📈Would You Rather

Sorry for the delay getting this out. Alex’s kid is sick and Ian has a boat.

This week we’re looking at “Would You Rather"?” from a behavioral economics standpoint.

Did someone forward this to you? Do us a favor and please subscribe.

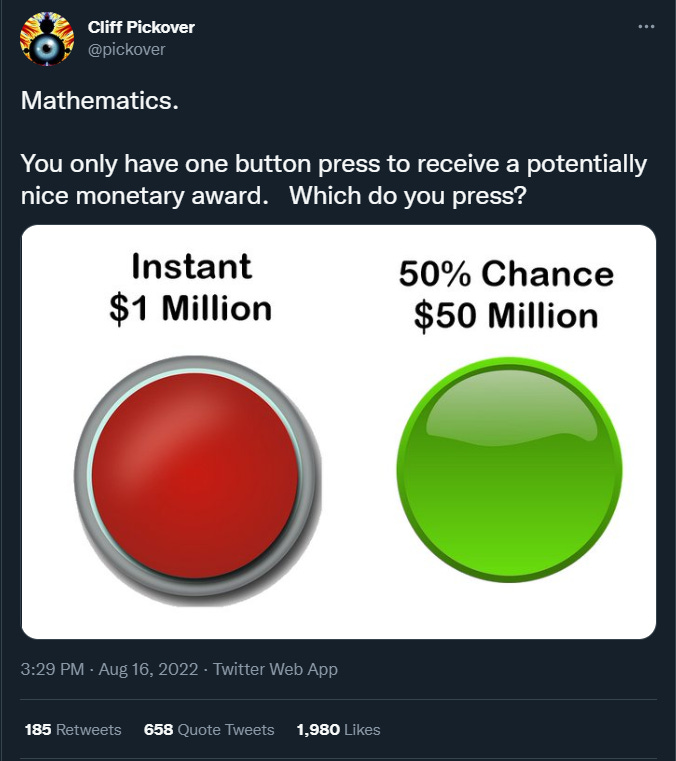

This week on Twitter there has been a hypothetical making its rounds about taking a sure thing or a chance at an even greater reward. Math nerds like me found this to be an interesting question so we thought we would share, as you can see below.

Before we get into it, think about what you would choose.

Did you pick? Okay, good.

Now math nerds like me would tell you that the technical “correct” answer is to select the green button because given the 50/50 probability the expected value of the green button is $25 million.

Since that is *checks math* 25x more than the red button is a no brainer right?

That math is correct but would work a lot better if you were given multiple chances to run this ensuring that you won at least some money. For example if you did 2 coin flips for $25 million dollars each, more people would take that because you now have 2 cracks at getting some of the money. Even though the total expected value hasn’t changed. Expand that to 10 coin flips for $5 million each and I think just about everyone would take that bet. But that is the thing with only 1 coin flip this original hypothetical is purely a bet.

As many of you know, I am a gambling man and would therefore take that bet for the significantly larger reward. But given the nature of the bet and the possibility of life changing money I wouldn’t fault anyone who wanted to take the sure $1 million. In fact Howie Mandel made a whole career out of this phenomenon, offering safety versus betting on the big prize. (Really this is how all game shows work to some extent, Who Wants to Be a Millionaire, Press Your Luck, etc. but Deal or No Deal offered the most dynamic pricing).

In the above hypothetical both amounts are life changing amounts of money for myself and presumably most readers. Making this a decision mainly driven upon personal risk tolerance.

But what if we changed the amounts of money at stake as another twitter user @EconomPic did…

As you can see when you lower the stakes everyone is willing to gamble for a chance at $500k vs a sure $10k.

It also gives us some insight that of the 500+ votes he got a slight majority would take the chance at $50 million in the original hypothetical (this may be skewed since his followers lean finance bros).

In the final hypothetical, the guaranteed money rises to $100 million and nearly everyone would take that over a chance at $5 billion. I mean who really needs more than $100 million?

And while this may seem basic it highlights the idea of diminishing marginal utility of income. In layman's terms, at some point you just have so much damn money who needs anymore?

What’s the Upside?

While these are purely hypotheticals we face similar decisions in investing all the time. Last year with the NFT and crypto hype people were chasing FOMO trades to try and make millions they heard about on the news. Today that continues with stories on continued meme stocks like AMC or Bed Bath and Beyond stocks.

The lesson is that chasing some of that can be fun, just like buying a lottery ticket for the chance at billions, but remember this is simply gambling (which we are all for if done responsibly). But when it comes to investing for your future, I sadly am here to tell you it remains boring and does not have any magic green button.