We’re in a recession. Or, maybe we aren’t? Ian walks us through why things aren’t as bad as the headlines would suggest.

Gross Domestic Product (GDP) numbers were released yesterday. Before we get into what those numbers said, let’s talk about what exactly GDP is. Now, I hate an acronym just as much as the next guy so let’s break GDP down to its simplest components.1 Below is a textbook definition with my translations highlighted in red.

Add all these together and you get how much our economy/country as a whole spends in a given year. Because we have become a service-based economy where you all work from home and buy stuff on Amazon, essentially ⅔ of this number is based on the Consumption component.

Yesterday we saw a negative GDP number (-0.9%) for the second consecutive quarter which may be slightly shocking. Everyone feels like they are spending more money lately, whether that is due to summer, loosened Covid restrictions, or simply because of our old nemesis inflation.

Because GDP accounts for inflation, we have to outpace the inflation rate for GDP to grow, which is not exactly easy these days. Since real GDP (GDP adjusted for inflation) declined for the second straight quarter, this, by some definitions, means we have entered an economic recession.

While the ‘2 quarters of declining GDP’ has been the rule of thumb way to define a recession for a long time, it is not a hard and fast rule. Our little corner of Twitter (obnoxiously called FinTwit) has been in a civil war over this definition since the White House released a statement last week claiming 2 consecutive quarters of declining GDP does not mean a recession. (It’s a bit wordy but the text is below)

This statement is obvious White House spin to get in front of the headlines. It’s not, however, some conspiracy theory to move the goalposts. They are pointing to the definition NBER has always used.

There, argument settled. Was that so hard?

Let’s move on to some good news. We’ve written about the pain of 2022 economically here, here, and here, so let’s do something bold and be positive now (it’s called the Weekly Upside, right?)2

Lending

Banks continue to lend at the highest level in the decade (aside from Covid PPP outlier). This means that, despite significantly higher interest rates, people are still borrowing money to invest - one of the key inputs to GDP. This number was deeply negative in 2009 and 2020, the prior two recessions.

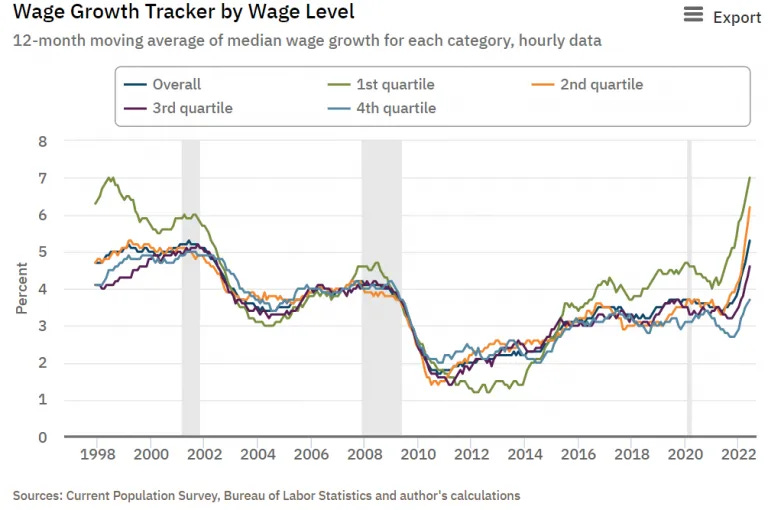

Wages

Traditionally, wages don’t go up during inflationationary periods. Not only are wages rising, but they are rising the fastest for low-income workers, who traditionally spend most of their wages. That adds consumption, the largest component of GDP.

Wealth

Household wealth is still hovering around all-time highs, helped out by the rapid rise in home prices. Even so, is it so bad for record-high home prices to moderate a bit?

What’s the Upside?

Here’s the takeaway: things are not as bad as they seem.

Our wealth, wages, and productivity are up, a testament to the resilience of our country and capitalism. Could we see some tough times ahead? Sure. Can we get through? Absolutely. So, let’s rage.

Just to make things more confusing, there are a million ways to measure GDP. For a more complete definition, hit the Investopedia link: to read more.