📈 Working Recession

Alex is up this week to check in on how the non-recession recession is going after a surprisingly strong jobs report last Friday.

And if someone forwarded this post to you, do us a favor and subscribe to get our free newsletter delivered each week.

The January jobs report landed with a bang: per the Bureau of Labor Statistics (BLS), the US added 517,000 jobs last month, shocking economists, investors, and permabears

alike.

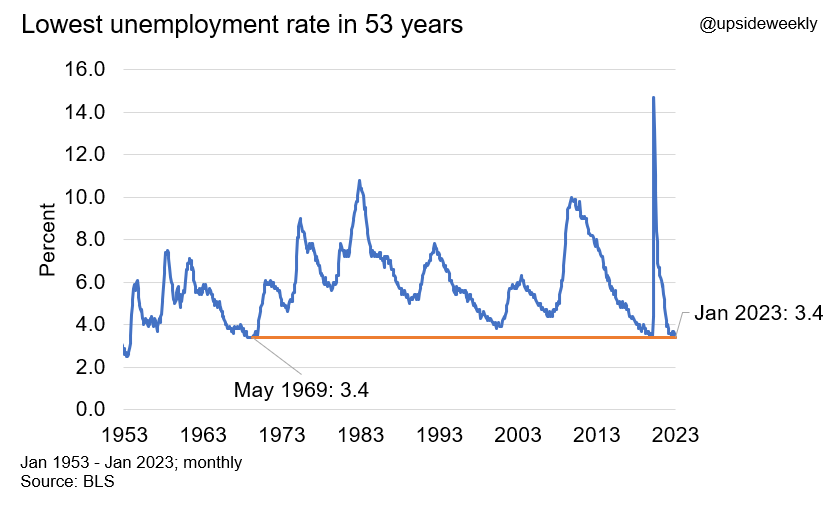

The jobs number was strong enough to drop the unemployment rate to 3.4%, the lowest in 53 years.

Fed Chair Jerome Powell upon seeing this number:

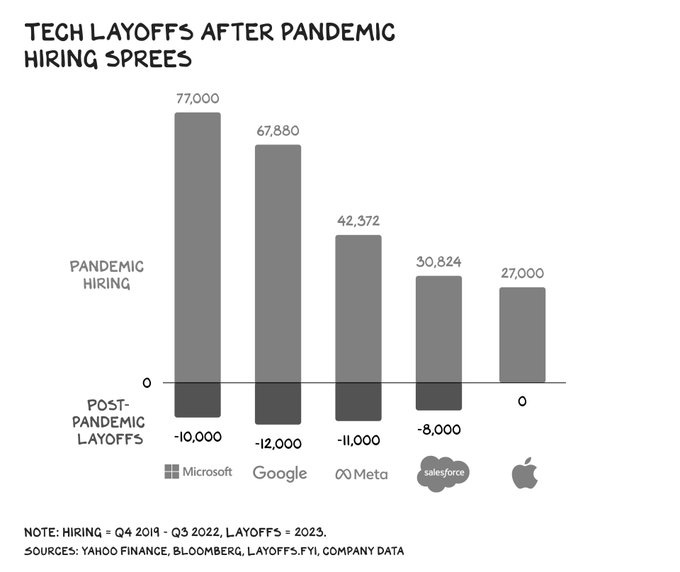

This news obviously lands amid the bloodbath that’s been the tech sector, where we seem to get a new round of layoffs from another tech name each week.

And Twitter will never let a good crisis go to waste, so people happily report doom for clicks.

However, unemployment in the tech sector remains even lower than the national average at 1.5% largely due to the fact these layoffs came after massive hiring sprees in the tech sector post-pandemic.

So jobs, even in the tech sector remain strong, despite the scary headlines. So, what gives? Are we heading toward a recession? Are we already in one? It can be hard to know given all the economic data that floods out of our respective agencies.

So, let’s build a simple framework for judging the relative health of the US economy using these indicators, all of which are publicly available on fred.stlouisfed.org.

But let’s start here: who remembers the definition of a recession?

If you said “when Cardi B says we’re in one” you are correct! For the nerds, “recession” derives from the Latin recessio, which means "a going backward, a withdrawing.” So, a recession is literally the “going backward” of our aggregate economic productivity (measured by GDP) for two quarters in a row.

What is GDP? It measures the aggregate economic productivity of a given economic zone (otherwise known as countries to human beings). For our purposes, it’s simplest to think of GDP as “what Americans spend their money on.”

That’s not that much of an oversimplification, either: consumer spending makes up about 70% of the US GDP.

Okay. So GDP measures whether Americans are spending their money, and a recession is when we stop spending our money at the same rate for two quarters (6 months) in a row.

Given that definition, we can answer whether we’re heading toward a recession with two straightforward questions:

Do Americans have jobs to spend money on stuff?

Are companies making money on the stuff Americans buy?

From there, the second-order questions are:

Are the prices for stuff Americans buy going up or down?

What does it cost to finance that stuff if Americans need to borrow?

Easy, right?

For Your Weekend

Read

How to Save American Drinking in Five Easy Steps by Clare Coffey (The Bulwark)

The author advocates for a carafe of wine at lunch. Who am I to argue?

How the Cocaine Bear Was Brought to Life by Jake Kring-Schreifels (The Ringer)

Bringing one of 2023’s most ridiculous movies to the big screen took sick imagination, deft stunt work, and plenty of commitment from a host of seasoned actors. (And cocaine, obviously.)

The End of the English Major by Nathan Heller ($ The New Yorker)

I’m legally obligated to include anything when my alma mater is mentioned in a positive light.

The crisis, when it came, arrived so quickly that its scale was hard to recognize at first. From 2012 to the start of the pandemic, the number of English majors on campus at Arizona State University fell from nine hundred and fifty-three to five hundred and seventy-eight.