Note: Holy hell, inflation was up again. Is it time to shine up our disco shoes? Or will it be ‘transitory’ like the Fed keeps telling us? Still too soon to tell. We’re watching this one though.

What is inflation? We covered the topic a few weeks ago. Please click to read that newsletter. Wondering which indicators to keep an eye on? Check out the ‘Inflation Watch! 2021’ article on our site.

Most financial media stories fall into one of two camps:

Practical but boring how-tos and FAQs often related to financial literacy, or

Sensationalistic hits about how a Redditor became a multi-millionaire, simply because “they liked the stock.” Boy, what useful advice! Thanks for that, Roaring Kitty!

We don’t have stock tips today - sorry. If you’d like to lose money (with friends!), we have a Reddit thread for you to check out.

Instead of talking about how to invest your retirement savings, we’re going to focus on where you should invest your retirement savings. Because, frankly, where you invest has far more impact on your present and future financial health.

Inflation and abysmal interest rates mean we need to invest in something other than a savings account to save for retirement; clearly, a savings account won’t cut it.

Naturally, the next question is: which retirement account is right for me? Unfortunately, the answer to this question gets us into a web of mind-numbing phrases like tax-deferred, capital gains, and 401(k), courtesy of the IRS tax code.

The tax code is a legal document, which means it needs to be meticulously and tediously specific. This newsletter is not a legal document, so we can be a lot more direct. All those words and numbers mean is that the government is giving you the choice of when you’d like to pay taxes by choosing where to invest your retirement savings. And some accounts make more sense than others, depending on a few factors; namely, the tax treatment your savings receive.

Let’s consult the How to Be a Millionaire chart from last week:

Suppose you saved for retirement in a Robinhood (brokerage) account for thirty years. If you start investing 30 years before retirement, that means you may be able to turn $180k into $1 million over that time! That’s a gain of over $800k. Under current regulations, the government will take one-fifth of that money you’ve made, please and thank you.

In this scenario, the government will take 20% of your gains, or $160,000. That’s a new Mercedes and a nice one at that.

Was investing in Reddit stocks in a brokerage account for thirty years the right call? Under current regulations, uhhh, no. No, it was not. Because Roth IRAs exist.

What is a Roth IRA? It’s an individual retirement account that allows qualified withdrawals on a tax-free basis, provided certain conditions are met. Tax-free? 100 points for Gryffindor.

How’s that work? You contribute to a Roth using money you already paid taxes on. The government can be a real bastard about taxes, but they won’t tax you twice. Pay taxes on the way in, don’t pay taxes on the way out. Oh, and you can withdraw the principal after you’ve had the account for five years tax-free as well. Tax-free withdrawals and greater liquidity? Another 100 points for Gryffindor!

That is different from your 401(k). No taxes on the way into a 401(k) means you pay taxes on the way out.

You also have to wait until you reach 59.5 years old to withdraw from a 401(k) without paying a penalty (there’s exceptions, notably the loan provision, but you still have to pay that back in most cases).

What’s the catch? Eligibility. You can only make so much money before you’re ineligible to contribute to a Roth IRA. Under current regulations, you are ineligible to contribute to a Roth if you make more than $124,000 single or $196,000 joint per year. Bummer. But also, sick paystub brah.

