📈Fed Up

If you are reading this, please stop and go watch March Madness. It is your American duty to skip work while watching/gambling on unpaid amateur athletes. If, however, your bracket is already busted, saddle up to the bar and let’s talk about our old friend the Federal Reserve or “Fed.”

On Wednesday the Fed announced they raised the Federal Funds Rate by 0.25%. Kudos to them for hiking rates for the first time since 2018 on a weekend where no one does work from Wednesday on. And we would also forgive you if economic events like the war on Ukraine or the price of gas took precedence over a minor rate hike.

Nonetheless, this was a huge event for the markets and ultimately consumers. By hiking interest rates, the Fed signaled it has moved from accommodating growth in the economy and focused on fighting inflation. This is a seismic shift in policy because everything since the start of the pandemic has been focused on stimulating growth and making sure our financial institutions continue to function.

To understand why this shift in priorities is occurring we have to understand the Fed’s dual mandate. Essentially, they are tasked with:

Fostering maximum employment (aka, low unemployment)

Providing price stability (aka, stable inflation)

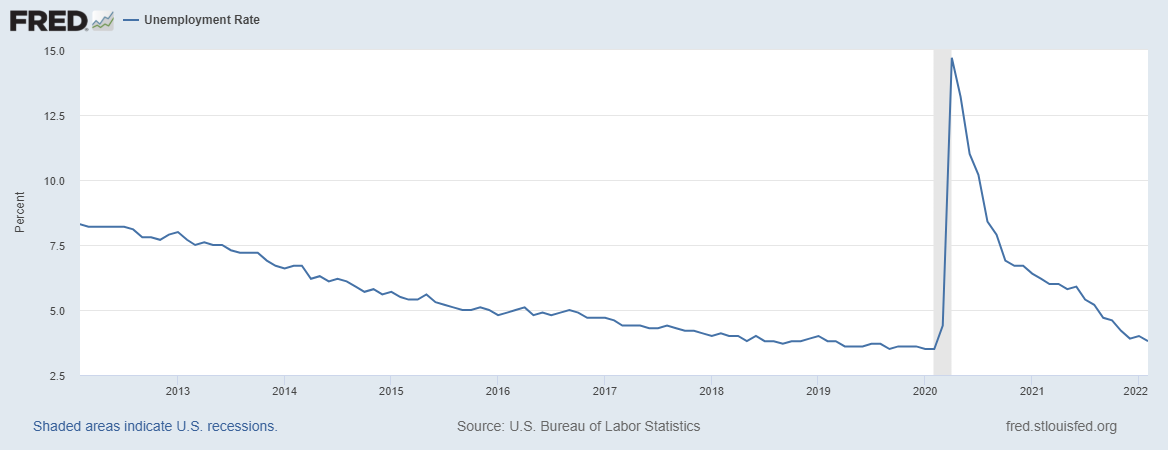

The good news is unemployment is at 3.8% - nearly at the low before the pandemic and much lower than most of the prior decade.

