“Cash is King,” as the saying goes.

But, in today’s environment, that statement feels like it’s losing relevance by the day. Not only do we have credit cards, Venmo, and even cryptocurrencies to replace cash, but our old enemy inflation is lurking to erode its value.

Despite all these factors, we know we need to have some cash on hand. And we really prefer you don’t sleep on it.

So, the first question is how much cash should you have around at any given time?

This is often referred to as an emergency fund. An emergency fund is what it sounds like: it’s cash you can easily access in the event of an emergency, like the loss of a job, medical issues, or anything else unexpected. Google and your friendly neighborhood financial professional will prescribe between three to six months of your fixed expenses in cash.

Fixed expenses are payments you need to make to keep you and your credit score alive. Rent/mortgage, utilities, food, insurance, etc. You can subtract your bar bill and new shoes since those aren’t necessities.

What’s that work out to?

Fixed Expenses x 3-6 months = Emergency Fund Amount

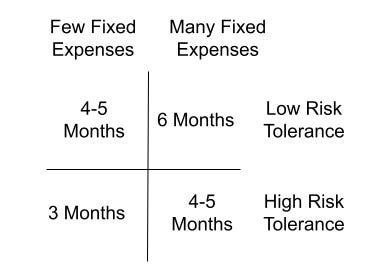

If you need help deciding on if it should be 3 or 6 months here is an easy chart:

If you have a huge mortgage, a kid on the way, or think gambling means the occasional scratch-off ticket, 6 months of expenses is for you. However, if you live in your parents’ basement trading Dogecoin for a living, you can probably get away with only having 3 months.

Either way, building an emergency fund will help you avoid serious financial issues if something unexpected happens, so you don’t end up like our buddy Joe (remember him?)

Just as important as how much to save is where to save it. Again - under the mattress is not an option. To be clear, this is different from investing, so we aren’t talking 401(k)s and Roth IRAs.

We are talking about money set aside for emergencies like a health scare, losing your job, or saving for your home, so this money needs to be liquid. Liquid means accessible within a day or two and safe from potential losses. So we can’t take risks, we have to play it safe, and that leaves us with banks.

Sadly, given today’s interest rate environment, Jess isn’t that far off. As all of you know very well, banks pay you nothing to save your money with them. That’s not how it used to be. Normally, we’d advise against putting your money into something that doesn’t pay you, but our priority is safety first. So, banks are where it goes.

Almost every bank account is FDIC insured up to $250,000. Meaning, even if the bank fails or is robbed, the federal government will reimburse all your money up to $250k.

Everyone reading this likely has a checking account linked to your debit card for ATM withdrawals and to pay a multitude of bills online. The next level up for this is called a savings account which should provide some interest payments.

Even if this amount is low, (around 0.50%) you should take advantage of any interest you can get. Your checking account, and sadly most savings accounts are giving 0% interest which means you are giving away $50/yr for every $10k you have saved in those accounts.

CDs or Certificates of Deposit are a common alternative to these kinds of accounts. Historically, CDs paid you more interest than a savings account, however, you had to trade liquidity to earn the higher rate. So, if you received 1.00% from your savings account, you could maybe see 2-4% on a CD, depending on how long you were willing to leave it with the bank.

Yeah, not so much anymore.

CDs aren’t a good fit for your emergency fund. Yes, they’re safe, but they aren’t liquid, and the interest rate is nominally higher than your savings account, so… pretty close to zero.

You’re better off looking at “high-yield” savings accounts from institutions like Ally or Marcus by Goldman Sachs.

What’s the Upside?

Saving money in a zero interest rate environment can be frustrating. But having money set aside for emergencies and big life events is important. Despite near-zero interest rates banks still provide the best options, especially if you search for promo deals.

So save that money, because the sooner you do, the sooner you can start investing in the fun stuff.

On Twitter

In honor of college football season, we compared popular stocks and college football teams. Here’s a taste:

Find out if we roasted your school. Join the conversation.

For Your Weekend:

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Watch:

‘The White Lotus’ (HBO Max)

HBO’s latest miniseries opens with baggage handlers loading a casket marked ‘human remains’ into the belly of a plane while a very stressed-out-looking Shane (Jake Lacy) looks on. So begins arguably the worst - and darkly funny - Hawaii vacation ever for ten people crammed together into one exclusive resort.

The show operates on two levels: the knowledge that someone is going to die hangs over the show’s six episodes while the darker dynamics of unresolved conflict simmer beneath. In ‘The White Lotus,’ no deed goes unpunished.

Fair warning: it’s HBO, so expect some gratuitous sex scenes and lots of swearing and drug use. It’s a dialogue-driven show, so the action takes place over dinner and drinks rather than in any set pieces. 50 First Dates it ain’t. That dialogue frequently touches on contemporary cultural discussions.

The White Lotus works because it’s a show with a point of view and a clear sense of who its characters are in their cores. We recommend it.

Spider-Man: No Way Home Trailer

Let’s have some fun.

The Tom Holland-led Spider-Man reboots are the only Marvel movies that are still required viewing when they’re released. The latest - No Way Home - doesn’t look like it will disappoint. Hello, Peter.

Follow:1

If you're in the market for some legit nutrition advice, check out Nutriving. They are a virtual nutrition counseling practice run by two Registered Dietitians. With weekly blog posts, meditations, recipes, and 1:1 virtual nutrition counseling, they help clients ditch dieting and find sustainable healthy habits.

Chuckle:

Sponsored post. Contact us at weeklyupside@gmail.com if you’d like to promote your product or service.