At great personal risk, let’s talk about why renting can be a good financial decision.

While there is no “right” answer, the talking points usually devolve into a screaming match about building equity in your home vs not paying maintenance costs and flexibility.

Both sides have their pros and cons, and there are endless articles to help you decide. Ultimately, it isn’t so much a math equation as it is a matter of personal preference.

We are simply here to remind you that you can build equity in more than just your primary residence. Like equities!

Everyone throws around ‘building equity in your home’ like they know what that means. To make sure we’re on the same page: ‘building equity’ means gradually owning more of your home as you pay off the six-or-seven (or eight?) figure loan you took out to buy said home. You receive the amount you’ve paid when you sell the home, thereby enabling you to afford a larger down payment on your next home. And, the value of your equity increases when home prices go up.

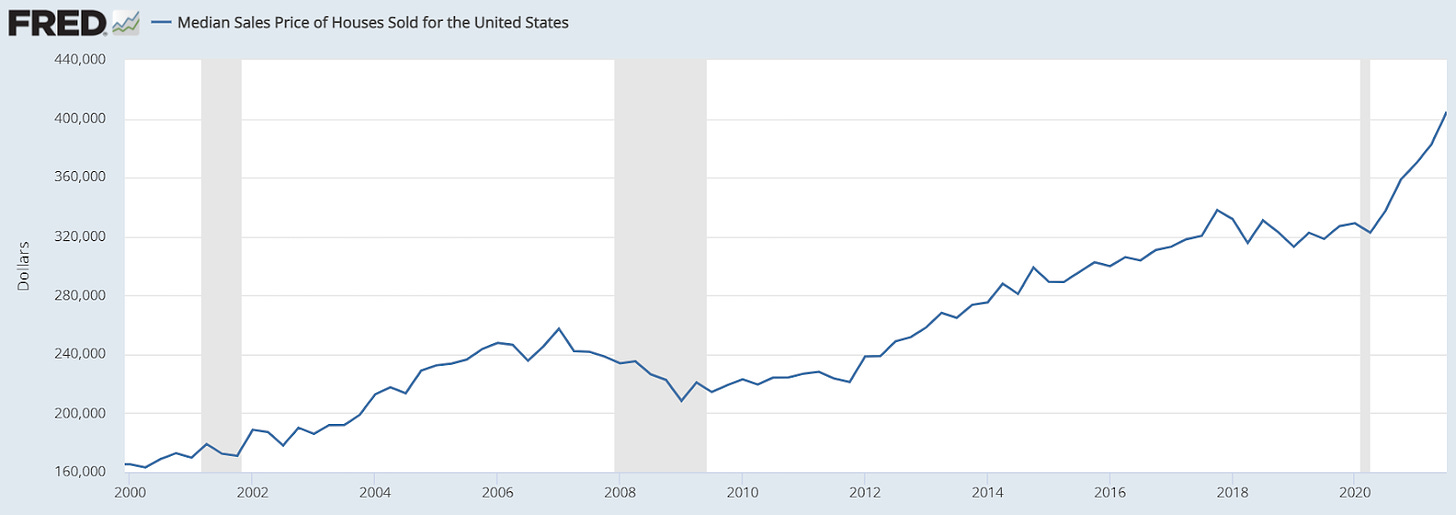

Given how home prices have risen over the past couple of decades, this whole building equity thing sounds mighty attractive.

Now, this data only accounts for new home sales, not existing homes changing owners, but still from ~$160k in 2000 to over $400k in 2021 is a hell of a move.

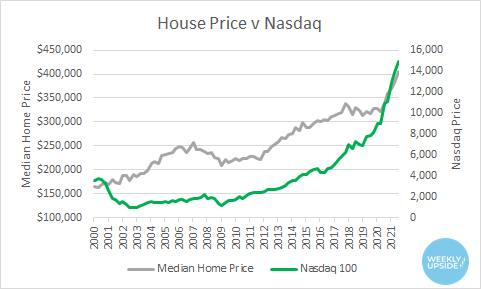

Which got us thinking: what if you had invested in the stock market instead of a home over these last twenty years? And, since our hindsight is *perfect* let’s say we invest in tech companies the whole time.

Well, hot damn. Despite a bumpy start - what with that whole DotCom Bubble and such as - tech stocks played catch-up nicely relative to the average home price.

