📈 Working Recession

The January jobs report landed with a bang: per the Bureau of Labor Statistics (BLS), the US added 517,000 jobs last month, shocking economists, investors, and permabears1 alike.

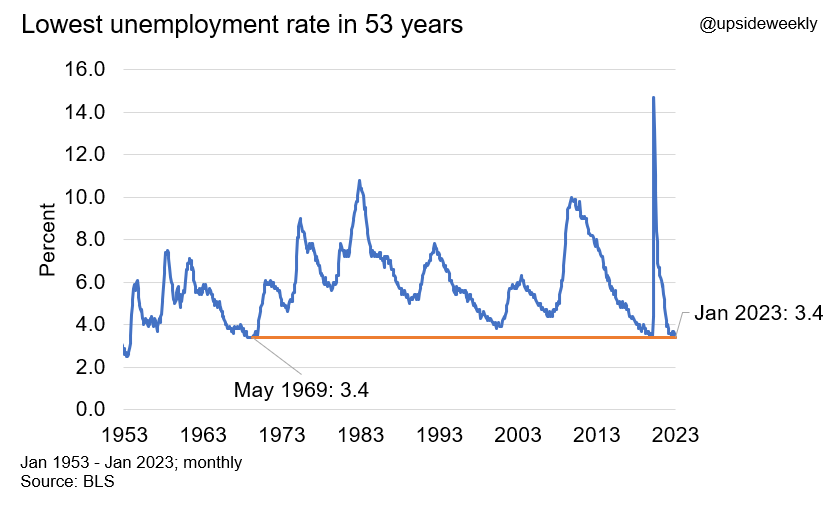

The jobs number was strong enough to drop the unemployment rate to 3.4%, the lowest in 53 years.

Fed Chair Jerome Powell upon seeing this number:

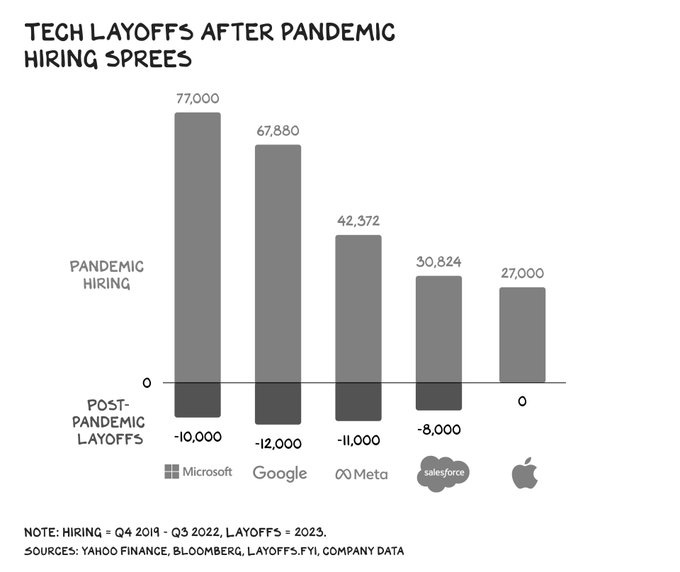

This news obviously lands amid the bloodbath that’s been the tech sector, where we seem to get a new round of layoffs from another tech name each week.

And Twitter will never let a good crisis go to waste, so people happily report doom for clicks.

However, unemployment in the tech sector remains even lower than the national average at 1.5% largely due to the fact these layoffs came after massive hiring sprees in the tech sector post-pandemic.

So jobs, even in the tech sector remain strong, despite the scary headlines. So, what gives? Are we heading toward a recession? Are we already in one? It can be hard to know given all the economic data that floods out of our respective agencies.

So, let’s build a simple framework for judging the relative health of the US economy using these indicators, all of which are publicly available on fred.stlouisfed.org.

But let’s start here: who remembers the definition of a recession?

If you said “when Cardi B says we’re in one” you are correct! For the nerds, “recession” derives from the Latin recessio, which means "a going backward, a withdrawing.” So, a recession is literally the “going backward” of our aggregate economic productivity (measured by GDP) for two quarters in a row.

What is GDP? It measures the aggregate economic productivity of a given economic zone (otherwise known as countries to human beings). For our purposes, it’s simplest to think of GDP as “what Americans spend their money on.”

That’s not that much of an oversimplification, either: consumer spending makes up about 70% of the US GDP.

Okay. So GDP measures whether Americans are spending their money, and a recession is when we stop spending our money at the same rate for two quarters (6 months) in a row.

Given that definition, we can answer whether we’re heading toward a recession with two straightforward questions:

Do Americans have jobs to spend money on stuff?

Are companies making money on the stuff Americans buy?

From there, the second-order questions are:

Are the prices for stuff Americans buy going up or down?

What does it cost to finance that stuff if Americans need to borrow?

Easy, right?

Do Americans have jobs to spend money on stuff?

