Ian fires up the take machine to weigh in on 401(k)s: what they are, where they come from, and are they really worse than a pension?

Also, thanks for your patience while we got this week’s edition out. One perk of daycare is you have the right - nay, the privilege - of paying $1,300/mo. to contract every infectious malady known to man. Stronger immune system now, I guess?

Did someone forward this your way? Thank them by subscribing to our newsletter!

Once again, I am going to take you to the Twitter streets to discuss 401(k)s. While we have talked about them tangentially in the past and alluded to why you should always take your 401(k) company match, we haven’t directly discussed what 401(k)s are.

This tweet is what piqued my interest.

First of all, 401(k) is just a part of the tax code that authorizes a savings and investment retirement plan an employer can offer their employees. There are traditional and Roth versions of 401(k) that provide pre- or post-tax benefits for you to save up to $20,500 per year as of 2022 ($27,000 if over 50).

So a tax-beneficial account in and of itself cannot really be a scam. It’s just a retirement account with tax advantages.

There are some scams out there that Marlon Humphrey may be familiar with.

Yes, the man saying that most Americans' main vehicle for retirement savings is a scam is also buying Bored Ape crypto NFTs. And as we have discussed, there are plenty of scams going on in cryptoland.

Not only is this Bored Ape down roughly 33% in price at the time of writing (many projects are down 100%, aka, worth zero dollars), but the company that created it is currently under SEC investigation.

https://www.bloomberg.com/news/articles/2022-10-11/bored-ape-creator-yuga-labs-faces-sec-probe-over-unregistered-offerings

To be fair to Marlon, there is one aspect of a 401(k) that has some history of being a scam. Namely, it wasn’t set up to be the principal way Americans save for retirement.

Back in 1978, most employers offered employees a pension (technically called a “defined benefit” plan because the payout (“benefit”) was scaled or “defined” based on your seniority and time served with the company; so, a 20-year assembly line worker would receive a lower benefit than a 20-year vice president who may have started as an assembly line worker).

