📈For Richer, For Poorer

Both work and life in general have been quite busy lately, so you may see less of me around here. Not to mention, I am clinging to the last of the summer weather in Chicago, living my best boat life before football season rolls in along with the snow. All this has meant less time for me to roam the interwebs looking for things to get pissed off about.

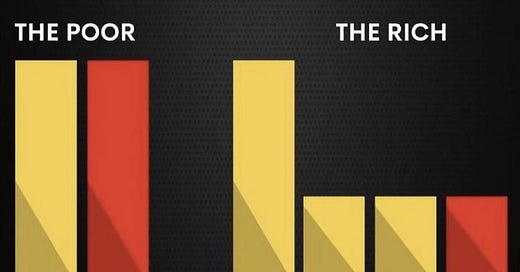

A couple of weeks ago, however, I did, and once again, it was brought to our attention by our friend Nicky Numbers. That link has an article he did about the same article that pissed me off, and while Nick is normally reserved, even he got fired up. As always, his articles are worth a look. Now, the image in question was this.

First of all, let’s crudely fix the scale in Microsoft Paint so we can at least have a discussion based on reality.

There we go, as you can see, the “Rich” and the “Poor” most likely do not make the same amount of money. Therefore the “Poor” (I hate this word, so tasteless. I prefer peasants) have to spend most if not all of their income.

This all seems logical, and if you read Nick’s blog, he will elaborate on how making more money is actually the key to becoming wealthy. This seems obvious but somehow, instead, we are just gaslighting poor people peasants into thinking it’s their fault they are poor.

And all joking aside, imagine telling someone living paycheck to paycheck to simply cut their spending by 67% so they can invest and save it instead of buying groceries for their family or gas for their car. It’s this out-of-touch bullshit that makes everyday people hate/distrust financial professionals.

Now since you are reading a financial blog, I am going to assume that you are somewhere in between the rich and poor on that horrible chart. So we can throw that out and focus on the other annoying people online.

While it is much worse to chastise people for not being able to save, there is a new cottage industry around shaming people who spend too much.

But it’s not just lattes, there is something about flexing that you don’t spend money that appeals to the Twitter or X crowd these days. Specifically a fetish for driving old Toyotas, which couldn’t be me (I drive a 2010 Hyundai Elantra my fiance lets me borrow).

These guys aren’t wrong and Dividend Hero often preaches a lot about long term investing which we like, albeit specifically in dividend stocks which we don’t like (They are fine, just not the end all be all).

My advice is different.

But based on my follower count on any social media app, and the blog readership, I know this opinion isn’t popular or exciting but.

Everything in moderation.

What’s the Upside?

You can buy a coffee.

You can drive a car that isn’t 20 years old.

And as much as I love Kirkland Signature products you can buy things that don’t come by the pallet.

Even doing all these frankly reckless behaviors you can save enough to retire comfortably, and if you fall short of the wealthy mark because you drove a car that worked? So be it. Life is too short.