We know the answer to the first part of the question is 'yes,' given unemployment is at 53-year lows.2

Are Americans spending money on stuff? As of today, the answer is still ‘yes,’ but that demand appears to be softening:

Right back to the long-term historical average. Now, that doesn’t mean it won’t continue to fall (due, in no small part, to inflation and interest rates), but look at the peak it’s coming down from! So, it might feel like things are a little slower, but that’s because Americans incinerated any cash to buy stuff once we decided World War COVID was over.

So, Americans have jobs (falling unemployment) and are spending money on stuff. For things to inch toward a recession, the unemployment number would need to go up and consumer spending would have to keep falling. So far, only one of those things has kinda-sorta happened.

Are companies making money on the stuff Americans buy?

It’s been said that capitalism rewards those who give people what they want, not what they need - for better or worse.

Need proof? I give you one of my favorite videos of all time to explain human behavior and capitalism in one go: celebrity chef Jamie Oliver making chicken nuggets for kids, wherein, after showing the kids that McDonald’s chicken nuggets are essentially one step above dog food, he asks how many of the kids will still eat said McDonald’s nuggets:

The American consumer is undefeated.3

So, if I’m in the business of business, I need to make sure I’m making stuff people will buy that I can also make money on to afford to keep making stuff for people to buy.

This is why corporate profits tend to follow consumer spending. Historically, profits spike after a recession because Americans start spending again, then level off once we regain a sense of propriety.

Why do profits matter? If I spend all that money to make stuff for Americans to buy and I don’t make any money on it, why would I make it again?

So, if I’m in the business of business, I need to make sure I’m making stuff people will buy that I can also make money on to afford to keep making stuff for people to buy.

This is why corporate profits tend to follow consumer spending. Historically, profits spike after a recession because Americans start spending again, then level off once we regain a sense of propriety.

Why do profits matter?

Companies make money, and those companies hire workers.

Those workers make money, and spend that money on things companies make.

Those companies profit and hire more workers.

Thereby ensuring the self sustaining and ever growing American economy.

Are the prices for stuff Americans buy going up or down?

Ah, welcome to the inflation portion of our TED talk.

Generally, prices have been quite stable for decades, with only modest inflation peaking up to say hello from time to time (often right before a recession, incidentally).

Well, we know that all changed after the government dumped money on America as COVID cases waned around the country. Policymakers wanted their Grand Re-Opening, and they got it. 40-year highs in inflation is what #winning looks like.

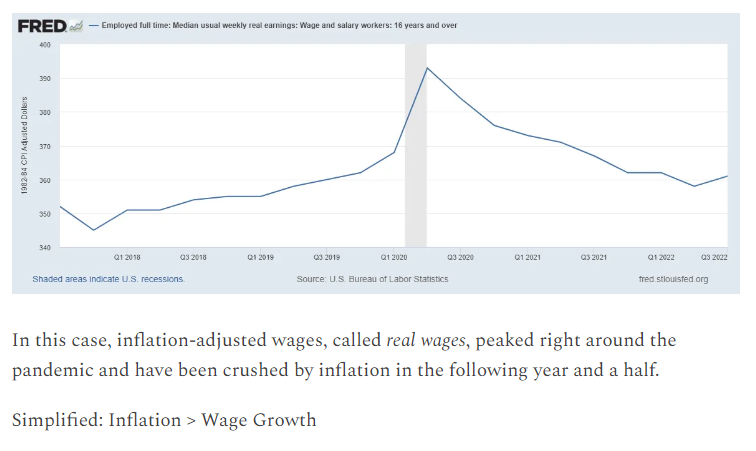

Why does inflation matter? We just covered this, people.

It comes down to the power of your dollar. Inflation is a rise in the general price level of goods and services. This means that if prices of goods and services increase, the same amount of money can buy less than it could before. So, if wages don’t keep up with inflation, people’s standard of living for consumers will go down because they can’t afford to buy the same amount of stuff.

In short: modest inflation is good because it acts like a nudge to the rest of the economy to keep up. High inflation is bad because it doesn’t leave enough time for the economy to adjust to the new prices, which opens us up to some unpleasant knock-on effects.

Inflation has cooled slightly, but it’s still got a “6” in it.

What’s the Upside?

We are in a strange strange economic environment. I know we say this a lot but it’s true. Who would have thought a global pandemic would have such an effect?

American’s (that's you) continue to make more and more money but are fighting an uphill battle against inflation. Whoever wins this will decide if we enter a true recession or power through it. So keep that job and keep spending that money.

A permabear is a portmanteau of “permanent” and “bear” to describe someone who always finds a reason to think the US economy is about to crater and take the stock market with it. They tend to use their dire prognostications to hawk scammy gold products. They make a lot of noise but are wrong until the one time they’re right, and then they really don’t shut up.

There’s more nuance here than just unemployment but that’s for a different blog. Labor force participation has actually been declining for some time. I do not know why nor have I researched why. If so inclined, have at it and let us know. Maybe, one day, you too can have a modestly-read Substack newsletter.

Say you want about Elon, but he did get Americans to think electric cars were cool. I maintain my position that you have to put a little Elvis into your stuff for Americans to actually care, which is why environmentalists scolding us about climate change is unlikely to break through, unfortunately. Al Gore ain’t Elvis.