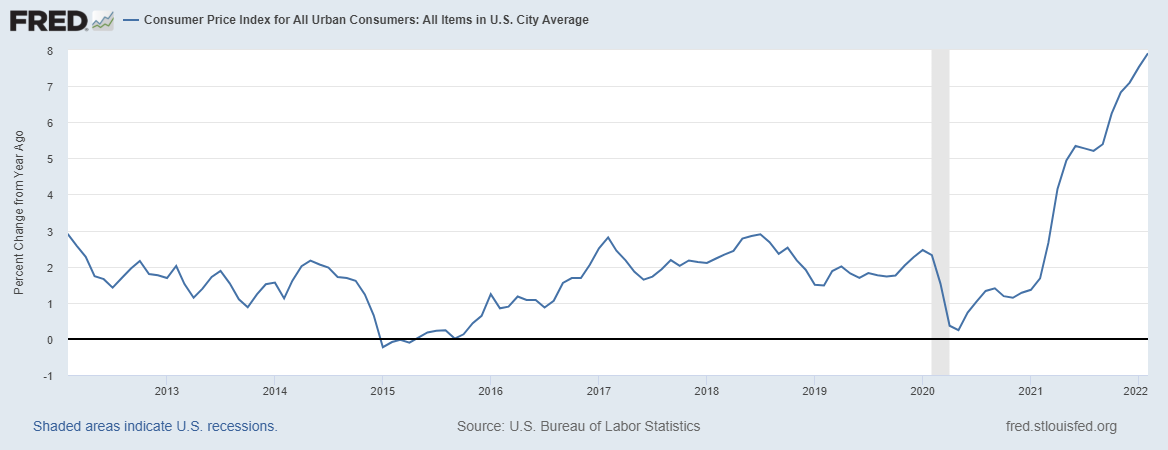

Inflation on the other hand, well, you know how that's going.

Considering the Fed has traditionally targeted 2% inflation, they’ve missed by…

So, if unemployment is down to pre-pandemic levels (great), but inflation is raging (not great), what’s the connection between rising inflation and higher interest rates?

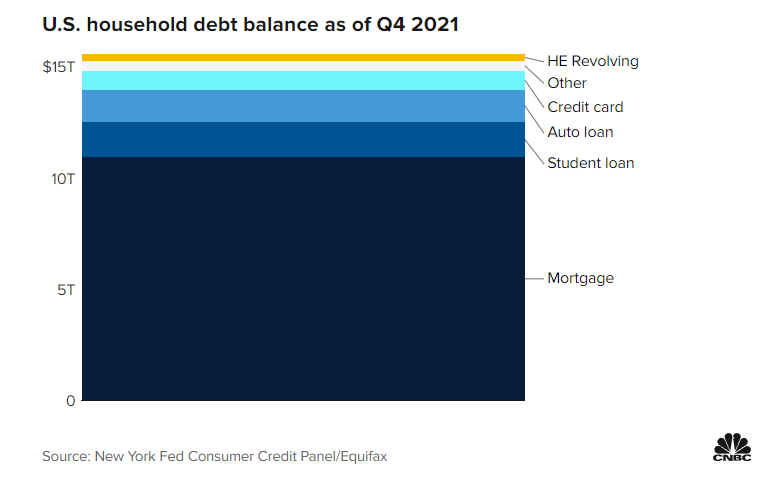

Simply put, higher interest rates means borrowing money becomes more expensive. And if there is anything Americans love more than March Madness it’s borrowing money to buy stuff. To wit: consumer debt totals $15.6 Trillion and increased over $1 trillion (with a “T”) in 2021!

The expectation, then, is that the higher cost to borrow will make people think twice before taking out a loan, charging the credit card, or taking out a second mortgage to YOLO into sh*tty stocks. Enough people thinking twice about borrowing money to buy stuff - in aggregate - should help cool off demand and *presto* inflation slows down. At least, that’s how it worked last time.

When the Fed sets interest rates, all other rates take notice. That means that when the Fed raises their interest rates, every other interest rate adjusts upward if it’s not already fixed. Credit cards, car loans, and yes, your mortgage rate will take its cue from the Fed.

Let’s use your mortgage payment to illustrate the impact that higher interest rates can have, particularly since home mortgages represent the bulk of that nearly 16 trillion in consumer debt.

