📈Law of Large Numbers

Humans are good at plenty of things, but large numbers are generally something we suck at. I personally find that this is a problem when it comes to financial planning. Things like investing for 30 years and needing millions of dollars all seem far away (it is) and very abstract. We often try to break down $1 million savings into much smaller more manageable steps, hell we even did this in our first “Manifesto”.

But this still makes it difficult to imagine, I mean we are asking you to think 30, 40 or even 50 years in the future when you will need that money for retirement.

I am going to compare this to miles per hour (MPH) in a car. Why did we decide to measure in miles? Do we actually even understand how fast that is?

To illustrate this, how long do you think one of the white lane divider stripes are on the highway? As in, how many feet long are these actually?

If you guessed 10 feet you would be correct. If you are like me and the 100’s of participants in a study, you probably guessed a lot less. Most people said 2 feet, and they also thought the space in between each stripe was the same distance 2 feet, when in reality it was 30 feet!

Since a guessing game where you are reading this alone and I can’t hear your answer is so fun, let’s do one more about the speed of a car. Using what we now know about lane lines, how many feet per second do you think a car is going at 70 MPH?

70 MPH = ??? Feet/second

102.67 feet per second.

That’s a football field every 3 seconds. Meaning if you look away for even a second on the highway a lot can happen.

Now we use MPH for a reason, if you are driving on a road trip and the destination is 140 miles away, and you average 70 miles per hour its a 2ish hour drive. If we measured in feet per second being told you were 739,200 feet away would be much less helpful.

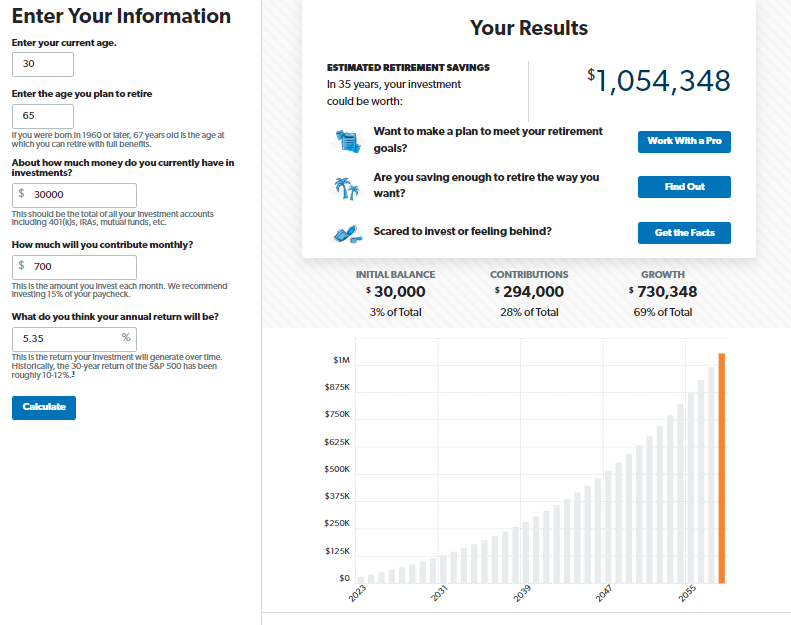

So while it makes sense to say invest for 30, 40 or 50 years and spit out a monthly number it fails to highlight what this adds up to. So let’s zoom in and look at what these savings do for you on a yearly basis. We will be using average retirement savings by age group according to NerdWallet and multiplying that by the current 3 month treasury rate which, as we have discussed you can buy at TreasuryDirect.gov currently yielding 5.35%. In reality you can earn more or less than this depending on how you are inverted but this is called the risk free rate in finance so we will highlight that.

By zooming in a bit we can see that even a modest amount of retirement savings can produce real FREE money every year.

But if we zoom in even further just like in our car example we can see what this means per day.

Now the average under 35 daily amount may only pay for a latte but that is enough to ward off the evil Suze Orman spirits.

But by the time you accumulate the average for the 35-44 age group, your savings are essentially handing you a $20 bill. Every. Single. Day.

That is a pretty good deal just for rolling out of bed in the morning, and I can appreciate this because I am months away from marrying a (beautiful) lunatic who hides money in her winter clothes at the end of the season so she can find it next winter and be excited.

And remember unlike that $20 you find in your pocket, this money continues to grow and grow and grow. Leading to that big picture we always hear about where that modest under 35 savings with some help and some growth turns into over $1 million by retirement.

What’s the Upside?

It can be daunting to try and save a million dollars or the likely multiple that you will want/need for retirement. But by zooming in and seeing how much a difference this makes on a monthly and even daily level hopefully we made it more encouraging.

Retirement is a long way down the road, but those lane lines will go by real quick.