📈Bumper Bowling

Remember bumper bowling?

Those guard rails that popped up and saved every ball you and your friends hurled down the lane after getting jacked up on Mountain Dew? With the bumpers, bowling was easy - even if you missed you couldn’t miss. Take away the bumpers and, all of a sudden, you can just as easily toss a gutter ball as a strike.

Bumper bowling has been the market environment we’ve been in over the last few years. The Federal Reserve’s accommodative approach – aka, pumping money into the system and keeping interest rates near-zero – functionally acted like guard rails for the stock market. Which makes bowling and investing fun and easy because you basically can’t fail.

You’ve no doubt heard of the trading strategy called ‘buying the dip.’ That’s where traders will plow money into the stock market should the market fall from it’s highs. To these traders, the ‘dip’ represents an opportunity to purchase high quality stocks at a discount. While we believe you should simply always be buying stocks for the long term, these short term dips are appealing and have been profitable of late.

Easy, right? The only variable to define is what sort of drop constitutes enough of a dip to borrow money and buy in? Is it 2% beneath the highs? 5%? 10%?

There are two ‘bumpers’ that many traders look at to judge whether it’s time to buy the dip called the 200-day and 50-day simple moving average. The 50-day moving average tells you the average price of the S&P 500 over the last - you guessed it - 50 days. That 2.5 month window provides some insight into short-term market sentiment.

The other bumper is the 200-day simple moving average. It’s calculated exactly like the 50-day, only it covers the average price for the last 10 months or so. So, the 200-day can provide some insight into longer-term market sentiment - is it trending up or down?

Taken together, the two moving averages serve as the bumpers that many traders use to judge whether the market has dipped enough to warrant buying more.

