📈"I" of the Beholder

Last week, we recommended that you watch basketball instead of reading our blog. Thankfully, most of you ignored that advice. This week (despite our awful NCAA betting recs) we wanted to offer a straightforward piece of actionable investment advice.

Yes, our pro tip is to buy government bonds, basically the most boring and riskless investment in the world.

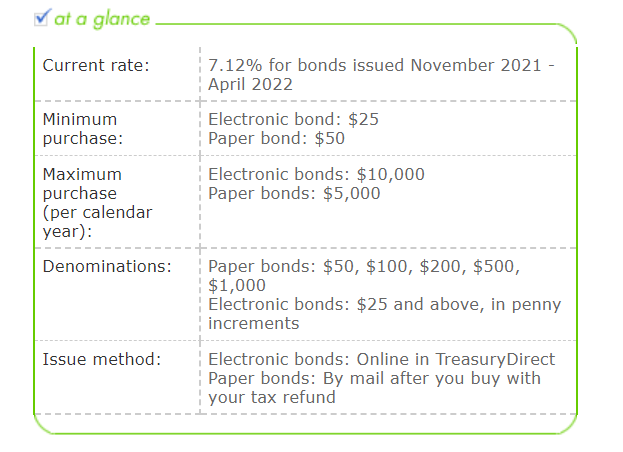

An I Bond is a type of investment that has been an afterthought for years because it uses our nemesis inflation to determine how much it pays. With inflation largely a non-story for the last decade, no one was buying I Bonds. Now, with 7-8% inflation, I Bonds are making a comeback. Below is a quick stat sheet about I Bonds.

You can directly buy a bond from the US Treasury for up to $10,000 (per person - see marriage has some perks) and earn 7.12% interest until the end of April. This is just a littttllllle bit more than your bank account, or CD will pay you currently.

Since these are both risk-free investments (federally backed/insured) this comparison is significantly fairer than crypto bros and their yield farming. However, there are some notable drawbacks that must be discussed.

First, the minimum investment period is 1 year, and it must be held for 5 years to cash out without paying any penalty. The good news is the penalty is only 3 months of interest so you still come out way ahead of your current savings account (7.12 x 0.75 = 5.34% don’t @ me math nerds). So if you already have an emergency fund of liquid cash this is a great next step to save money for midterm goals while effectively fighting inflation. Patiently waiting for that money…

Another issue is the interest rate is not constant like a CD, for example. Since it is tied to inflation, they reset the interest rate 2 times a year based on Consumer Price Index (CPI). While this is not ideal, if you buy I Bonds by April you will lock in 6 months of 7.12% interest, and based on where CPI is headed it will likely be adjusted even higher. Leaving you with at least a year (the minimum hold time) of high returns.

(Get it? I Bond? Yields got high, like Afroman’s hit single? Work with us)

Now that we discussed some of the drawbacks, albeit minor, let’s cover a couple of additional benefits. One, the interest on these is federally taxable (as is bank account interest) but it is not state taxable. Second, for any parents out there it can be used as a way to help save for college. If the funds are used for higher education expenses the federal tax is also waived.

So, in a world where savings account pay you diddly and inflation looks to be higher for longer, you can use the I Bond to keep compounding your savings without any risk of losing money or owing state taxes on the interest.

What’s the Upside?

All investments have their place in a portfolio. Having cash to cover short-term expenses and emergencies is important, and of course, investing in stocks for the long run is always a good choice. But if you are diversified and have both these ends of the spectrum covered, I Bonds represent a great opportunity to hedge against inflation and still provide liquidity for anything that may come up.

For Your Weekend

Our round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

Can Shohei Ohtani Be Even Better? by Ben Lindbergh (The Ringer)

The new so-called “Shohei Ohtani rule” for DHs could help a little, but even the underlying numbers show that the reigning AL MVP could improve in 2022

Madeleine Albright Was the First “Most Powerful Woman” in U.S. History by Robin Wright (The New Yorker)

As America and its allies debate how to counter Putin’s invasion of Ukraine, the so-called Albright Doctrine is relevant today. It blended her profound moral values from her childhood experience in Europe with U.S. strategic interests. In most cases, she advocated for “assertive multilateralism.” During the war in Bosnia, she presented the first evidence that Serb forces committed genocide after the fall of the town of Srebrenica. During subsequent debates about whether the U.S. and nato should conduct air strikes against Serbian forces, Albright famously turned to Colin Powell, then the chairman of the Joint Chiefs of Staff, and asked, “What’s the point of having this superb military you’re always talking about if we can’t use it?”

I AM THE TOP HUMIDIFIER ACCORDING TO WIRECUTTER AND I CAN’T TAKE THE PRESSURE ANYMORE by Andrew Palmer and Brian Platzer (McSweeney’s)