FAT: Frequently Asked Tax Questions

As many of you know, I despise taxes. Despite having an accounting degree, I just flat out don’t like it. And nothing to me is more boring than personal taxes. That being said, my blog last year about taxes remains one of our most popular blogs so Alex is making me write another.

Basically, last year's blog talks about why you should minimize your refund so you aren’t simply giving the government a loan, and also recommends using your preference of online software to help you file taxes quickly and effectively.

We stand by this advice and recommend checking out that blog again if you have more interest in why we think so. However, much to my dismay I continue to get asked additional questions about how taxes work or why some people owe money this year.

Just kidding, let's cover a couple.

Why is my refund less/why do I owe more money this year?

The IRS warned about this in 2022 due to the fact pandemic era Economic Impact Payments did not exist, and taxpayers using the standard deduction (~90%) were no longer able to deduct charitable contributions in addition to this deduction.

Effectively the government is saying:

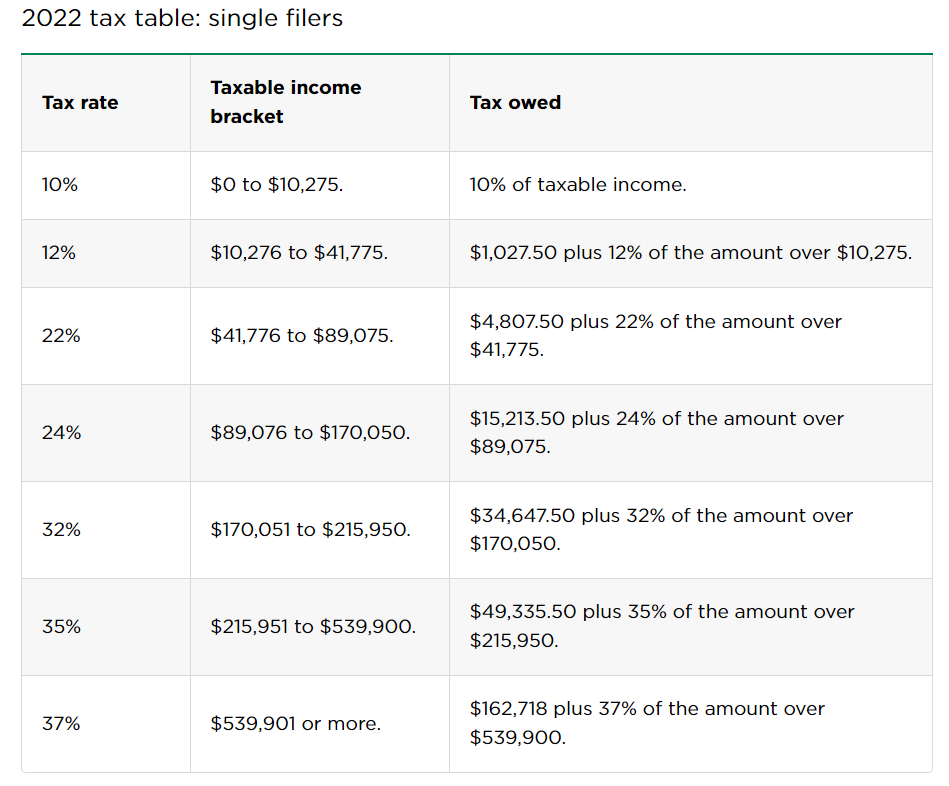

Did moving up a tax bracket cause me to owe more taxes? And should I avoid this if possible?

Well, in the most simplistic sense, yes, if you made more money you are going to pay more taxes. This is what I like to call a good problem to have. But some people actually think that jumping tax brackets will cause them to owe on their taxes for the year, but this is not true because your first X amount of $ is taxed at a certain percentage, and everything above that is taxed at the next, and so on and so on. Below I have inserted a chart with the levels from last year.

So jumping brackets will not lead to you somehow bringing home less money despite making more since we have this progressive tax system. Meaning you pay higher taxes only on the new money.

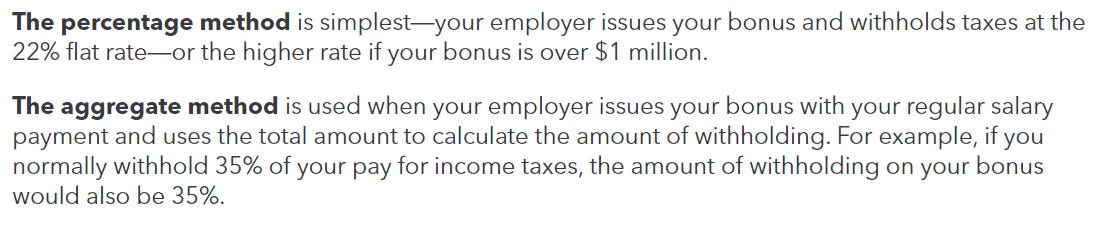

How do my bonuses get taxed?

Bonuses can be taxed using two different methods described below.

Either way, you end up paying the same amount in taxes because bonuses in the end count the same as all other income. The aggregate method will take out the same as the rest of your wages meaning that it shouldn’t affect your refund or payment when you file.

However, the percentage method is easier and often used by employers to withhold taxes on your bonus. So if your tax rate is higher than 22% they likely withheld too little and therefore you will have to pay taxes come April 18th. This may be the reason some people in question #1 owed more than expected. Alternatively, if your tax rate is lower than 22% you will likely receive a bigger refund.

But in the end under both systems in the end you will pay the same amount. The amount of taxes originally withheld ≠ the amount paid at the end of the year. We do file taxes for a reason sadly.

What’s the Upside?

We still maintain that using online software to file your taxes is the best route to go since most people (90%) simply use the standard deduction. And we encourage you to try and owe as little on your taxes if possible, owing $0 come tax day is preferred over getting a large return.

However, we understand that it can be frustrating to owe money at the end of the year. And despite it being the best option for most filers, the TurboTaxes of the world aren’t always there to give you a simple answer. So hopefully this article helped explain those weird outliers, if that didn’t help there is only one other option.

Did you find this helpful? If you did, someone else will, too. Do us a favor and share this post with someone. It’s the only we grow!

For Your Weekend

Read:

Tattoos Do Odd Things to the Immune System by Katherine Wu ($1 The Atlantic)

When you stick ink-filled needles into your skin, your body’s defenders respond accordingly. Scientists aren’t sure if that’s good or bad for you.

Watch:

You ($ Netflix)

The soapy, saucy drama is back for Season 4, Part 1 (!).

Netflix: A dangerously charming, intensely obsessive young man goes to extreme measures to insert himself into the lives of those he is transfixed by.

Chuckle:

$ Indicates a subscription may be required to view the content