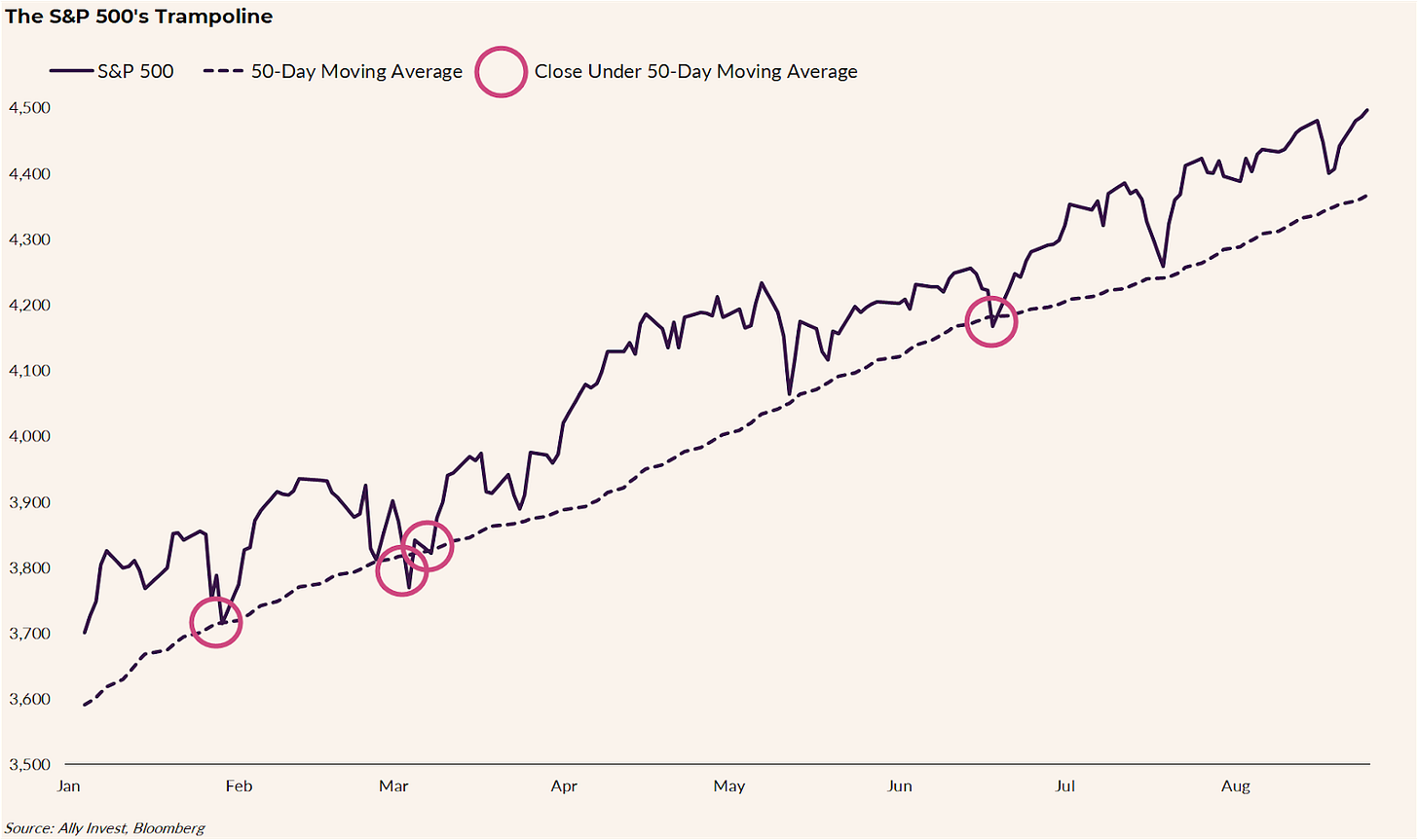

Markets kicked off 2021 by going straight up, ricocheting off the 50-day moving average like one of those pink 6 lb balls that slams off the guardrails and rockets down the lane. If you simply bought every time the market hit the 50-day you would be killing it, thanks in part to the Fed and their proverbial bumpers.

As we highlighted last week, stocks cannot go up forever. With the Fed getting more aggressive to fight inflation to end 2021 by raising rates, the proverbial bumpers look like they’ve been packed up. Critically, the S&P 500 had bounced off the 200-day moving average for months, never quite falling far enough to break through the floor. Until last week:

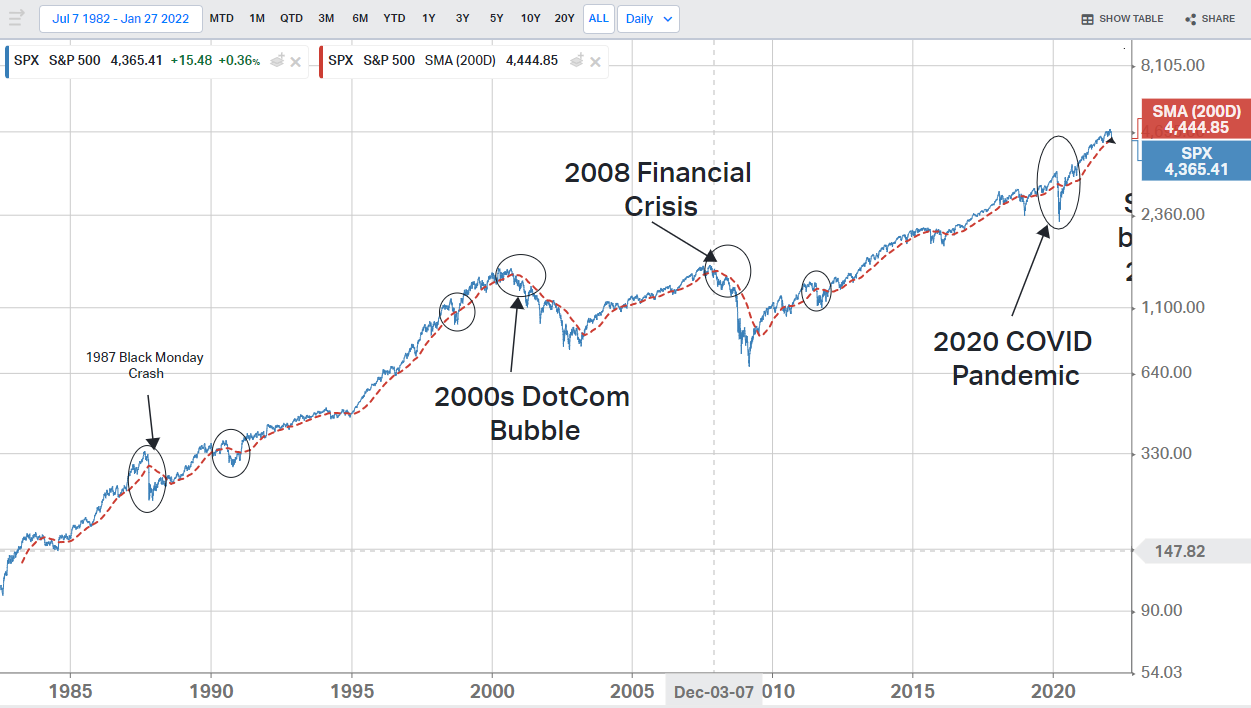

The 200-day SMA is a critical measure of market sentiment because, going back decades, it’s usually not so great if the S&P 500 falls below that key threshold. Because things tend to get ugly below the 200-day:

Knowing this, it makes sense to bang the 50-day SMA if you’re trying to buy the dip. While the 200-day may represent an even bigger discount from the highs, breaching the 200 day also has a grim history. It’s not a dip if the dip keeps on dipping.

Easy money made it easy for the market to bounce back from short-term dips, propelled by trading seeking to take advantage of short-term discounts. While the Fed doesn’t actually put up these ‘bumpers,’ they’re the ones hosting the party.

