📈Rate of Change

In the fall of last year, we introduced the concept of the Federal Reserve and their tapering of asset purchases. Essentially, the Fed has kept long-term interest rates low using something called quantitative easing (QE), which has helped fuel the economic recovery over the past year (and since 2008, if we’re being honest).

In brief, QE is a fancy term for a government shell-game: Congress needs money, so it tells the Treasury Department to create new bonds (normal process, so far). The Treasury creates the bonds as requested to raise money from the open market (still normal). To make sure Congress gets its money, the Federal Reserve buys the bonds the Treasury Department just printed (WTF). This effectively keeps interest rates low and improves financing terms for companies, which allows the economy to grow and asset prices to increase. It is also not normal.

Since we wrote that blog, they not only started tapering but had to start tapering TWICE as fast as originally expected due to our old friend inflation.

Well, Wednesday they released the Minutes from last month's meeting where they decided that not only did they need to speed up the taper, but they may begin raising rates as soon as March to fight inflation.

The stock market's response to the Fed raising rates was, well…

Now despite the dramatic gifs and headlines, stocks are within 5% of all-time highs. So why is everyone freaking out? Rate of change.

Last year, the market knew what the Fed was going to do with the taper and subsequent rate hikes, and they had a reasonable idea of the speed of that change. This is why you saw the market close 2021 up 27% in the S&P 500. But over the last month or so, inflation fears have caused them to suddenly hit the brakes on their financial stimulus. Which has led to a minor crash, which definitely has people on edge.

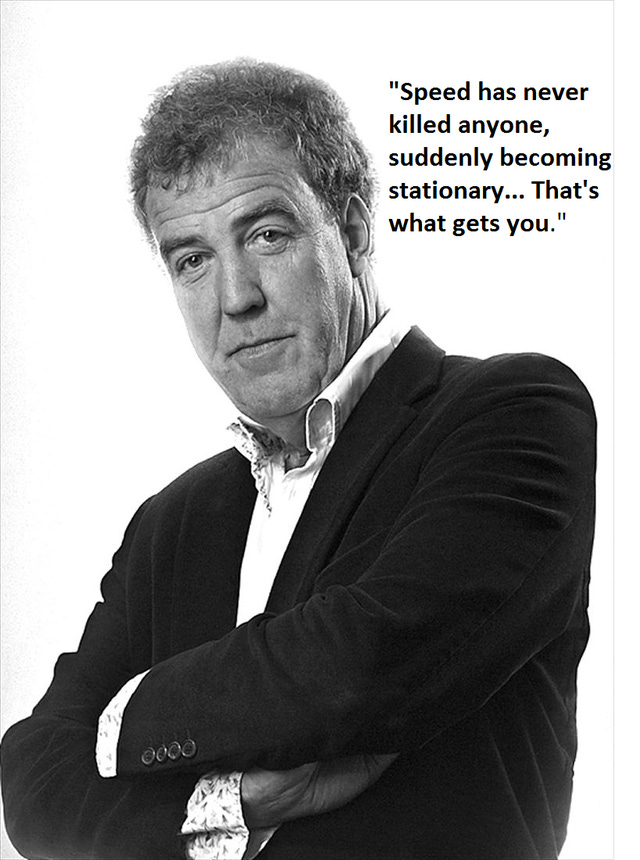

Said very concisely by our friend on Twitter:

So why do rates matter so much for stocks?

The simplest way to think about this is when you buy a stock you are paying a price for all future earnings of that company. The price of a stock is a prediction of what cash that stock will produce for shareholders over the long run.

This is where interest rates matter. With 0% interest rates, your options are investing in stocks or earning nothing on your money (actually negative if you factor in inflation, which we do). So stocks are much more attractive even if they won’t be producing income for a long time. It costs you nothing to wait for the stock to start producing.

Now, let’s say interest rates rise to 5%. Suddenly, these stocks have a much higher bar to clear. Now you can earn 5% on your money sitting in the bank so stocks become less attractive as there is now a 5% cost per year to wait for that income. This is a theory called the Discounted Cash Flow method.

This affects some stocks more than others. Previously we’ve discussed value vs growth stocks and how value stocks are generally highly profitable in low-growth industries while growth stocks have little to no profit but are growing rapidly. Over the last several years, with rates at 0%, growth has beaten value like Jake Paul beats retired UFC fighters.

But as these interest rate fears spread through the market, we have seen some high-flying growth names crash back to earth while boring and income-producing companies have done much better:

VTV (Purple line) = Boring, Income-Producing Companies (Value)

ARKK (Blue line) = High-Flying Growth Names

What’s the Upside?

Despite some dire-sounding headlines to start the new year, rising interest rates don’t automatically spell doom for the markets. Shifting expectations can cause temporary crashes or rotations across sectors like growth to value.

Hit it Kunu:

For Your Weekend

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

An Inconvenient Truce by Rusty Guinn (Epsilon Theory)

In 2005, Nicholas Shackel, now Professor of Philosophy at Cardiff University, published the wonderfully titled The Vacuity of Postmodernist Methodology. In the paper, Shackel first coins the term “Motte-and-Bailey Doctrine” as a means not of describing medieval defensive structures, but as a means of describing arguments which put forward an aggressive and perhaps controversial premise that the arguer finds attractive. This is the bailey. When that premise is challenged, that person puts forth a second, infinitely more sensible and defensible premise that is at least partially related to the first. This is the motte. They then intentionally conflate the sensible premise with the aggressive one.

Watch:

Gordon Ramsay’s Kitchen Nightmares - UK Version (YouTube)

In the annals of mindless reality TV, Ramsay stands out for his brash persona and no-BS attitude. If you’re looking for something to throw on while scrolling Twitter or TikTok while pecking at dinner, this is a good option.

Most of these episodes were filmed pre-2008, so before Ramsay became a household name in the United States. You can see him honing the persona that we’ve come to know on shows like MasterChef and the US version of this show here; however, there are moments where you get the sense he genuinely cares and wants to help the restaurant make it. The US version dropped some of Ramsay’s more practical moments for - what else? - tension and conflict, usually sparked by Ramsay. So, in that sense, the UK version stands on its own as one of the better Ramsay projects.

Chuckle: