Last week, we wrote a brief primer on inflation and why it matters. Knowing our audience, we used brunch mimosas to illustrate this point. The Fed chose animated Lego videos, clearly a sign of competition. Noted, Fed.

Credit where it’s due: the videos do a good job explaining inflation on a 101 level. However, they downplay the significant role the Fed plays in controlling inflation, specifically, their ability to raise and lower interest rates in response to rising or falling inflation.

Luckily, this is an easier concept to understand than inflation slowly stealing your mimosa money. Nope, interest rates are much more direct. They break two ways: you either earn interest or get charged interest.

Below is a comparison of those different rates. As you can see, you get charged a lot more in interest than you earn from a savings account, CD, or bond right now.

What do interest rates have to do with inflation? They actually go hand-in-hand:

That’s called a pun, friends, try to keep up.

So, if my money will buy less tomorrow than it will today, why not just say, “fuck it” and borrow as much money as possible to buy whatever I want, right now?

This is the whole premise behind 0% interest rate credit cards or car loans. Buy as much as you can now and worry about paying it back later. It shouldn’t be a surprise, then, that acquiring a copious amount of debt has been the American way after all!

Let’s play this scenario out a bit more. Suppose every adult American borrows as much money as we legally can at 0% interest to spend every dollar (‘Waiter: I’ll have my mimosa with freshly-picked Florida oranges and a Cristal; please and thank you’). For the sake of argument, that pesky thing called bankruptcy doesn’t exist.

The result of this hypothetical should be pretty obvious: companies big and small would be overrun with demand. If you owned a Best Buy, for example, would you keep prices at the same level after one weekend of watching your 80-inch flatscreens fly off the shelves? If you knew you could sell just as many $1,000 TVs for $2,000 per TV, why not raise prices? Whether it’s a TV, or new Jordan’s, that Gucci purse, or the hottest Christmas gift, if there is enough demand and limited supply, then prices go way up.

Eventually, lenders like Visa, Wells Fargo, Chase, etc. say ‘enough is enough, we’re taking too much risk.’ They’ll stop the 0% promos and raise interest rates to discourage excessive borrowing. Raising rates signals to consumers “you can borrow, but it will cost you.”

Less money to spend means less money to buy stuff, which, in turn, means prices come down. Said another way, higher interest rates slow down demand, which throttles inflation back to more normal levels.

What’s the takeaway? Interest rates control inflation (and it only took us 500 words to get there).

To summarize:

What does the Fed have to do with any of this?

The Fed influences interest rates using something called the Effective Federal Funds Rate (‘Fed funds rate’).

Here’s what you need to know about the Fed Funds Rate: it is the most important interest rate in the world.

Every other interest rate takes its cue from the Fed Funds rate, from your savings account to your mortgage to credit cards and car loans. When the Fed raises rates, lenders raise their rates accordingly. This discourages spending/encourages saving (AKA lower inflation).

On the other hand, the Fed can lower the Fed Funds rate to help spur economic growth by encouraging more spending (AKA higher inflation). Rather than read that three times, just look at the chart above.

Currently, the Fed Funds Rate is functionally 0% - the lowest in history. Just like Visa enticed you to spend with 0% credit cards, the Fed has enticed the economy to grow and produce inflation.

What’s the upside?

The Fed is actively communicating with the market and investors right now via Congressional testimony, press conferences, and Lego videos. Their message can best be summarized as “inflation is up, we have it under control, keep doing what you’re doing.” (That’s a haiku - nailed it).

For now, what should you do about all of this? Frankly, not much. Keep some cash handy for emergencies, limit spending on credit cards, and then put whatever you’ve got leftover to work in the market. If you’ve already done that or are comfortable with your current portfolio, then follow the investment wisdom of Kunu:

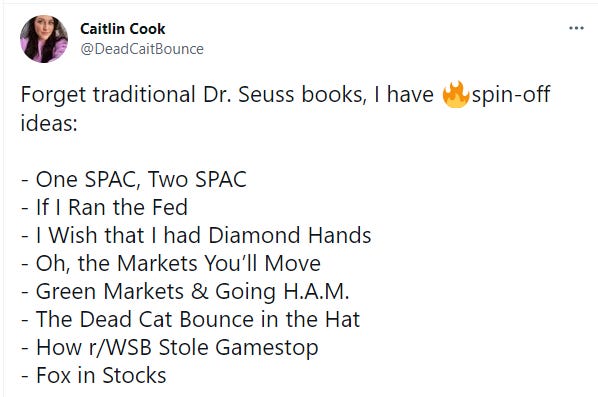

We wrote a poem

Following this prompt from Twitter user @DeadCaitBounce, we felt moved to verse over (what else) the Fed:

For Your Weekend:

This is where we’ll post a round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

Modern Monetary Theory or: How I Learned to Stop Worrying and Love the National Debt by Dr. Ben Hunt (Epsilon Theory)

There’s an argument out in the universe (Twitterverse) that goes something like this: interest rates have never been lower, so now’s the time for the government to spend on big wish-list items. We can just grow our way out of the fact we’re adding trillions to the national debt, right? Right?

The financial media-afflicted among us will recognize this line of thought as something called Modern Monetary Theory. One of our favorite thinkers - Dr. Ben Hunt - spilled some ink on this subject back in 2019. His post is worth re-reading. Extra points will always be awarded for Dr. Strangelove references:

Nothing like a good porn fantasy to change the reality of nuclear annihilation from fear and loathing to “actually, doomsday machines can be fun and rewarding”. Yes, mistakes were made, but when all is said and done the world will be a better place for our having blown it up. Don’t you feel better already? This is the power of theory in the service of political expediency, the power of post hoc rationalizations gussied up as “theory”.

The Dark Side of Congo’s Cobalt Rush by Nicolas Niarchos (The New Yorker)

The Congo has some of the world’s richest cobalt deposits. Cobalt is a key ingredient in lithium-ion batteries, the engine for an increasingly electric world. Locals will do anything to extract the precious ore – anything. Especially when the Chinese are paying.

Southern Congo sits atop an estimated 3.4 million metric tons of cobalt, almost half the world’s known supply. In recent decades, hundreds of thousands of Congolese have moved to the formerly remote area. Kolwezi now has more than half a million residents. Many Congolese have taken jobs at industrial mines in the region; others have become “artisanal diggers,” or creuseurs. Some creuseurs secure permits to work freelance at officially licensed pits, but many more sneak onto the sites at night or dig their own holes and tunnels, risking cave-ins and other dangers in pursuit of buried treasure.

Finally, because we need a palate cleanser after those two heavy topics:

It’s Going to Take More Than a Headbutt to Break the Suns by Dan Devine (The Ringer):

It’s the Clippers’ turn, once again, to take the hits and keep on pushing. They’ve got their work cut out for them, because Game 2 proved that the Suns are the kind of team that tastes its own blood and decides it wants yours. When you fight guys like that, you’re in for a long night. If the Clips can’t change things up, and quickly, it could also mean they’re in for a short series.

#Valleyoop

Listen:

How Uncle Jamie Broke Jeopardy (Update) (Planet Money)

James's Jeopardy! strategy isn't a reckless gamble. It's informed by probability.

The story of how James Holzhauer played Jeopardy like no one ever had. He broke almost every record and won ~$2.4 million along the way.