The 50-day and 200-day SMAs become psychological bumpers for investors and traders, signaling when it's time to buy more, when it’s time to hold, or when it’s time to call the party over.

What’s the Upside?

Technical measures like the 200-day moving averages are not gospel. However, they matter to a lot of investors, so it’s worth keeping an eye on where the S&P 500 (or your preferred index) is trading relative to the 200 or 50-day moving averages. Historically, when the market falls below its 200-day things get a little dicey. It doesn’t mean a crash is coming, it just means the bumpers are gone.

And while our advice of staying calm and investing for the long term doesn’t change, we will admit investing in these conditions takes a little more…

For Your Weekend

Our round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

The Rise of A.I. Fighter Pilots by Sue Halpern (The New Yorker)

A fighter plane equipped with artificial intelligence could eventually execute tighter turns, take greater risks, and get off better shots than human pilots. But the objective of the ace program is to transform a pilot’s role, not to remove it entirely. As DARPA envisions it, the A.I. will fly the plane in partnership with the pilot, who will remain “in the loop,” monitoring what the A.I. is doing and intervening when necessary. According to the agency’s Strategic Technology Office, a fighter jet with autonomous features will allow pilots to become “battle managers,” directing squads of unmanned aircraft “like a football coach who chooses team members and then positions them on the field to run plays.”

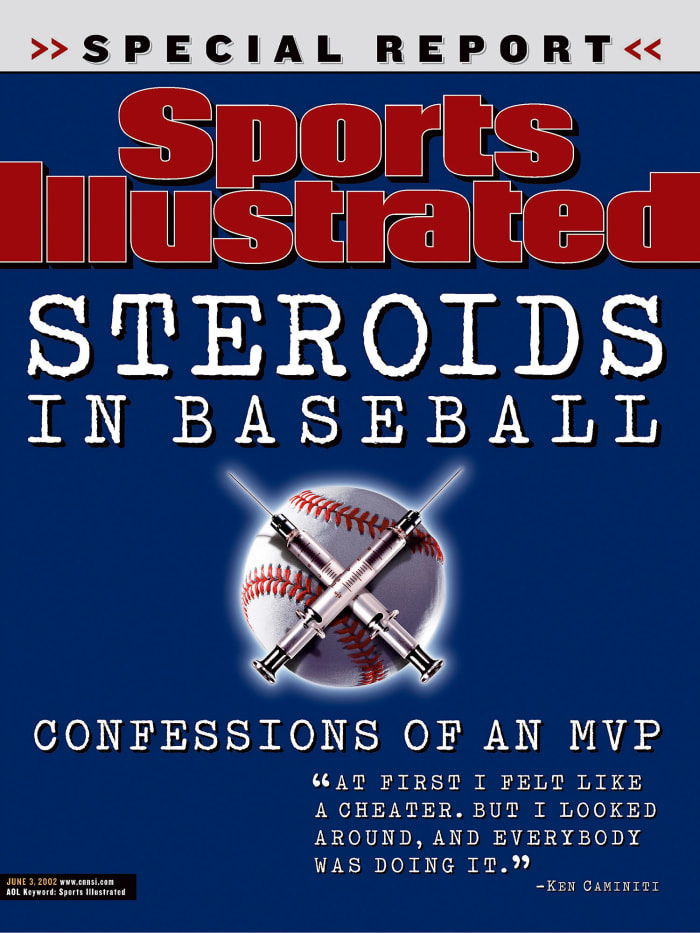

Totally Juiced by Tom Verducci (Sports Illustrated)

This week, pitcher Roger Clemens (354* wins (9th all-time) 3.12* lifetime ERA) and outfielder Barry Bonds (762* home runs (most all-time), a ridiculous lifetime .444 OBP*) were shut out of the Hall of Fame by the Baseball Writers Association of America, failing to win the required 75% threshold from the 400-person body.

Their failure to reach the Hall can be attributed to one story.

Sports Illustrated’s Tom Verducci blew the lid off the rampant steroid use in the Major League Baseball in Totally Juiced, his original, groundbreaking report from 2002. It’s not hyperbole to say that this article fundamentally changed baseball, forever.

To Cheat or Not to Cheat is Verducci’s follow-up article on the tenth anniversary. He profiled four bubble players impacted by the steroid use - one who made it, winning a World Series with the New York Yankees - and the other three who played the game clean, and never made it to the Major Leagues.

Watch:

Anthony Bourdain: Parts Unknown - Congo (HBO Max)

If Apocalypse Now is a cultural touchstone for you, then, by default, Joseph Conrad’s Heart of Darkness should carry just as much impact. Bourdain makes plain that his motivation to visit the Congo isn’t for much else other than his lifelong desire to travel the Congo River, as Conrad did. Appropriately, it’s one of his and his crews’ most difficult shoots. As he says in the episode:

“It is written that I should be loyal to the nightmare of my choice. I think I now understand what that means.”