📈Not Good Enough?

It’s natural for humans to benchmark ourselves to our peers, no doubt a genetic holdover from the Savannah days when the difference between keeping up with the tribe and falling behind meant life or death. Now, those glass rectangles attached to our hands make it easy to peer into someone else’s life via social media and render judgment, whether on them or, perhaps more perniciously, on ourselves.

While the stakes have been lowered, the genetic trait remains to feed the anxiety loop that we’re not doing enough: to save, to invest, to work out, on and on. It’s Keeping Up with the Joneses x 10000.

Ian’s here to set the record straight with #facts. Then, do us a favor and subscribe to get the Weekly Upside delivered straight to your inbox each week.

After recently trying and failing to convince my (let’s call her frugal) girlfriend to spend more money (yeah, I know I’m lucky), I realized that it’s often hard to know where you stand amongst your peers or the general population financially.

For example, do you ever log into social media and see people buying a house you don’t think you could afford? Or going on another extravagant vacation? While we should all be happy for our friends or even successful online strangers, sometimes this can make you question your own success and come to the conclusion that you aren’t doing enough.

This is a natural impulse, I think, although I am far from what you would call a psychologist. I’m from the midwest, so you just shove those feelings down deep and move on with your life. Maybe have a drink and buy a lotto ticket if you want to be proactive.

But this week, I wanted to tackle it. Because there are douchebags on Twitter hyping up the idea that you aren’t doing enough. Click the image below to watch the video if you want to add a new person to your personal Mt Rushmore of punchable faces.

Now, because I write a finance blog, and work in the markets (not the stock market bro) people are often sharing their financial situations with me more than a normal stranger. And I love it because I enjoy helping people with their money, although none of you pay me for this blog. Or for the advice, now that I think about it.

My own business mistakes aside, I can assure everyone that has talked to me about finances and I am willing to bet most people reading this blog is farther ahead in life than the internet would lead you to believe.

To illustrate this point I am going to pull from our old friend Nick Magguilli and his recent post linked below.

I encourage you to read the article if you want but let's look at some highlights. He uses household data, so that means the total for you and your partner or spouse. If you are single, you can simply halve these values to get a rough idea of where you stand. So let’s see what it takes to be a top 10% household based on age groups.

If you are under 35, the threshold may surprise you, obviously, this increases into middle age with your prime earning years. And before you ask, this does depend a lot on where you live. $122k in NY, LA, or Chicago is not going to go as far as in bumblef*ck Iowa, but still, we are talking about the top 10% of earners!

