📈How Your Raise is Killing the Economy

Ian’s up this week with a walk-through of why your raise is actually hurting the economy (at least from an economist’s perspective).

Okay, that might be a bit of a hyperbolic title, but some economists would argue that higher wages are a major detriment to lowering inflation. And unfortunately for you, one of those economists is the head of the Federal Reserve, our old pal Jerome Powell. A couple of weeks ago he said this during a speech at the Brookings Institute.

Quick translation…

Now, a while back we covered why the Fed was raising rates and how it would help cool off some higher prices in the economy. The logic behind this is pretty straightforward: with cheap and easy money, people were able to take out large loans to buy new cars and houses for a very low monthly cost, accelerating demand in a post-pandemic economy still playing catch-up with inventory thanks to pinched supply-chains.

By raising rates, the Fed discouraged or made this behavior impossible with higher mortgage rates and the like. While also encouraging you to save more money with interest rates on things like bonds becoming way more attractive. If you would like a refresher on this part of the Fed’s plan, you can read it below.

While this part of the plan sounds pretty good to most people the other part of the plan is likely extremely unpopular.

Powell remains concerned with something called a wage-price spiral. This phenomenon essentially boils down to more money chasing goods causing inflation. We have seen this over the last several years with employers having to raise wages and offer incentives to come back to work post-pandemic.

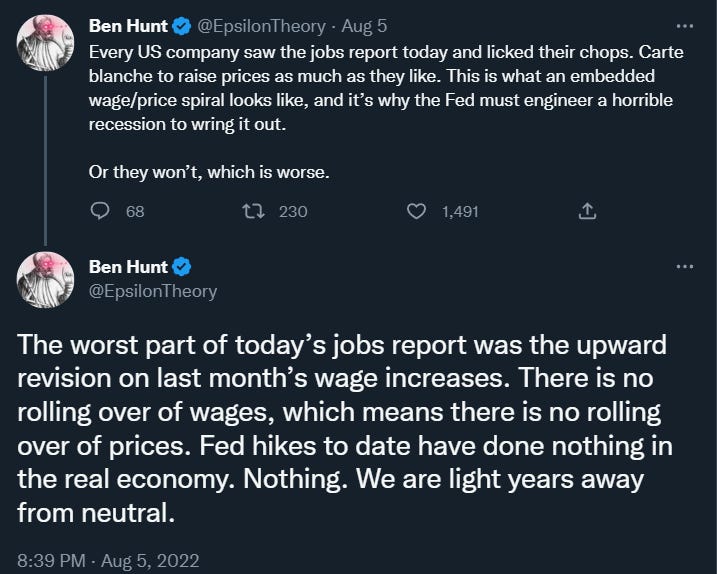

All that wage growth has allowed us, the consumers, to keep spending. This allows companies to keep raising prices long after supply chain shortages have eased, creating a wage-price spiral style of inflation that becomes embedded in our economy. Below this is described by a much better writer than myself back in the summer as inflation was at forty-year highs.

So high wages are causing high prices, which may have you thinking…

And you would mostly be correct to think that.

It is not your fault that a pandemic occurred.

It is not your fault that employers raised wages to bring people back to work.

And it is certainly not your fault that companies are taking advantage of this to raise prices as high as possible.

While it is not your fault, it is your problem.