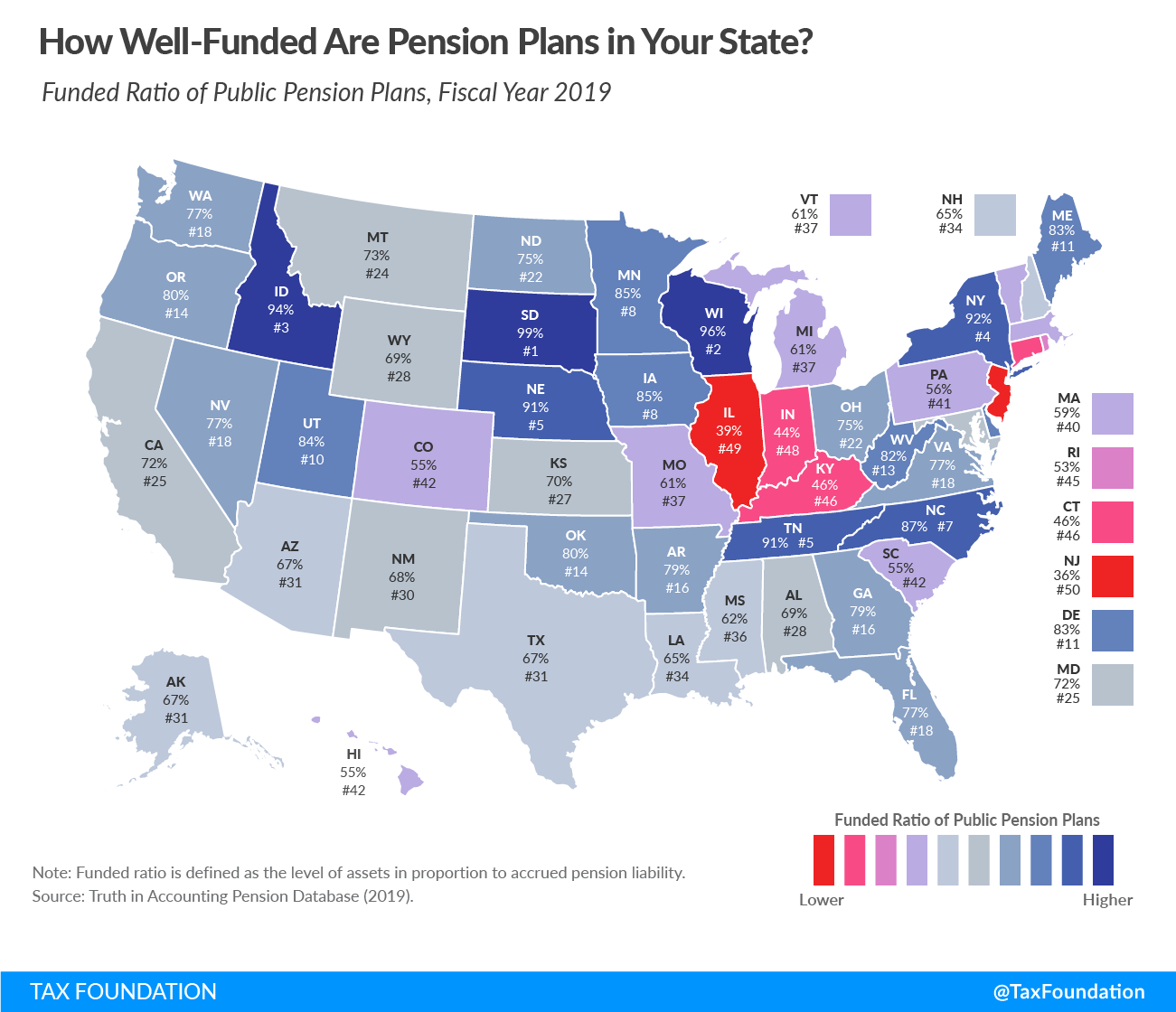

So, the “pro” of the pension is that you know exactly what you will get per month or year when you retire because the retirement benefit is defined. And, it’s on the employer to manage the investments to ensure it has enough money to pay that benefit when you finally call it quits. This arrangement may sound egalitarian, but it makes one key assumption: that the people running the pension will do a good enough job to keep it solvent.

How’s that going? Not so great. If you want to hear how not to run a pension, tune in to the Illinois Governor’s race.

But then 401(k) came along, and it flipped the pension on its head. Rather than a defined benefit when you retire, the 401(k) defines the amount you can contribute each year. While you aren’t guaranteed a certain payout at retirement, you get to reduce your taxable income by the amount you contribute, your employer has the option to contribute money to your 401(k) via a match, and you can choose how to invest the money you’ve put into the account.

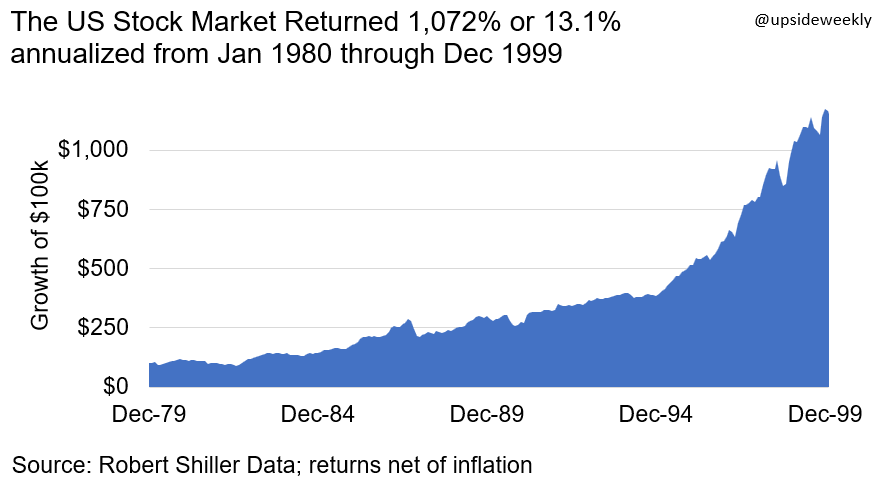

At first, employees like the idea of taking control of their own retirement. This was YOUR plan, not Todd from accounting’s plan, and you could totally outperform that nerd. And if you look at stock market returns from 1980, when 401(k) became popularized, until 2000, you can see why people were excited about this new plan.

Then returns, uh… weren’t so good for a while.

Cut to your employers who love the idea of a 401(k) because they’re off the hook from having to stress about owing you pension money in 50 years, or how to invest it, or really anything. They just set up a 401(k) and contribute x% of your salary for you as a retirement benefit. Hell, they don’t even have to contribute at all!

This is why we LIKE 401(k)s, especially when you are taking the match, but we LOVE Roth IRAs, which offer lower fees, more flexibility, and tax benefits.

Also, Roth and traditional IRAs only let you save $6,000/year ($7,000 if you are old), so the fact a 401(k) allows you to save $20,500 ($27,000 if old) is a huge perk. It is a tool to help you set aside large amounts of money for the long term and invest them in the market while providing tax benefits.

And yes, they do require you to keep the money in there until you are 59 ½ years old, which again could feel scammy but really is helpful as a forced savings feature for retirement. And if you are able to retire well before that and would like to access that money, there are ways to do so, and it is also what we like to call “a good problem to have.”

What’s the Upside?

401(k)s are neither inherently good nor evil, scam or otherwise. They simply are a tax-advantaged account set up through an employer. And while we may yearn for the days of defined benefits, those are long gone for most of us.

So get that match, fill that Roth, and then back to work, maxing out your 401(k) if you can. If you would like a better idea of how that part should be done, check out our piece from last year.