📈Don't Buy the Hype

It’s easy to get caught up in the hype of the next great idea. Let’s face it, FOMO is a powerful force. The chance to win big drives us to buy lotto tickets, bet on parlays, and invest in the latest and greatest idea.

Today’s “greatest idea” is AI - artificial intelligence. We’ve covered how AI may be coming for some jobs but is also here to empower us to do even more.

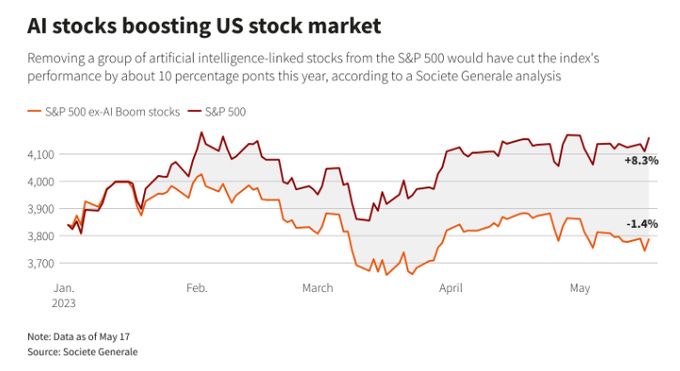

Whether robot overlords take our jobs or enhance productivity, the implications are huge for the economy. Both scenarios would lead to much more profitability and the stock market has noticed:

These high-flying stocks have driven a lot of market performance since the start of the year. So the question is should you buy in? Unfortunately, this means deciding between chasing past performance or missing out on investing early in generational technology.

Let’s take a look at Nvidia (NVDA), the current darling of the AI revolution and part of the “AI Boom” shown in the graph above. Nvidia has more than doubled its value since the start of the year, briefly becoming one of only 5 companies to have a market cap of $1 trillion (with a “t”).

While this is amazing, it puts a lot of pressure on the stock to deliver. In the image above the P/E or Price to Earnings (refresher on P/E ratios) ratio is now nearly 200/1. That means you are paying $200 for every $1 of profit NVDA makes, which is more than 8x more expensive than the stock market as a whole.

So the pressure is on for not only AI to continue to be a hot topic, but for NVDA to profit handsomely off the revolution.

I am not doubting that AI will be huge or that NVDA will profit greatly off of it, but there is difficulty in living up to sky high valuations. To highlight this we can look at some recent IPOs that were also hot companies, in hot industries.

As you can see a majority of these companies are currently valued at less than their IPO price. Essentially, this implies they failed to live up to the initial hype that sent them to sky-high valuations in the first place. Many companies can still be profitable and have great futures, but living up to unreasonable expectations can be difficult and costly.

And as we have seen in the past, the “next big thing” can come and go quicker than expected.

History doesn’t always repeat but it rhymes. Just look at the 2000 stock bubble, even the successful companies got out of control.

What’s the Upside?

Buying the latest and greatest stock on the market is always exciting - initially. Not only can your investment double in the span of a couple of days but you feel like you are investing in history. You can tell your grandkids how you saw the next big thing coming and paid for their college with it.

But these trends come and go faster than you would like, and even some of the greatest companies can become victims of overblown expectations.

We encourage betting on new technology and thinking about the long term, just don’t get caught up in the hype.

For Your Weekend

Listen

In May of this year, the Writers Guild of America went on strike. For weeks, TV and film writers have been walking in picket lines in Los Angeles and New York, and the strike threatens to bring TV and film development to a screeching halt. Historically, strikes both reflect history—the ever-changing business models behind the media we consume—and change history. The 2007-8 strike famously accelerated the rise of reality TV. Today’s guest is Matt Belloni, the host of the Ringer podcast 'The Town' and a writer with Puck News. He breaks down what’s at stake for writers and studios and answers my deeper questions about how this strike could change the future of TV and film.

Read

The DEI Industry Needs to Check Its Privilege by Conor Friedersdorf ($1 The Atlantic)

[T]he worst of the DEI industry is expensive and runs from useless to counterproductive. And even people who highly value diversity and inclusion should feel queasy about the DEI gold rush that began in 2020 after the murder of George Floyd. A poor Black man’s death became a pretext to sell hazily defined consulting services to corporations, as if billions in outlays, mostly among relatively privileged corporate workers, was an apt and equitable response. A radical course correction is warranted.

Chuckle

May require a subscription to read.