📈Climbing the Wall of Worry

Alex is up this week to shed some light on “Wall of Worry,” a phrase you may have come across over the past few weeks or so.

A big ‘thank you’ to everyone who shared last week’s ‘New Baby Financial Checklist.’ It’s a huge help to us! Keep sharing! it’s the only way we grow. : )

What is it about the market that it lends itself to all sorts of arcane phrases, aphorisms, and metaphors? One has to wonder that it’s partly a coping mechanism to keep the monkey brain from becoming too overwhelmed by the dollar amounts in play and the implications of failure.

“Climbing the wall of worry” is one such phrase. It’s often used metaphorically to illustrate that the market's upward movement is akin to scaling a wall, with each worry or concern representing an obstacle to overcome. It signifies the notion that even in uncertain times, investor confidence, however shaky, can still drive the market higher.

And climb higher we have.

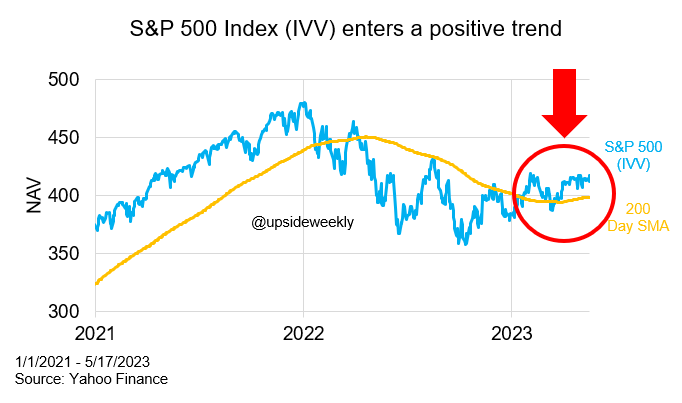

Using our trusty 200-day moving average to gauge the investment climate, 2023 has shown more life than 2022 ever did.

Remarkably, that little dip in the red circle is the “banking crisis” where Silicon Valley Bank, Credit Suisse, and First Republic all got incinerated by bad duration decisions.

Will the trend continue as the next two “walls” approach?

Wall #1: Debt Ceiling - June 1

The next “wall” investors will need to scale is the upcoming debt ceiling deadline. We’ve written about how idiotic the debt ceiling is and how it’s now used as a political cudgel to extract concessions from whichever side holds power in Washington, DC. Speaker Kevin McCarthy (R-CA) and President Joe Biden (D) are in a standoff, and, blah, blah, blah. Honestly, they will get a deal done because, whatever you may think of them personally, neither side is foolish enough to let the US default because the implications for them are catastrophically bad politically (and the entire global economy, but let’s keep our priorities straight).1

If you can’t tell, we’re not worried about the debt ceiling at all. It’s a headline war.

Wall #2: Fed Meeting - June 13

After that, investors will need to scale the fallout from the next Fed meeting on June 13th, where Jerome Powell and his Merrie Krewe have signaled their intent to raise interest rates again. The case is pretty simple: inflation is still high, people keep getting hired, and consumer demand remains persistent (not exactly strong, but not falling off a cliff either).

Notably, its not super-great that American credit card balances have never been higher while interest rates keep going up:

But that’s not J-Pow’s problem. YOLO, my brothers and sisters in debt, YOLO.2

Honestly, after the 2021s “transitory” fiasco, the market seems to have figured out that Powell will keep hitting the “raise” button until inflation calms the f*ck down. If that means a recession, so be it.3

Meaning, it wouldn’t be surprising if stocks go up on June 14th after Powell announces another hike.4

Bonus Wall: The Yield Curve

A bonus wall! Hanging over all of this (to mix metaphors) is the yield curve, which inverted in October 2022 and has remained inverted since. This is not awesome. Historically, an inverted yield curve presages a recession.

Why? That’s a post on its own. Short answer: it’s not a sign of a healthy lending market if market participants prefer short-term rates over long-term rates. It’s a sign of anxiety and an unwillingness to take risk. Which, in its own way, can actually accelerate the arrival of a recession.

What’s the Upside?

Other than the yield curve, the next two walls for investors to scale are both very do-able. The debt ceiling fight is a dumb headline war that only the most skittish, doomsday-prepper investors will fret over and those people usually don’t buy stocks for the long term.

Similarly, the anticipated interest rate hike also appears somewhat baked in and it wouldn’t be a surprise to see stocks shrug off another rate hike. There might be tremulations in certain sectors, even though many of the companies in those sectors - like tech and energy - made adjustments last year.

Once stocks achieve breakout velocity above the 200-day moving average, they tend to stay there or bounce off of it. So, let’s hope we maintain altitude and keep climbing.

For Your Weekend

Watch

Puss in Boots: The Last Wish ($ Prime Video, others)

Alex considers it one of the best movies he’s watched this year. It executes flawlessly. Voice acting is stellar (John Mulaney steals the show), the pacing is welcome (particularly amid all of the sludgy TV series that take an entire season for a character to have a realization), and the animation has a cool, pseudo-anime/rotoscope look to it. Shrek is nowhere in sight. This is all Antonio Banderas. Watch it.

Read:

Can We Stop Runaway A.I.? by Matthew Hutson ($5 The New Yorker)

The article discusses the concept of a "singularity," a point at which AI surpasses human intelligence and becomes uncontrollable or poses a significant threat to society. The article highlights the challenges of aligning AI systems with human goals and values and the need for caution in AI development. It also mentions the debates surrounding regulations and the difficulty of predicting and detecting advancements in AI technology. The article concludes with the idea that while preventing the singularity may be technologically possible, achieving the necessary social coordination to do so is challenging. It suggests that balancing curiosity and the potential risks associated with superintelligence is a crucial consideration in the development of AI.6

Chuckle

If we take him seriously and/or literally, other politicians may actually be so brazen to let the US default and see what happens. Why anyone thinks this person belongs back in the White House is beyond me.

But seriously, now is not the time to add a ton to your credit card. If you can batten things down for the next few months because there’s a chance rates start to flatten out or even fall.

Let’s remember that most recessions tend to be fairly mild contractions in the business climate. The cataclysmic recessions of 2008 and 2020 are atypical.

Another 25 bps is currently -500. You might get plus money on anything >50 bps.

A subscription may be required. Or just read in incognitio mode. Those commies at the New Yorker haven’t figured out that workaround yet.

Jokes on them: I used ChatGPT to summarize the article! Bwhahaha