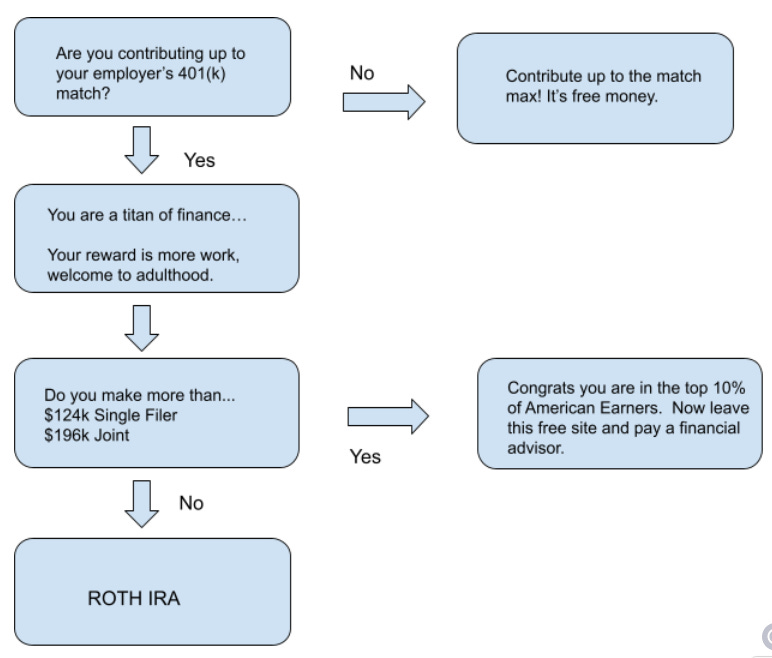

We’ve laid out three options for retirement savings: 401(k), Roth IRA, and Brokerage. Which one is right for you?

Most people should establish a Roth IRA alongside their 401(k). You know what’s not on here? A brokerage account like the one you’d get from Robinhood. Because:

A Roth IRA would help make the tax situation way more palatable. Sure, you’re paying taxes on the money you’re contributing. Again, where you invest is often more important than how you invest.

A Roth IRA would save you the hypothetical $160k in taxes we discussed above. Again, where you invest is often more important than how you invest.

And that’s just one advantage of a Roth. It has so many advantages that there are income requirements restricting high-earners from using them, so it’s imperative you take advantage while you still qualify and before you get that corner office (is this still a thing with WFH?).

Now it may seem crazy to lock up a lot of money in a retirement account early in life, so point brokerage accounts right?

Not only can you take the tax advantages of a Roth IRA but you also get the flexibility that it allows.

Buying your first house? Take the money out

Medical bills? Take the money out

Last minute trip to Cabo, all-inclusive, girls/boys trip that you absolutely can’t miss? TAKE THE MONEY OUT!

Well actually in the last case please don’t, but the point is you can. The tax law lets you use a Roth to save money for retirement while also letting you take out whatever you put in with no penalty.

What's the upside?

Parsing the tax code to figure out the best way to invest is annoying. But, by focusing on the simple things like contributing enough to get the employer match on your 401(k), using a Roth IRA, avoiding Robinhood, calling your mother, you can make meaningful steps to improve your future financial condition no matter which investments you choose.

Ready to open a Roth IRA? Check out this Nerdwallet article that compares the best places to open a Roth IRA. Don’t overthink it: Vanguard, Schwab, TD Ameritrade, and Fidelity are industry leaders for a reason.

For Your Weekend:

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

What Makes a Cult a Cult? by Zoe Heller (The New Yorker)

“Bernstein uses the lessons of evolutionary psychology and neuroscience to elucidate some of Mackay’s observations, and argues that our propensity to go nuts en masse is determined in part by a hardwired weakness for stories. “Humans understand the world through narratives,” he writes. “However much we flatter ourselves about our individual rationality, a good story, no matter how analytically deficient, lingers in the mind, resonates emotionally, and persuades more than the most dispositive facts or data.”

Why Harrison Ford’s Best Roles Are Neither Han Nor Indy by Bill Ryan (The Bulwark)

During a promotional interview for Return of the Jedi in 1983, Harrison Ford told a story about his first role as a bellhop in Dead Heat on a Merry-Go-Round (1966). Having displeased a Columbia executive with his performance, the executive told Ford that the first time Tony Curtis was ever in a movie, he delivered groceries. And, the executive continued, when you saw him you thought “That’s a movie star.” Ford replied, “I thought you were supposed to think ‘That’s a delivery boy.’”

Listen:

Wolfgang Puck | World-Famous Chef and Restaurant (The Founder Hour)

Wolfgang Puck is a world-famous chef, restaurateur, and actor. The one thing that sticks out is the drive and passion that he and other entrepreneurs have in risking it all to go for their dreams. His passion seeps through the episode and is inspiring. He shares what led him into hospitality and restaurants, how he wrote to different restaurants early in his career trying to get his foot in the door, and then venturing out on his own. He also talks about transitioning from a chef to a businessman that runs restaurants and how he innovated along the way through ideas like having an open kitchen for diners to view.