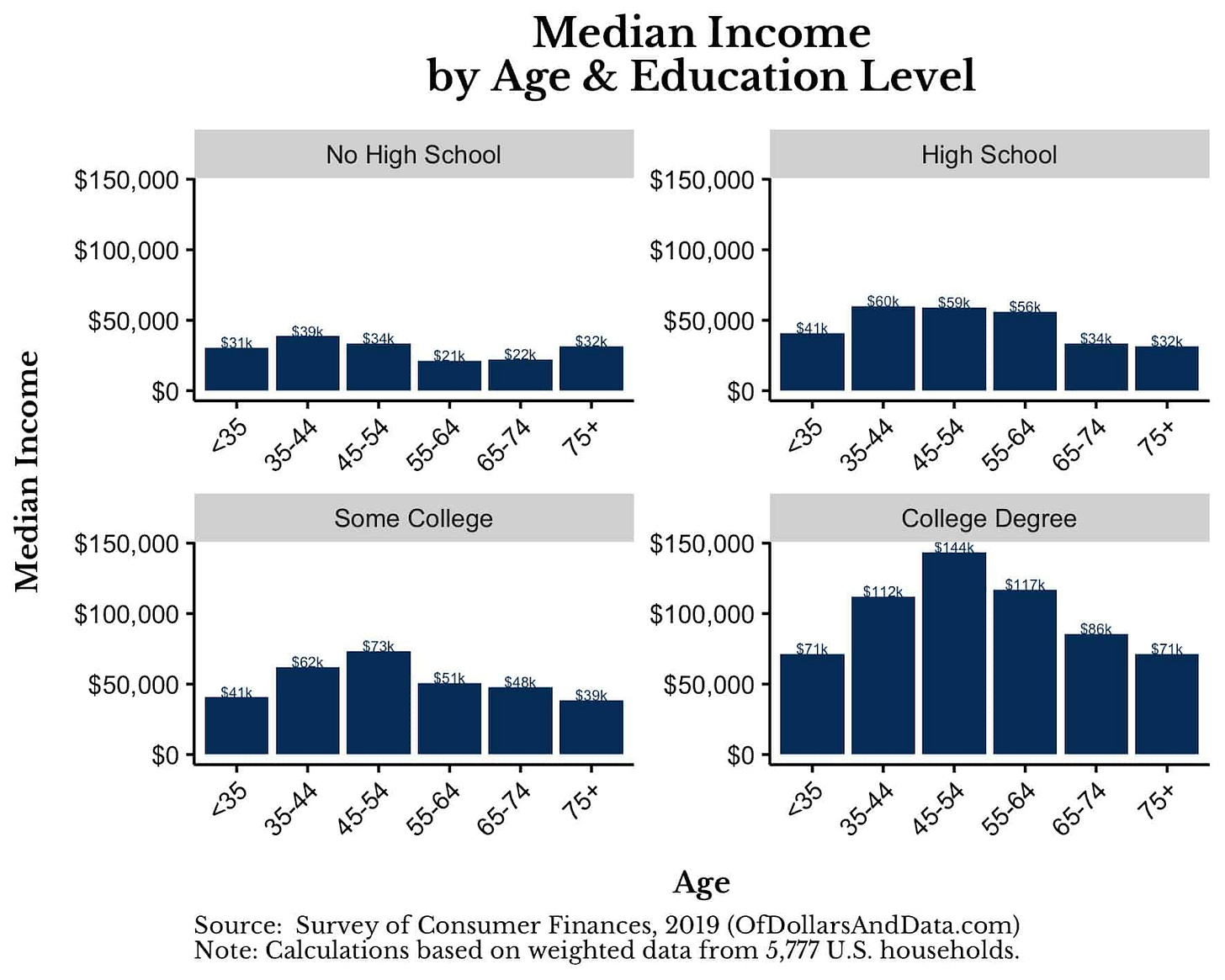

The other caveat may be: “well, fine but what about my education level? I paid a lot for college that Obama Biden hasn’t forgiven yet, so I need to earn more.” And guess what friendo you sure do.

Again these numbers are for households. So we have established that you maybe, just maybe are doing a bit better than you thought and that that degree has still most likely paid off despite its high cost.

But it’s not just income that matters; it’s savings, especially for retirement, as we know.

And I was listening to a podcast by Ryen Russillo, for those who are unfamiliar hosts a sports podcast that includes a segment called “Life Advice” at the end of each episode. If you want to listen, the link is here and the segment starts at 55:30

If not, here is the transcript of the part that annoyed me. The call came from someone in their mid-20s who thought he was falling behind his rich friends who had $100k saved for retirement already.

However, as I mentioned, I live in one of the most expensive States cities in America. Not to mention I have monthly vet bills for my dog and the used car I had to purchase after college since riding a bike everywhere would no longer suffice.

Fortunately, I stick to a somewhat strict budget where I save about 20 percent of each paycheck with 8% going to retirement savings (401k & Roth IRA), and 12% to an emergency fund and savings account to be used for large purchases.

This is a very solid plan and a good start if you can do it. Your percentages will vary but saving this much in your 20s will set you up for success. And to prove to this caller that having $100k in your retirement account by 25 is not the norm, we have more charts.

The average by 25 is $6.3k! And averages don’t even hit $100k until mid-40s. While this is a whole other topic about how Americans do not save enough for retirement, we are out of time. Plus you are much smarter than that, you loyal Weekly Upside reader you.

What’s the Upside?

You are most likely doing better than you think financially even when things aren’t going quite as expected. And since the “Jones’” may be poorer than you originally thought, it’s okay to spend on things that matter to you.

Just stick to the plan of investing early and often while doing so and everything will be just fine.

And hey, if this post helped put things into some perspective, do us a favor and forward it to someone else you think could stand to hear it.

For Your Weekend

Read

Trapped in the Trenches in Ukraine by Luke Mogelson

If you read one thing this weekend, make it this piece by Luke Mogelson. An experienced war correspondent who has covered the wars in Afghanistan, Syria, and Iraq, he’s embedded with a group of foreigners who volunteered to fight alongside the Ukrainians against Russia.

I dare you to put it down after the story reaches the point where the author, the photographer, and the volunteer soldiers are trapped in a shallow ditch dug into the floor of a bombed-out home as Russian artillery falls around them.

Watch

Lighten the mood after finishing the somber Ukraine article with a good ole fashioned J-Lo rom-com. Once again, she plays a bride. Once again, a hot dude (Josh Duhamel, in this go-round) plays her fiance. Except this time, the lessons learned the intimacy to be earned has to go through a band of pirates who hijack the wedding and demand $45 million in ransom money. Watch with your brain turned off, and it should deliver a modestly enjoyable, calorie-free ride.

Chuckle

The whole thing is pretty good… start from the top with “Do you ski?”