ii-era-box-office-record.html

https://cnb.cx/2TUzqOx

https://www.boxofficemojo.com/weekend/2019W21/occasion/us_memorialday_weekend/?ref_=bo_rl_table_8

https://www.marketwatch.com/story/amc-sells-85-million-shares-at-near-4-premium-to-mudrick-capital-stock-surges-2021-06-01