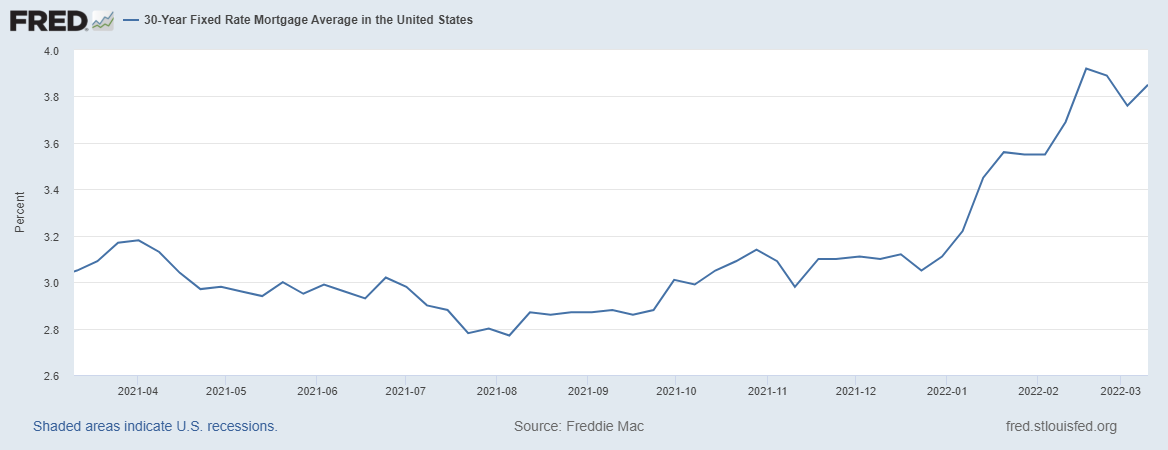

When the Fed raises rates, mortgage rates often go up - something we’ve already seen happening in anticipation of this Fed rate hike.

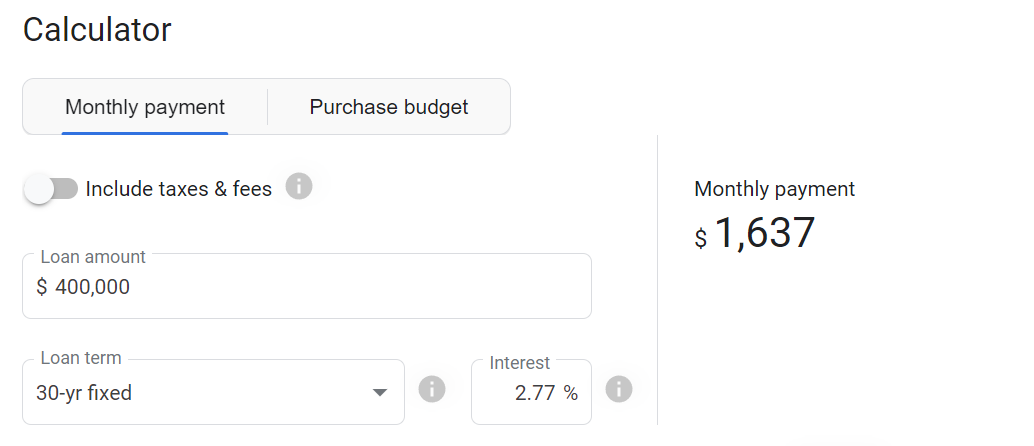

The median home price to end last year was $400,000 so let's see how much that would cost per month based on the lowest interest rate last year.

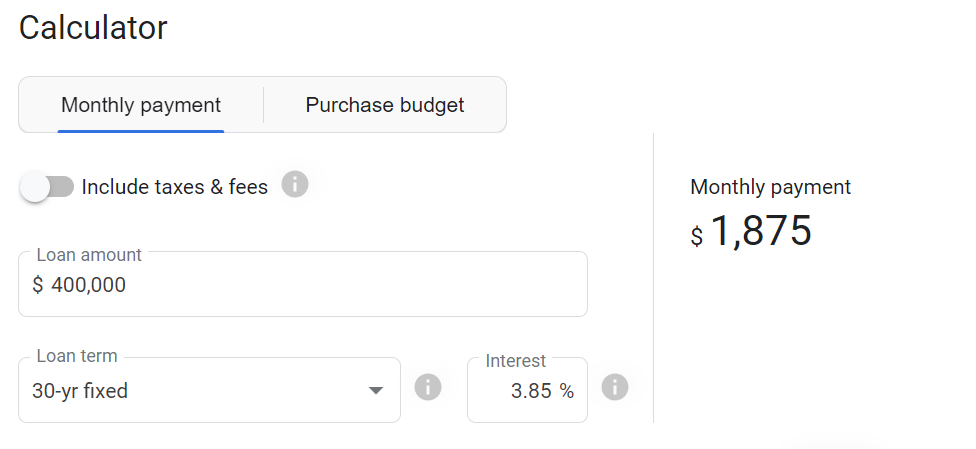

Cool, cool, cool. Pretty affordable such a large loan amount. What about current levels?

