We find ourselves yet again sailing gently along an ebb tide towards the lee of the lush, abundant forests found only on Personal Finance Island.

This week, we’re looking at debt consolidation loans.

You’ve seen versions of these ads everywhere, right

Each one dangles the promise of a simpler, less worrisome life because you paid off your high-interest debt. Imagine: just by taking out this loan you can relieve yourself of loan payments… ahh, the possibilities…

Yeah, you read that right. Even if the ad discloses that you are taking on a loan, it bears repeating: debt consolidation loans ARE LOANS. YOU ARE BORROWING MORE MONEY. You are borrowing money to pay off the other borrowed money.

Like matter in physics, debt cannot be destroyed, it can only be transformed.

Here’s how debt consolidation loans work.

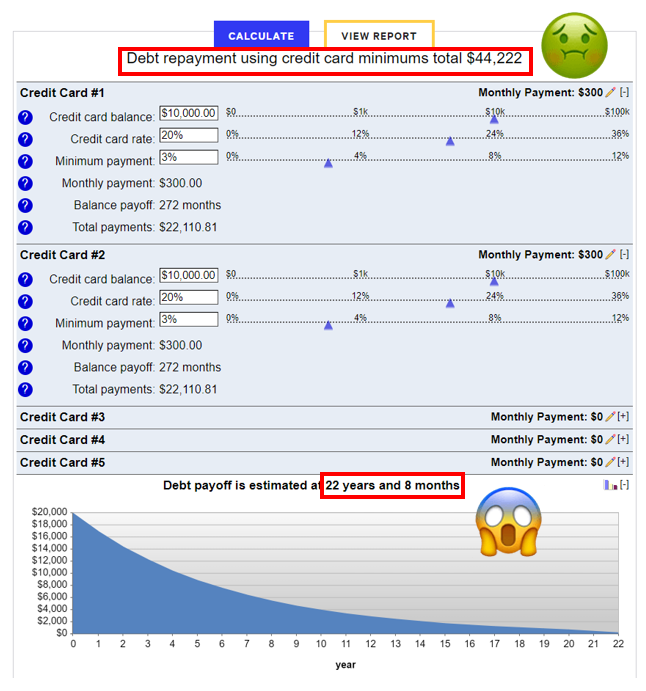

Let’s say you have $20,000 of debt on two credit cards that you can only pay the minimum on each month. The average credit card charges around 20% interest. Most credit card companies charge between 1 – 4% for a minimum payment; let’s use 3%. That’s a minimum payment of $600 per month initially. If you ONLY repay the minimum each month, you’ll pay off this debt in 22 years and 8 months and the total amount you paid back will be over $44,000 – more than double what you borrowed.

Brutal.

This scenario sucks and if you are anywhere near a situation like this, it makes sense to do something about it. What are your options?

Option 1: Keep paying the same amount every month

The minimum payment is a percentage of the total balance. It’s $600 per month in the example above if the balance is $20,000 at 20% interest. Fast forward 24 months and the minimum payment will be around $400 per month (3% of the remaining balance). Of course, this assumes no more spending on the credit cards, which, if you have a $20,000 balance, probably isn’t a good bet.

Alternatively, if you can keep up with $600 per month once, then, logically, you could keep paying $600 per month. Doing so would repay the balance in full in about four years. The total cost would be around $29,400, of which $9,400 is purely interest. That’s a lot better than repaying over nearly 23 years and paying more than double in interest, but still not great.

Option 2: Debt Consolidation Loan

Let’s say you want the balance gone in two years. Assuming you have a decent credit score, suppose you qualify for loan at 10% interest. So, instead of repaying the balance in four years, you’re repaying in two; and, instead of paying 20% interest, you’re paying 10%. These are good things, right?

In exchange, your minimum monthly payment has increased to about $900 per month. Whether you can afford that depends on your budget (more on that in a moment).

However, you’ve saved $7,250 on total costs. Based on these terms, the total cost has dropped from $29,400 over four years to $22,150 over two years. Still not great but saving anything on interest is looked upon kindly at the Weekly Upside.

Option 3: Consolidate some, pay down the rest

The third option (there’s always a third option) is to split some of your balance into a debt consolidation loan and pay more than the minimum on the remaining balance. Again, this is do-able if you can afford the monthly payments (not just the minimums on the credit cards).

How do you decide what to do?

Of all the numbers I just threw at you, the one we should zero in on is the balance - $20,000 in the red. That means you are spending WAY over what you make. Poppin’ bottles at the clob adds up, huh?

A debt consolidation loan would probably help in this situation because it will force you repay the money with a set end date and cost you less in interest. HOWEVER, it will become just another loan if you don’t stop spending on your credit cards. And you still need to make all payments on time each month – remember, missing a payment means bad things for your credit score.

What’s the Upside?

Debt consolidation loans can help dig you out of a debt hole faster and more efficiently than simply paying more on your credit cards, however, they’re still debt. If you’re not careful, you’ll add to your debt pile rather than make progress.

As mundane as it sounds, if you find yourself carrying a balance in the thousands each month, the best route out of a situation like this is to take budgeting seriously. You don’t need an accounting degree to get started, you just need a fairly accurate idea of the difference between what you bring in each month and what you pay out. That number is your starting point.

Most importantly, be brutally honest with yourself. From there, you can start to find solutions.

For Your Weekend

Read:

Astronomers Haven’t Been This Giddy in Years by Marina Koren (The Atlantic)

The James Webb Space Telescope’s first full-color images, set to be released in days, will signal the start of a new era in space science.

Watch:

The Boys (Amazon Prime)

Tired of the same giddy Marvel or dour DC superhero tale? Check out Amazon Prime’s The Boys. The show is an adaptation of a DC-turned-Dynamite comic created by Garth Ennis and Darick Robertson, who set out to “take the piss out of superheroes.” Compared to the bloodless Marvel, The Boys is an edged weapon.