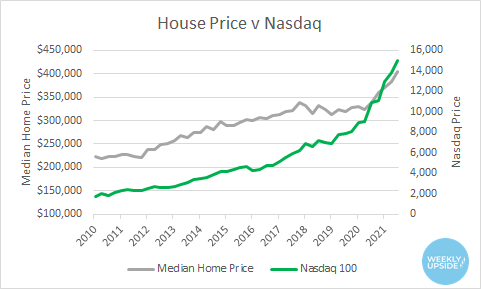

Let’s zoom in on the last ten years:

Both positions build equity, but instead of having to put together money for a down payment or pay an estimated ~1% of the home’s value per year in maintenance and upkeep, you can build equity without having to take out a six-or-seven-figure loan or worry about whether your hedge is encroaching on Joan’s roof. Or whether the water heater is a pipe bomb waiting to blow.

Newp. Just pop open an investment account, dump money in on a regular interval, and watch your equity increase while Gary the Landlord takes care of the water heater (eventually… can’t rely on that guy, sometimes).

The point is that you shouldn’t feel pressured to buy a home, even if you can afford it. There are other ways to build equity without getting into the home market. Which, given where home prices are, may feel a bit frothy right now.

It’s tempting to reduce the ‘buy vs. rent’ argument into a math problem, and while there are specific inputs that matter (like down payment, credit rating, etc.), the decision to buy a home is really a personal one.

What’s the Upside?

The big takeaway here is that it’s okay to rent, particularly if you can’t afford the home just yet. Renting affords you a flexibility that owning a home doesn’t, particularly if you expect you’ll need to move for a better, higher-paying job somewhere else within the next five years.

Use that space between your rent payment and your other expenses to invest in something that does accumulate equity on your behalf while you are renting. We suggest stocks because, unlike a home, the barrier to entry is a few clicks of a mouse and a couple hundred bucks. Don’t @ us about NFTs.

The New York Times put together this outstanding tool to help you judge if buying or selling is right for you. It has all the inputs you could possibly want, including the expected inflation rate and how long you expect to stay in the home. Use it to evaluate your specific circumstances.

Find it here:

https://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

If you end up buying a home, first, congratulations. Second, let’s get that house party cranked up:

For Your Weekend

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

“A Secretive Hedge Fund is Gutting Newsrooms: Inside Alden Capital” by McKay Coppins (The Atlantic)

The Tribune Tower rises above the streets of downtown Chicago in a majestic snarl of Gothic spires and flying buttresses that were designed to exude power and prestige. When plans for the building were announced in 1922, Colonel Robert R. McCormick, the longtime owner of the Chicago Tribune, said he wanted to erect “the world’s most beautiful office building” for his beloved newspaper. The best architects of the era were invited to submit designs; lofty quotes about the Fourth Estate were selected to adorn the lobby. Prior to the building’s completion, McCormick directed his foreign correspondents to collect “fragments” of various historical sites—a brick from the Great Wall of China, an emblem from St. Peter’s Basilica—and send them back to be embedded in the tower’s facade. The final product, completed in 1925, was an architectural spectacle unlike anything the city had seen before—“romance in stone and steel,” as one writer described it. A century later, the Tribune Tower has retained its grandeur. It has not, however, retained the Chicago Tribune.

To find the paper’s current headquarters one afternoon in late June, I took a cab across town to an industrial block west of the river. After a long walk down a windowless hallway lined with cinder-block walls, I got in an elevator, which deposited me near a modest bank of desks near the printing press. The scene was somehow even grimmer than I’d imagined. Here was one of America’s most storied newspapers—a publication that had endorsed Abraham Lincoln and scooped the Treaty of Versailles, that had toppled political bosses and tangled with crooked mayors and collected dozens of Pulitzer Prizes—reduced to a newsroom the size of a Chipotle.

Listen to Charlie Sykes interview McKay Coppins about this story.

Opinion: “It’s Time to Go Nuclear on Climate Change” by Jonah Goldberg (The Dispatch)

You… don’t refuse to use your most effective weapons, at least not in a fight for the survival of humanity, without a good reason. And in this case, the best weapon in our arsenal is nuclear power. As former NASA climatologist James Hansen and his colleagues have argued, there’s “no credible path to climate stabilization that does not include a substantial role for nuclear power.”

Chuckle:

https://thehardtimes.net/blog/we-sat-down-with-m-night-shyamalan-and-asked-him-not-to-make-another-movie/

![HD] Why would you say something so controversial yet so brave? - Album on Imgur HD] Why would you say something so controversial yet so brave? - Album on Imgur](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fa051ae9d-34a2-40f0-a2c2-af16bbad508c_1200x675.jpeg)