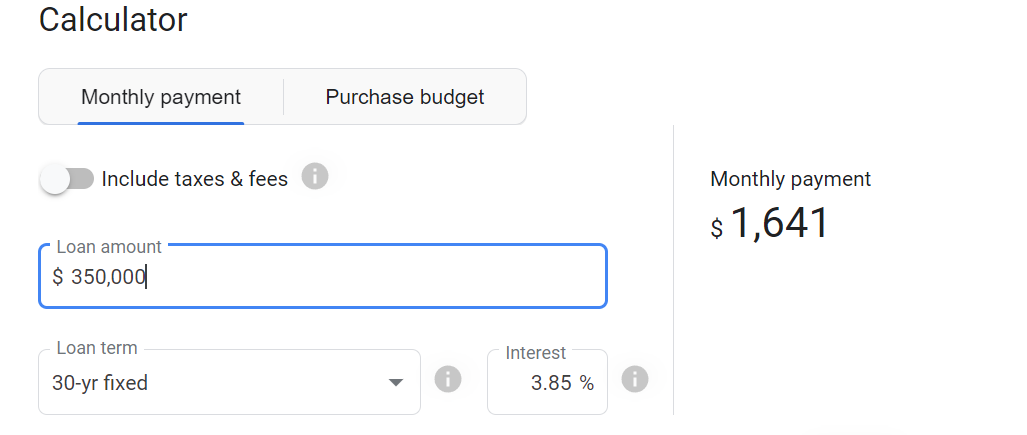

That’s $238 more per month, or over $2800/yr for the same loan! So, while we worry about things like gas prices, home mortgage rates have greatly increased. This means if you wanted to only spend the original monthly payment you can now only afford a loan of about $350k.

This is just one example of how higher rates make it harder for the consumer to spend borrowed money. If rates continue to increase, this divide will grow wider and wider.

Now apply this to car loans, credit cards, financing for your water bed, business loans - you name it. Higher rates means less “bang for your buck,” which should reduce the upward pressure on prices on things like cars and houses.

What’s the upside?

We can’t lower inflation via a magic wand or the flip of a switch. All policymakers at the Fed can do is change the incentives by raising or lower interest rates, then wait to see how the economy - composed of living, breathing human beings - responds.

It’s the Fed’s job to wrestle inflation back down to the stated 2% target. As a consumer, your job is to simply continue living within your means and hey, on the bright side your savings account is going to start paying interest again soon!

P.S. Everyone who is locked in a cheap mortgage, congrats boomer.

For Your Weekend

Our round-up of essays, podcasts, and streaming shows to check out over your weekend. We cast a wide net so you don’t have to.

Read:

I Have a Message for My Russian Friends by Arnold Schwarzenegger (The Atlantic)

The strength and the heart of the Russian people have always inspired me. That is why I hope that you will let me tell you the truth about the war in Ukraine.

Listen:

Marko Papic - A Multi-Polar World (Invest Like the Best)

Marko Papic is a partner and chief strategist at Clocktower Group. We cover current events in Ukraine and their potential economic impact, the prospect of inflation and the shifting role of the Fed in response to it, and the evolving positions of China and the US as players on the global stage.

Watch:

St. Patrick’s Day has passed, but don’t miss the opportunity to watch this gem of a film. Two teenage boys cycle 160km on stolen bikes pursued by police to find a missing bale of cocaine worth 7 million euro. Set around the real event of Ireland's biggest cocaine seizure in 2007 of 440 million euro. Features absolutely stunning cinematography showcasing the Irish countryside. We watch it every year.