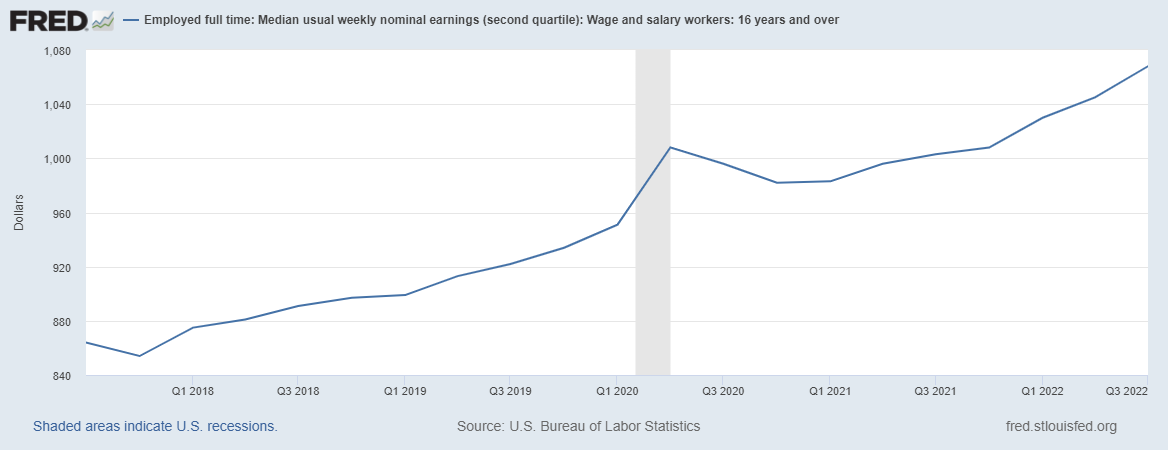

Let’s look at what wages have looked like over the last 5 years.

That’s pretty much a straight line up meaning wages have increased through and especially post-pandemic. This is great news, but these wages are not adjusted for inflation. When we adjust for inflation, things look a bit different.

In this case, inflation-adjusted wages, called real wages, peaked right around the pandemic and have been crushed by inflation in the following year and a half.

Simplified: Inflation > Wage Growth

Meaning most employees effectively make less than they did at the end of 2020. This scenario sucks for workers because it means your entire raise and more has been eaten away by inflation. And since the Fed cannot give you a raise, it only has one option.

The Fed has to SMASH the economy.

They have to keep raising rates to further encourage saving and discourage spending. Which for many businesses will eventually mean delaying investment in new projects and even laying off employees as we have already seen in tech.

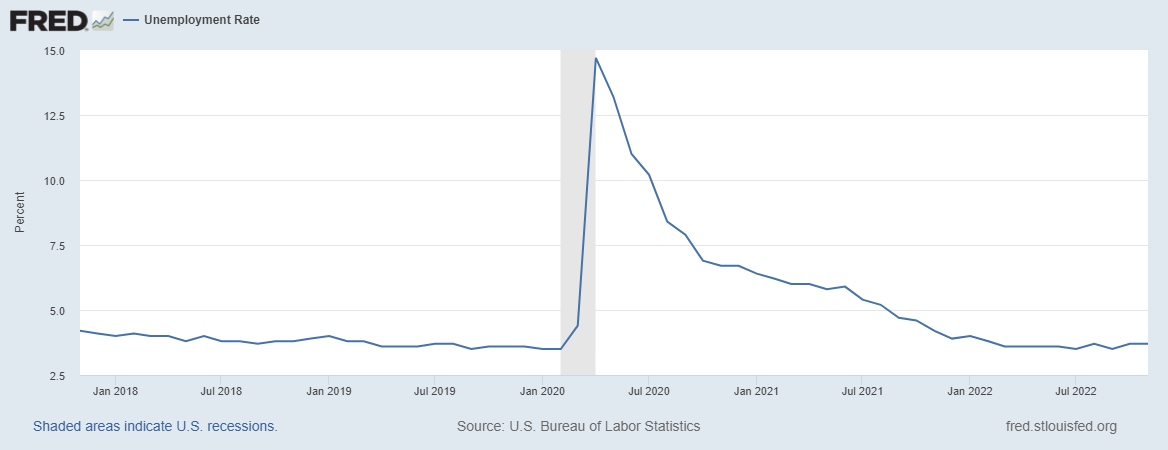

And they have to do it now while unemployment remains at pre-pandemic levels which are near all-time lows or things could get even worse.

What’s the Upside?

While I am not here to defend the Fed, I did want to provide context about why they are doing what they are doing. Trying to slow wage gains on its face sounds very stupid, but there actually is some method to the madness.

In the end, the Fed is trying to engineer what has been coined a “soft landing” where they kill inflation without causing a recession or large unemployment (you can google the term if you want to learn more, I hear it 10k times a day on CNBC).

The good news is so far they are pulling it off, with inflation starting to finally cool and the job market remaining strong. And to them we say…

If you this post helped answer a question or, optimally, makes you sound smart at the next happy hour, do us a favor and forward to someone you know. We only grow via referrals!